[ad_1]

Operation Choke Level 2.0 has disadvantaged the crypto trade in america of essential fiat cost channels. As NewsBTC reported, the liquidity of the Bitcoin market is close to historic lows, however what about altcoins akin to Litecoin (LTC), Chainlink (LINK) and XRP?

To that finish, Kaiko, a digital asset information supplier, has launched a brand new examine. For merchants, the analysis is a must-read to evaluate how risky every crypto asset relies on its liquidity. And the examine has just a few surprises in retailer.

Moreover BTC, Which Cryptocurrencies Are Most Liquid?

Firstly of the report, Conor Ryder, analysis analyst at Kaiko, notes that market depth is at a 10-month low due to OCP 2.0 and resulting from market makers having to drag their orders from exchanges. “[S]o it’s important traders can precisely consider the liquidity of every particular person asset to achieve an understanding of how a lot brief time period volatility to anticipate,” Ryder explains.

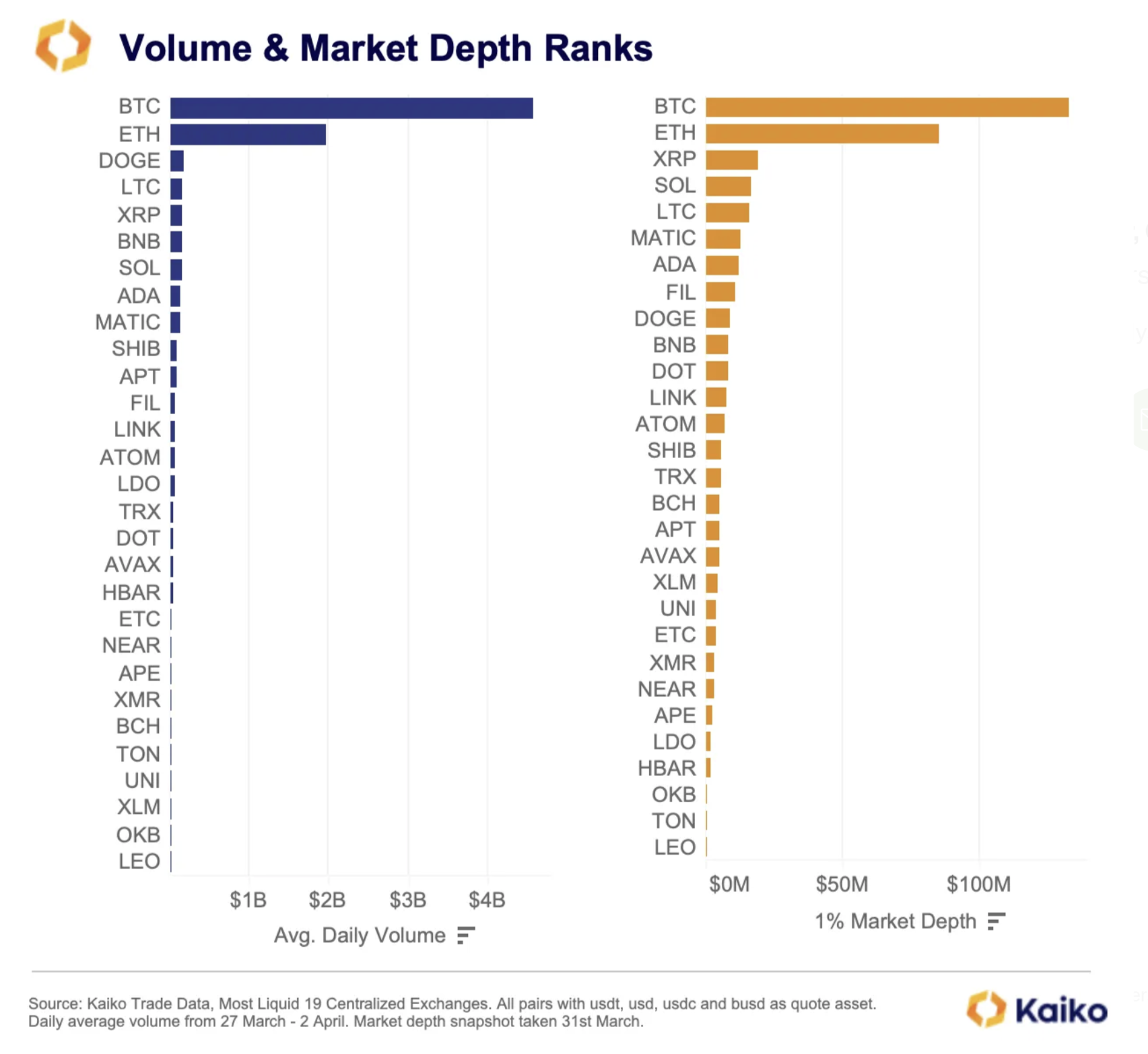

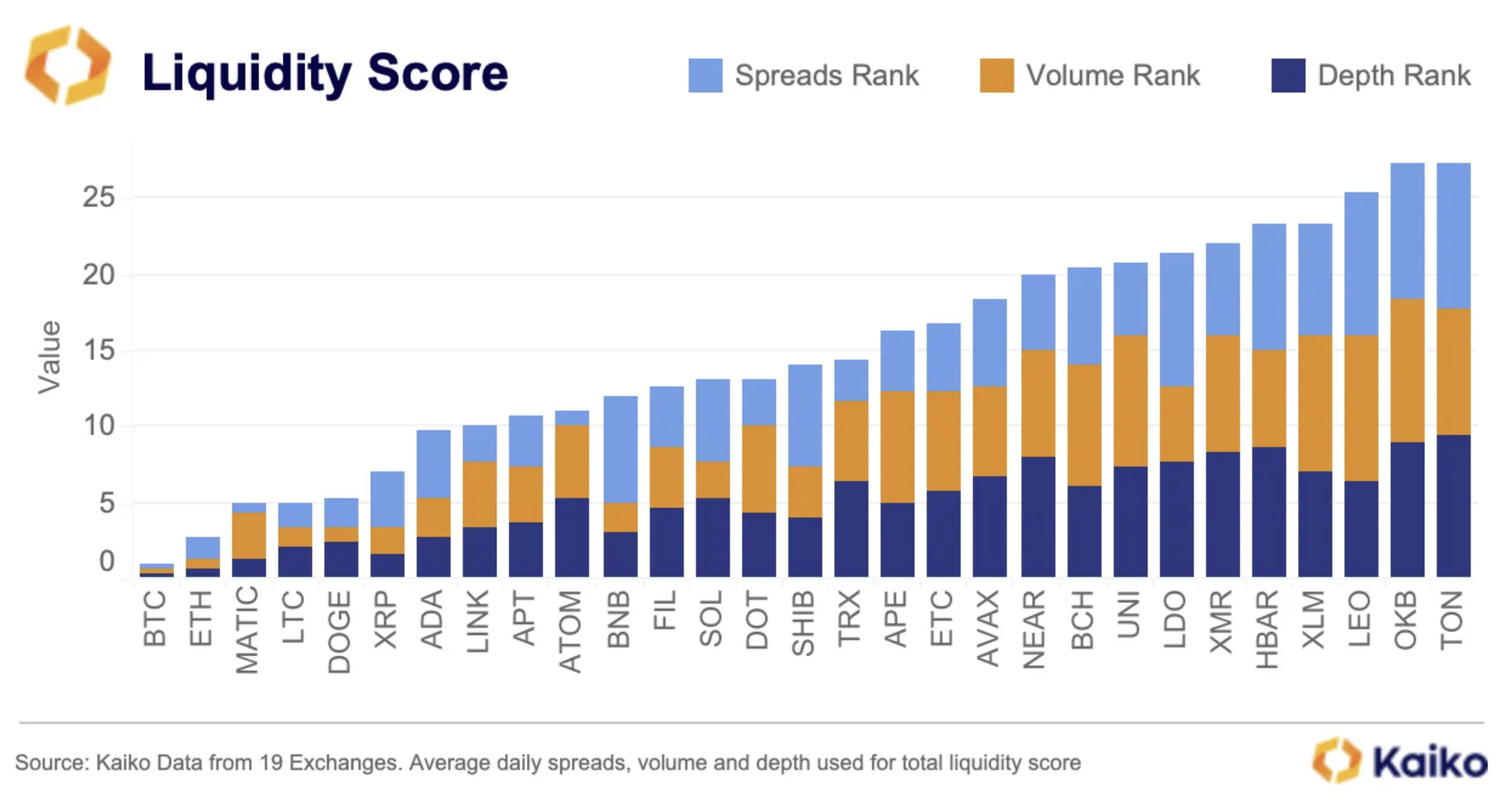

Total, Kaiko examined information on the 29 largest cryptocurrencies by market capitalization, excluding stablecoins and wrapped tokens. To outline a liquidity rank, three standards are used: volumes, market depth and spreads.

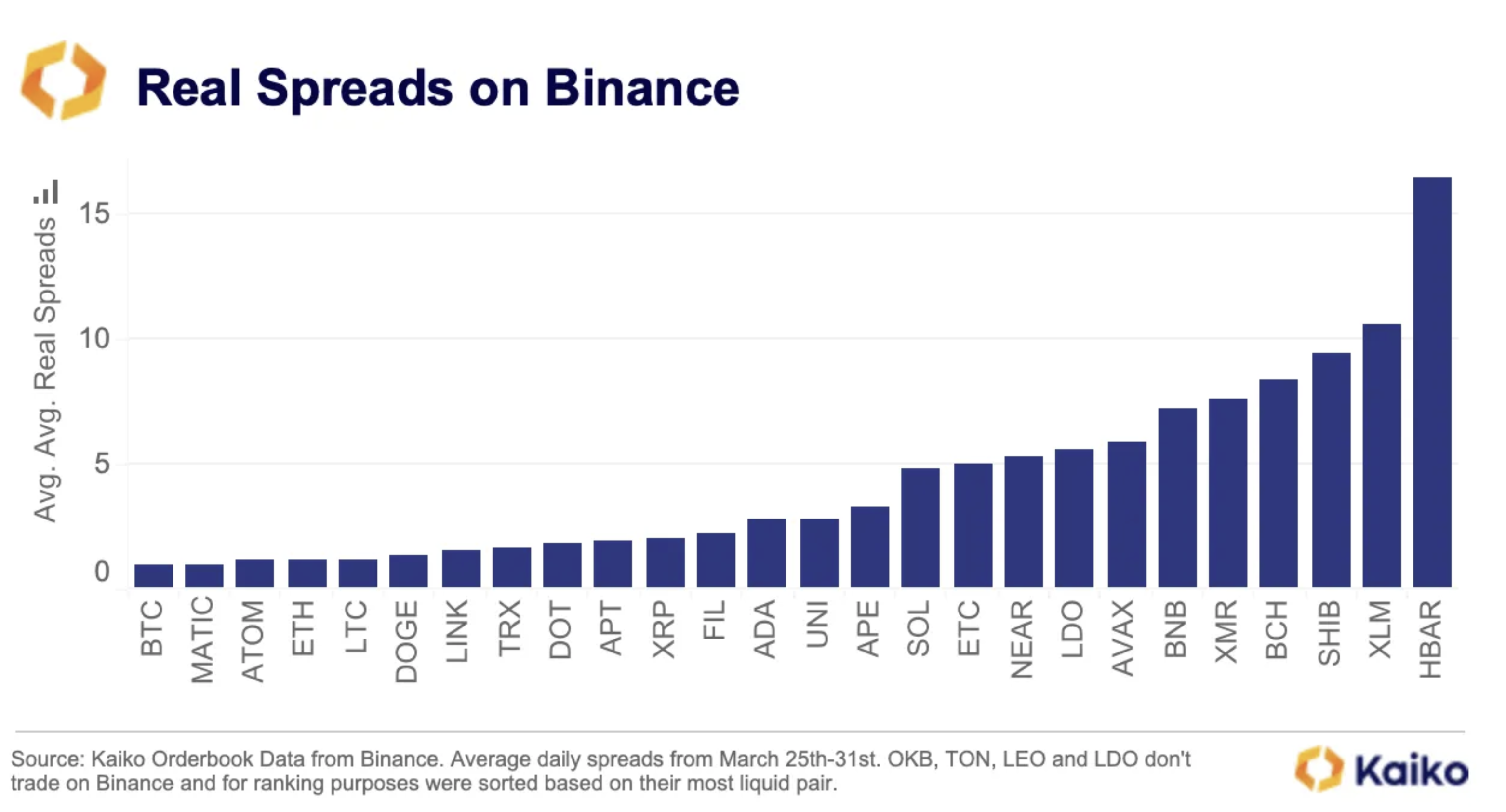

For quantity and market depth, information from all lively USD, BUSD, USDT and USDC pairs on 11 of probably the most liquid centralized exchanges had been mixed. For spreads, Kaiko makes use of solely information from Binance, probably the most liquid trade with the widest vary of markets.

By way of volumes, Dogecoin and Litecoin had been probably the most conspicuous cryptos within the first quarter of 2023. Because the chart beneath reveals, DOGE ranks a formidable third behind BTC and ETH, forward of a number of tokens with bigger market capitalizations.

Litecoin ranks 4th, regardless of having solely the eleventh largest market cap (excluding stablecoins). “The cautionary be aware with LTC volumes is that earlier this yr I discovered some examples of LTC wash buying and selling on Bitforex so the amount determine alone just isn’t sufficient to conclude that LTC is especially liquid,” the analyst states.

Chainlink additionally outperforms its rank by market capitalization and lands in thirteenth place by buying and selling quantity in spite of everything.

By way of market depth, XRP and Solana stand out positively within the subsequent locations behind BTC and ETH. Litecoin is once more in an excellent fifth place, whereas LINK ranks a decent twelfth. BNB, then again, is a adverse shock.

“BNB depth is surprisingly low once more, contemplating it’s the native token of probably the most liquid trade, remaining in tenth regardless of being the third largest non-stablecoin token,” notes Ryder, who additionally discusses that the decrease the market depth, the simpler it’s for bigger market orders to affect the worth.

In conventional finance, spreads are probably the most generally used indicator for assessing the liquidity of a market. Usually, the smaller the unfold, the extra liquid the market.

On this class, Polygon (MATIC) and ATOM impress, rating forward of Ethereum (ETH). Disappointing, then again, are as soon as once more BNB, which will get a twenty first place when it comes to spreads by itself trade, and Solana, which ranks sixteenth, regardless of being the eighth largest non-stable token by market cap.

How Do Litecoin, LINK and XRP Fare Total?

There are undoubtedly surprises within the rating of the general liquidity, which ends up from the three liquidity ratios talked about above. Typically, the rule is that the smaller the quantity of a metric to its rating, the higher its liquidity.

Behind Bitcoin and Ethereum, MATIC and Litecoin occupy the very best locations and are thus much less prone to the affect of bigger orders. XRP lands in sixth place, Chainlink in eighth, making them additionally typically susceptible to much less volatility. Ryder additionally highlights Aptos:

APT liquidity far exceeded its market cap, implying that it is among the most liquid tokens relative to its dimension and will profit from much less volatility in consequence.

LEO and BNB, then again, give Kaiko’s analyst trigger for concern. The market capitalization of the 2 trade tokens is much extreme in relation to their liquidity – ” an identical state of affairs to FTT who’s illiquidity performed a task within the collapse of FTX.”

At press time, the Litecoin worth stood at $90.30. Thus, LTC continues to be writing increased lows within the 4-hour chart, sustaining its upward development.

Featured picture from Traxer / Unsplash, chart from TradingView.com

[ad_2]

Source link