[ad_1]

Right here’s how the present Bitcoin rally stacks up towards the earlier ones when it comes to the drawdowns it has skilled to date.

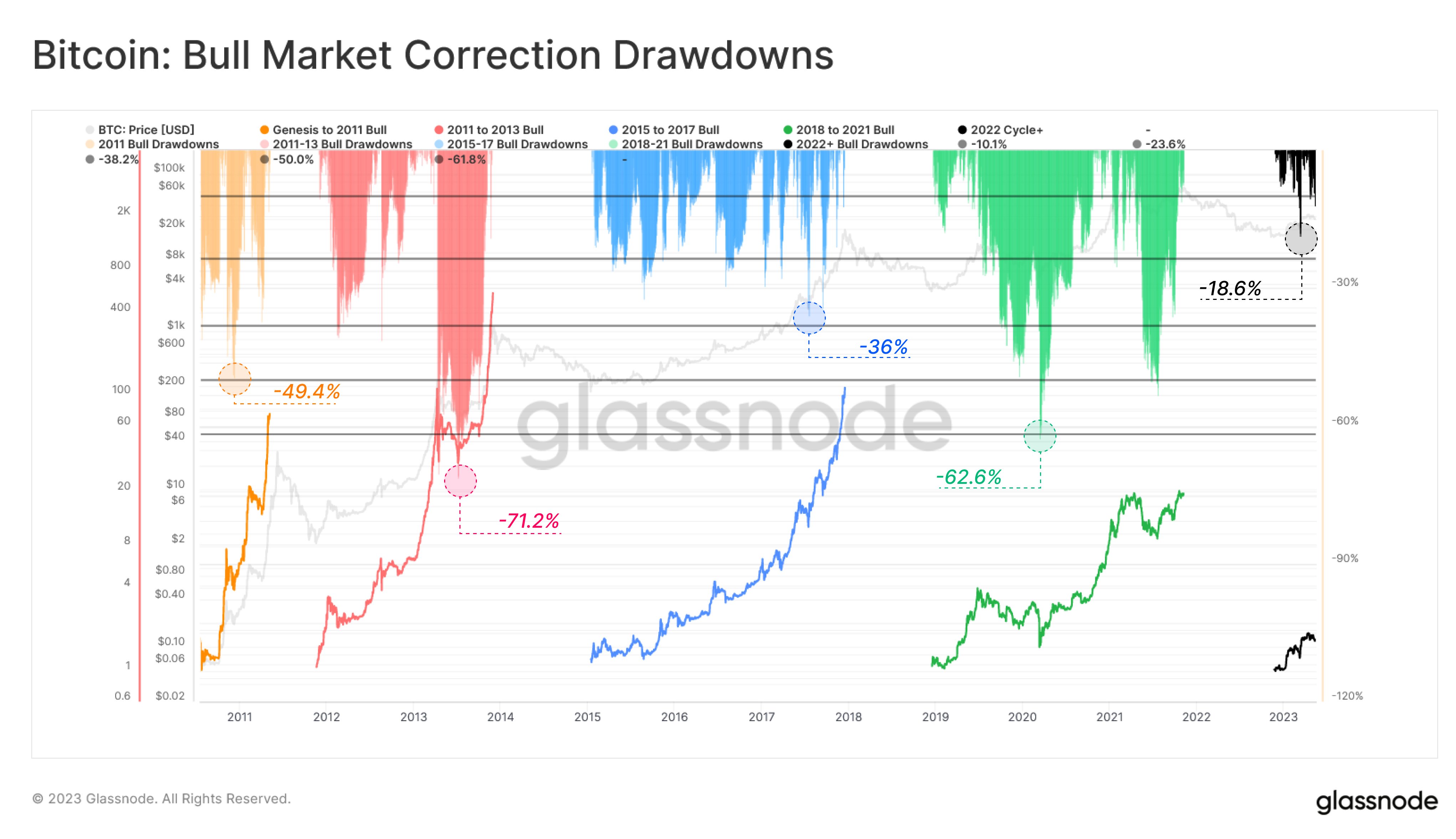

The Present Bitcoin Rally Has Seen A Peak Drawdown Of -18.6% So Far

In a current tweet, the on-chain analytics agency Glassnode in contrast the most recent Bitcoin rally with those seen all through the whole historical past of the cryptocurrency.

Usually, rallies are in contrast utilizing metrics like the share worth uplifts recorded throughout them or the period of time that they lasted (which can be measured when it comes to the blocks produced, as is completed when taking a look at cycles when it comes to halvings). Right here, nevertheless, Glassnode has taken a unique strategy that gives a brand new perspective on these rallies.

The comparability foundation between the value surges right here is the drawdowns that every of them skilled throughout their spans. Word that these drawdowns aren’t to be confused with the cyclical drawdowns which might be used to measure how the value has declined for the reason that bull run prime.

The drawdowns in query are the obstacles that the cryptocurrency encountered whereas the rallies had been nonetheless ongoing, and are therefore, those who the coin ultimately managed to beat.

Here’s a chart that exhibits the diploma of drawdowns that every of the historic bull markets skilled, and in addition the place the present rally stands compared to them:

Seems like the worth of the metric hasn’t been too excessive for the most recent rally to date | Supply: Glassnode on Twitter

The 5 bull rallies listed here are as follows: genesis to 2011 (the very first rally), 2011-2013, 2015-2017, 2018-2021 (the final rally), and 2022 cycle+ (the continuing one).

The analytics agency right here has taken the underside of every of the bear markets as the beginning of the following bull rallies. Which means components of the cycle that some could not contemplate as a part of the correct bull run are additionally included.

The primary instance of this is able to be the April 2019 rally, which is commonly thought of its personal factor however is clubbed with the final Bitcoin bull market within the above chart.

From the graph, it’s seen that the deepest drawdown that occurred through the first bull market measured round -49.4%. The following run, the 2011 to 2013 bull, skilled a fair bigger impediment of a -71.2% plunge halfway by way of it.

The following one (2015-2017) then solely noticed a drawdown of -36%, however the drawdown was once more up at -62.6% for the run that adopted it (that’s, the most recent bull market).

Up to now within the 2022+ Bitcoin bull market (which might solely be thought of a bull market in any respect if the November 2022 low was actually the cyclical backside), the deepest drawdown noticed to date is the March 2023 plunge of -18.6%.

Clearly, the drawdown seen within the present rally to date is considerably lesser than what the historic bull markets face. If the sample of the previous runs holds any weight in any respect, then this is able to imply that the present bull market ought to nonetheless have extra potential to develop.

BTC Value

On the time of writing, Bitcoin is buying and selling round $26,900, down 2% within the final week.

BTC has been transferring sideways just lately | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link