[ad_1]

Fast Take

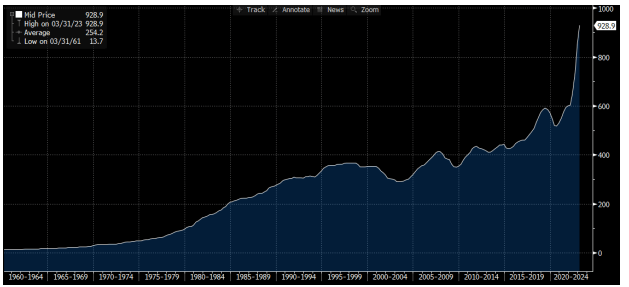

In line with the Founding father of Fairness Administration Associates, Lawrence Lepard, in his EMA Q2 report, the escalating curiosity expense, quickly nearing a run price of $1 trillion, is a serious explanation for the increasing authorities deficit. These elements suggest that the federal government’s curiosity funds are surpassing its expenditure on nationwide protection, in keeping with Lepard.

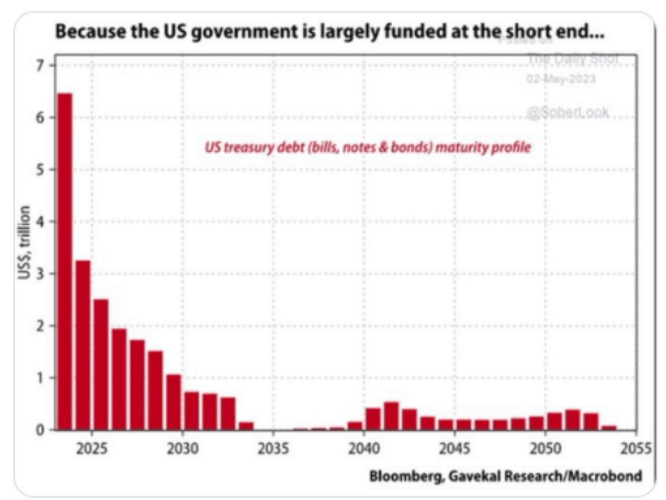

Lepard states that the U.S. Authorities has felt the pinch of the Federal Reserve’s marketing campaign to boost rates of interest. A lot of the federal debt is tied up in short-term maturities, that are at present topic to about 5.3% curiosity. It is a stark distinction to September 2021, when many of those securities had been tied to considerably decrease rates of interest, starting from simply 10 to 30 foundation factors.

He continues to say the U.S. Authorities’s dependence on the short-term bond market to underwrite most of its debt is compounding the difficulty. Gavekal Analysis/Macrobond knowledge signifies that the Authorities might want to renew $6 trillion of maturing notes in 2023 and one other $3 trillion in 2024.

In the end, Lepard remarks that this evaluation doesn’t take into account the potential market inflow of roughly $1.2 trillion of bonds and notes that the Fed might promote if it continues with Quantitative Tightening. Consequently, the deficit stress might intensify with these looming curiosity prices and debt renewals.

The publish How rising curiosity prices influence authorities funds appeared first on CryptoSlate.

[ad_2]

Source link