[ad_1]

The bitcoin worth, rising within the face of an ongoing banking disaster, seems to vindicate what Bitcoiners have identified all alongside.

That is an opinion editorial by Robert Corridor, a content material creator and small enterprise proprietor.

The occasions of the previous few weeks have spooked traders and regional banks alike. Extra importantly, the individuals who go to work and make the economic system run are beginning to query whether or not their financial institution deposits are protected. Fears of extra financial institution runs after the collapses of Silicon Valley Financial institution (SVB), Signature Financial institution, Silvergate Financial institution and Credit score Suisse are rampant.

And these fears will not be unfounded, if you happen to ask me. As an example, if you activate the TV and see that First Republic wants a $30 billion bailout to remain afloat, it doesn’t encourage confidence within the banking system. And extra banking chaos might come. Legendary investor Michael Burry believes that two extra banks might be in hassle in Comerica Financial institution and U.S Bancorp. Primarily, these banks are in the identical place that SVB was in. The chance of extra financial institution bailouts appears to be rising by the day.

To high all of it off, federal regulators are learning the opportunity of insuring all financial institution deposits in your complete banking system. There are roughly $19 trillion in financial institution deposits within the banking system. Any speak of insuring the financial institution deposits of each financial institution in America is insane and outright harmful. Discuss throwing extra gas on the hearth. I feel this could make folks extra nervous about their cash and spur extra financial institution runs. The federal government and the Federal Reserve are taking part in with fireplace.

The Federal Reserve is reacting to conditions as an alternative of being clear headed and planning forward. It will result in overreaction and implementing insurance policies that might do extra hurt than good. It’s loopy that the destiny of your complete economic system is within the palms of individuals like Janet Yellen, Jerome Powell and Joe Biden.

Do you sleep like a child at night time realizing these persons are accountable for the financial destiny of the planet? How we received to this place is effectively documented, and there’s no cause to enter element, however taking a step again makes you notice what a precarious state of affairs we’re in proper now.

Thank God For Bitcoin

I wish to be the primary to say in chaotic occasions like this: “Thank God now we have Bitcoin.” We’ve got certainty that our cash is our cash. There isn’t any third get together that’s going to f*ck with it and inflate its worth away. There aren’t any third events that may cease you from accessing it. Nobody can cease you from spending it on what you need or sending it to whomever you select.

For the primary time in historical past, the facility to transact is actually within the palms of the folks. Bitcoin is essentially the most progressive financial know-how ever created. This realization is beginning to daybreak on folks as extra folks flock to the security of Bitcoin throughout occasions of turbulence.

The bitcoin worth has ripped increased on the information of those latest financial institution collapses. As of this writing, within the final 14 days alone, the worth of bitcoin has shot up 28.8 %. This can be a huge transfer in a matter of two weeks. Is it protected to say that bitcoin is turning into a risk-off asset within the eyes of the common shopper? It’s definitely trending that means.

Bitcoiners already know this to be true; we’re merely ready for everybody to play catch-up in actual time. As of the writing of this text, the worth is simply north of $28,000, and in all chance, received’t keep there for lengthy if information of extra financial institution failures involves cross.

As a Bitcoiner, it’s good for extra folks to understand what now we have come to about Bitcoin and begin to save their wealth in bitcoin. Alternatively, I didn’t need it to occur in such a means that it endangers your complete international economic system.

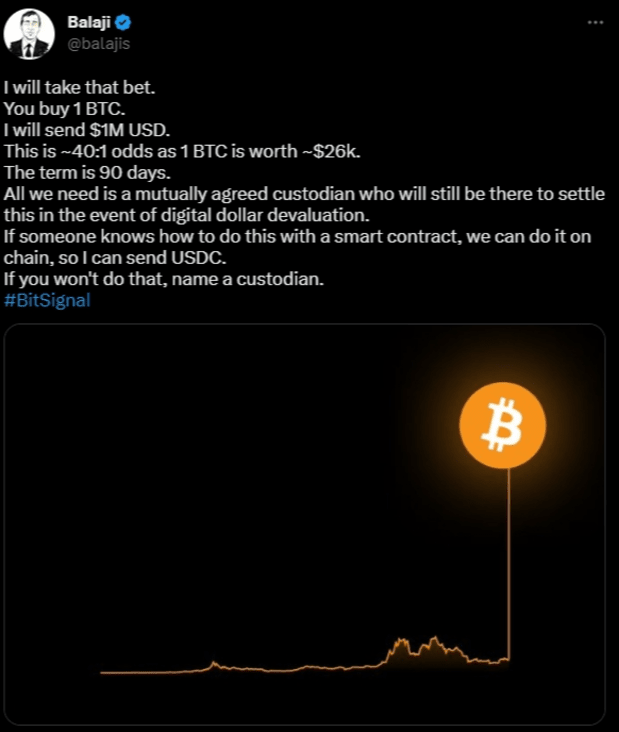

Some imagine bitcoin will attain $1 million within the subsequent 90 days! What a time to be alive, proper?

Occasions will occur the best way they’re presupposed to occur; the very best factor we are able to do as Bitcoiners is to proceed to unfold the phrase about Bitcoin to anybody who will pay attention and proceed to stack sats accordingly.

“There are a long time the place nothing occurs, and there are weeks the place a long time occur.”

–Vladimir Lenin.

Not that I like quoting lifeless communists, however I really feel like that is acceptable for the occasions we live in. 2023 might find yourself being a consequential 12 months for Bitcoin and the globe. Buckle up. It’s going to be a wild journey.

This can be a visitor submit by Robert Corridor. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

[ad_2]

Source link