[ad_1]

Claims about crypto trade Huobi’s monetary well being and its executives’ authorized entanglements have fueled market hypothesis over the weekend.

Huobi has been witnessing continued outflows from its whole locked-up worth (TVL), dropping to $2.4 billion from a degree of $3 billion in July. As reported by FX168 Monetary Information, there have now been rumors that a number of Huobi trade executives had been taken into custody by the Chinese language police.

Nevertheless, these claims had been categorically denied by Justin Solar, a worldwide advisor to the corporate, who took to social media to debunk the rumors. Regardless of these assurances, the market sentiment remained skeptical because the outflow continued.

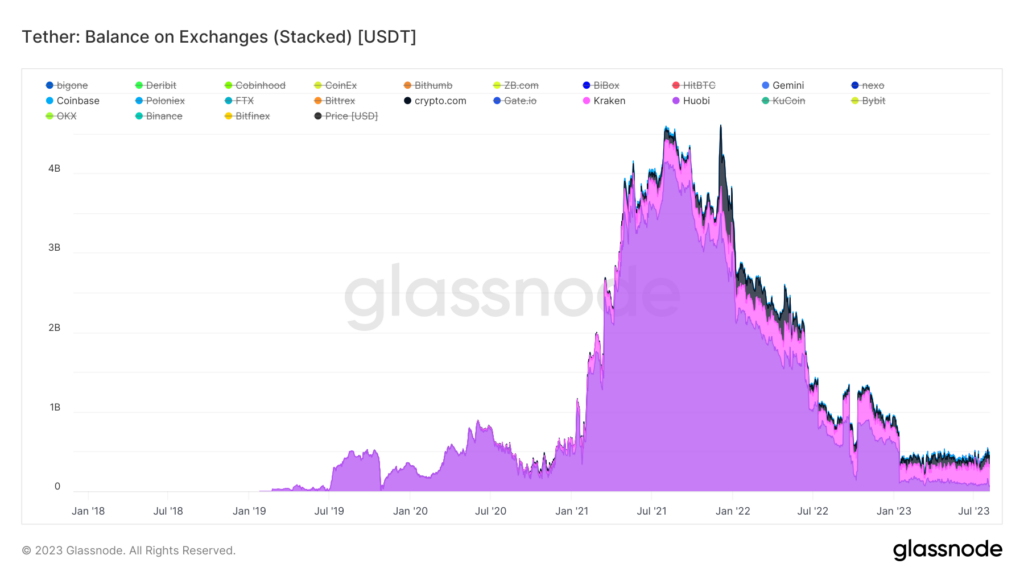

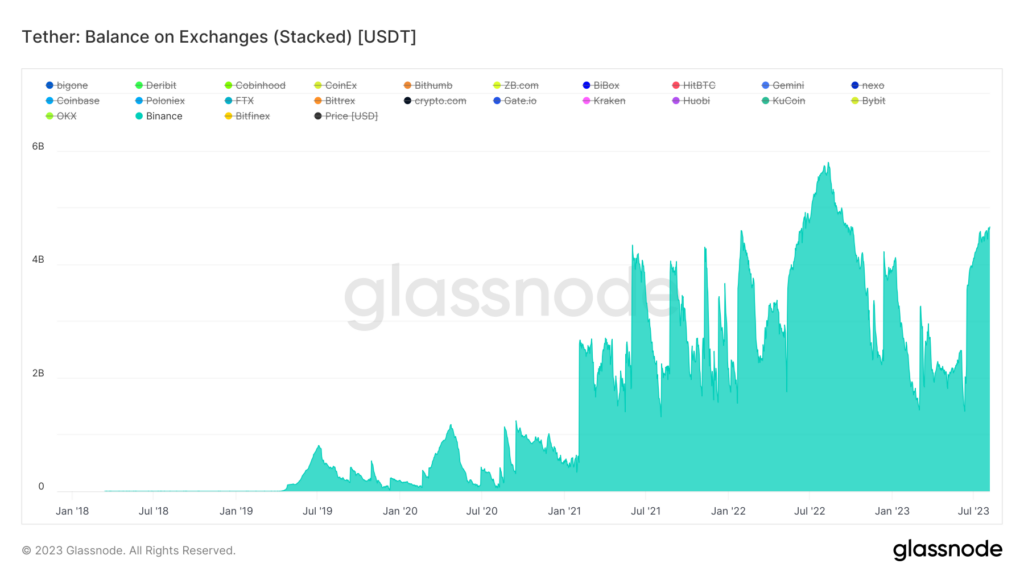

USDT reserves throughout exchanges

A better examination reveals that Huobi’s scenario might not be remoted. Based on information from Glassnode, USDT reserves, on all chains, throughout most prime exchanges, together with Huobi, have depleted at an identical price. This means that the issues round Huobi is likely to be a part of a broader market development quite than a problem particular to Huobi.

Curiously, Binance stands as an outlier on this situation. Whereas different exchanges have seen a lower of their USDT reserves, Binance has recorded a rise, based on Glassnode. This divergence raises questions on Binance’s function and methods within the present market atmosphere, that are markedly completely different from different exchanges.

Considerations about Huobi’s solvency.

Adam Cochran, a companion at Cinneamhain Ventures, raised issues over Huobi’s monetary well being in a submit thread on X on Aug. 5.

Cochran’s allegations focus on distributing and controlling USDT and USDC tokens inside the Huobi platform. Based on Cochran’s tweets on Aug. 5, Tron’s blockchain information means that 98% of the token is held straight by Solar or Huobi.

He additional claims that when customers’ stake’ their USDT into stUSDT, it will get swept right into a Huobi deposit tackle, indicating an absence of transparency. Cochran alleges that Huobi holds solely $90 million of belongings throughout USDT and USDC, considerably smaller than the $630 million reported in Huobi’s ‘Merkle Tree Audit.’

Information from Glassnode confirms that Huobi holds $58 million in USDT as of press time.

Whereas customers consider they maintain balances of $631 million in Huobi, Cochran posits that the precise quantity is considerably much less, with the shortfall being utilized by Justin Solar to bolster his different decentralized finance (DeFi) functions.

Along with the alleged USDT discrepancy, Cochran suggests a parallel scenario regarding Ethereum (ETH), the place customers’ holdings have been transformed into stETH with out their information or consent.

As Cochran reported, “Nevertheless it’s not simply that. All of the person ETH can be lacking; Solar has turned it into stETH. All of it. Customers assume they maintain 141,000 ETH on Huobi, and as a substitute, Solar holds about half that whole stability, and it’s all in stETH.”

This collection of revelations has ignited controversy and hypothesis, resulting in counter-claims from Huobi representatives.

A Huobi group supervisor, @33Huobi, retorted on Aug. 6, insisting that the police had been investigating neither Huobi nor Tron and that each one operations had been regular. Regardless of this, Cochran doubled down on his preliminary allegations, citing a senior government from the Tron crew as his supply.

Amid this conflicting data, Cochran continued his evaluation, reporting on Aug. 7 that Huobi’s whole stability stood at $2.5 billion. He maintained that even the whole liquid belongings on the trade had been lower than one-third of the reported quantity of USDT obligations, additional fueling insolvency rumors.

Cochran’s remaining tweet on Aug. 7 learn, “Huobi denied the rumors” Yeah… did you anticipate Justin to be like, “Oh yeah, we’re bancrupt?” Individuals lie. Blockchains don’t. 🤷♂️”

Whereas the reality behind Cochran’s allegations requires extra data and affirmation of sure accounts’ possession, this example serves as a vital reminder of the significance of transparency and accountability inside the crypto trade.

Regardless of these issues, Huobi continues to reassure its customers and the broader group of its operational stability. Xie Jiayin, Huobi PR, has reiterated that the platform’s operations are operating as normal and requested the group to chorus from spreading or believing in rumors, based on FX168. Huobi’s spokesperson additionally urged additional investigation into the data supply to keep away from FUD.

As of press time, Huobi had not responded to CryptoSlate’s requests for remark.

[ad_2]

Source link