[ad_1]

The lead analyst at Glassnode has defined how a lot capital one would want to vary the Bitcoin market cap by $1.

Bitcoin Realized Cap Wants To Change By This A lot For $1 Market Cap Change

In a brand new put up, the lead analyst on the on-chain analytics agency Glassnode, @_Checkmatey_, has mentioned the affect of capital flowing into or out of Bitcoin on the asset’s market cap.

To make this calculation, the analyst has used the “realized cap” mannequin of BTC. This capitalization mannequin assumes that the true worth of any coin in circulation shouldn’t be the present spot value however the value at which it was moved on the blockchain.

Because the realized cap consists of the worth each investor purchased their cash at, its worth primarily represents the entire amount of cash the holders have put into the asset. “Positive, there are nuances, however it’s a fairly rattling shut estimation in my expertise,” says the Glassnode lead.

Now, to see what the precise quantity of change produced in the marketplace cap is when this realized cap adjustments (implying an influx or outflow of capital), the analyst has taken the 90-day share change of each these metrics and has then taken their ratios (the realized cap first, then the market cap).

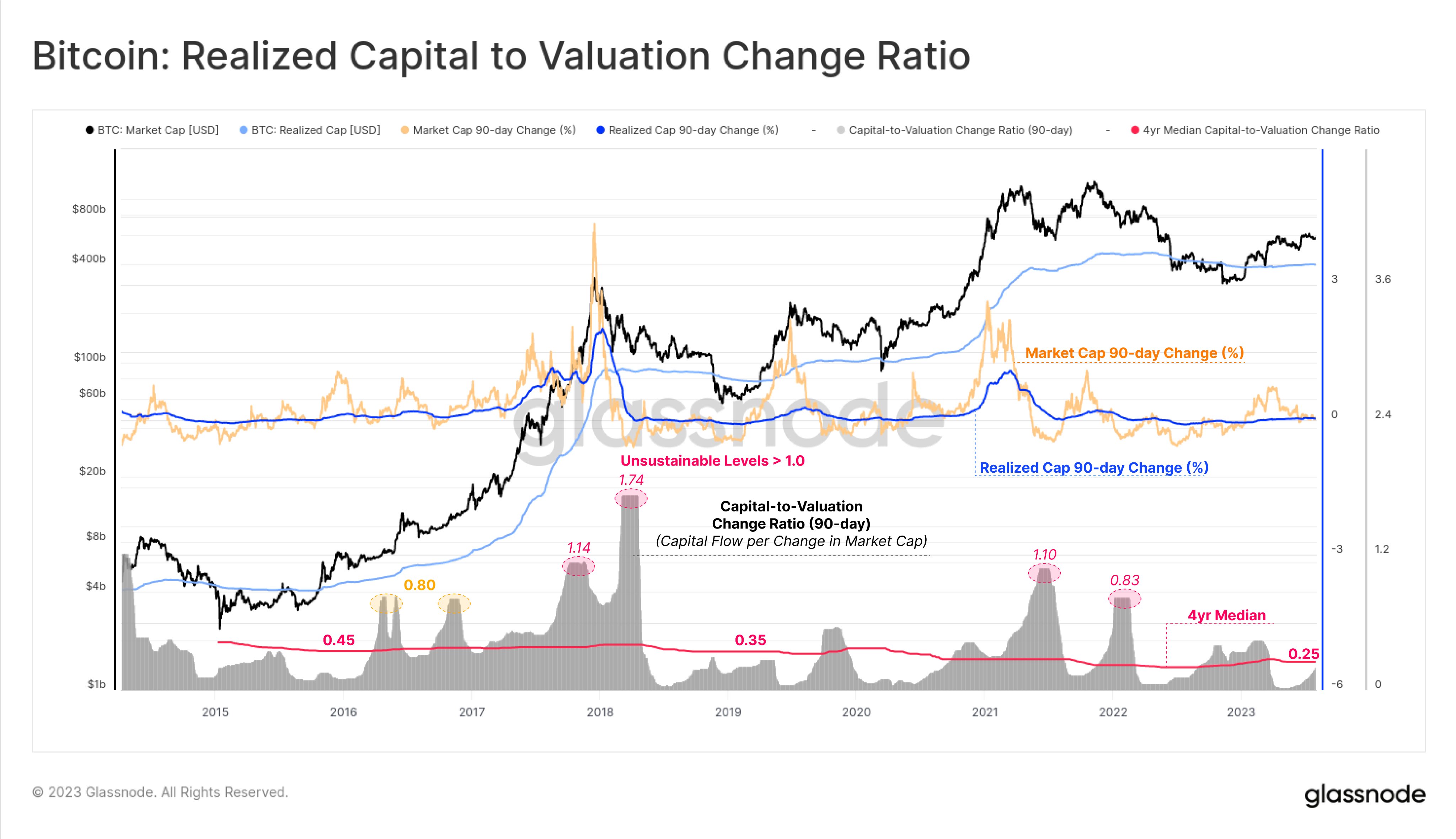

Beneath is the chart for this Bitcoin ratio.

The ratio between the 90-day adjustments in realized cap and market cap | Supply: @_Checkmatey_ on X

The graph exhibits the ratio between the 90-day adjustments in realized cap and market cap coloured in gray. As is obvious, it seems like the worth of this metric has fluctuated quite a bit over time.

Some fascinating patterns will be famous, nevertheless. It could seem that bull markets have traditionally tended to peter out when the ratio has gone above 1.0.

At this worth, greater than $1 have to be invested into the asset to boost the market cap by $1. Naturally, that is unsustainable, which is probably going why the highest turns into prone to be hit when these situations kind.

Earlier than 2016, the metric’s worth fluctuated between $0.45 and $1, because the Bitcoin market was nonetheless immature, and few holders ever HODLed their cash for vital intervals.

Nonetheless, the 4-year median (the crimson line) has dropped to simply $0.25. “HODLers are extra in tune with Bitcoin than ever earlier than resulting from schooling, and the liquid circulating provide continues to say no,” explains the analyst. “That is regardless of there being an ATH in circulating provide.”

Because the chart exhibits, the BTC realized capital-to-valuation change ratio at present has a price of lower than $0.25, which means that lower than 25 cents is all it takes to maneuver the market cap by $1.

“So to summarize, there is no such thing as a excellent mannequin for capital in vs. valuation out, however my intuition is that this isn’t the worst estimation strategy,” notes the Glassnode lead. “It retains it easy and aligns with intestine really feel and odor exams, normally good indicators.”

BTC Value

On the time of writing, Bitcoin is buying and selling round $29,200, down 1% within the final week.

BTC has been transferring sideways not too long ago | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link