[ad_1]

Be a part of Our Telegram channel to remain updated on breaking information protection

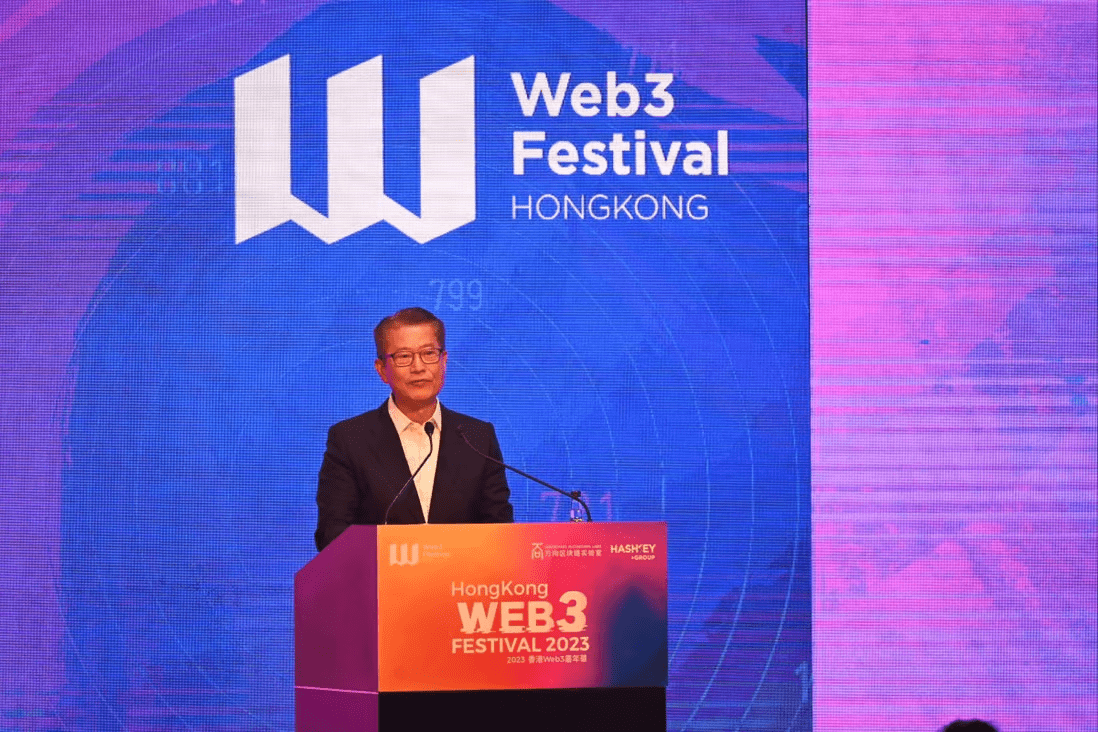

Due to its unprecedented development through the years, the blockchain trade has managed to realize worldwide reputation. The demand for cryptocurrencies retains on rising, regardless of the fluctuating value ranges. With festivals, occasions and meets being arrange globally to draw the eye of buyers and propagate some great benefits of blockchain tech, the group additionally appears to be rising continuously. One of the latest was the Web3 Pageant in Hongkong, which can be an indicator of Hongkong doubtlessly turning into the following crypto hub.

The largest problem inside the blockchain sector has all the time been establishing a regulatory framework. The shortage of this has even precipitated a number of international locations to utterly abandon the know-how regardless of being conscious of its benefits as an idea. Nonetheless, discussions concerning the implementation of the know-how are nonetheless within the works for a number of nations worldwide, which may function an excellent headstart for the sector.

Why is Hong Kong Main the Race Towards the US

The US is indisputably, one of many greatest markets for any fintech giants to take a position their time and cash in, which might ideally make it the primary selection for firms. Nonetheless, the situation of the US financial system appears to be dire, together with the federal government’s curiosity in letting cryptocurrency change into a big a part of their operations.

Hong Kong was beforehand a centre for cryptocurrency firms, which has grown tremendously again when the foundations round blockchain weren’t as tight as they’re now. Firms like FTX bought a headstart whereas working inside Hong Kong, together with many different now-successful entities. However because the cryptocurrency ban in China, the winds shifted to the West, the place the US took over because the favorite place for buyers to park their funds once more.

However as talked about, the present financial system of the US together with rising considerations from the federal government has precipitated the blockchain area’s development to stunt in some methods. Over the previous 12 months, the cryptocurrency market has been below vital strain from U.S. authorities, which has exacerbated the market’s already tumultuous state.

The FTX collapse additionally had a extreme impression available on the market, inflicting main banks that centered on crypto, comparable to Silvergate Capital and Signature, to fold this 12 months. Silvergate’s decline was particularly obvious because it misplaced greater than 60% of its deposits in a single quarter following the FTX crash. The downward pattern within the cryptocurrency market has been a persistent difficulty, and it has change into more and more dire because of the U.S. authorities’s crackdown.

The US Commodity Futures Buying and selling Fee (CFTC) not too long ago filed a lawsuit towards Binance for violating buying and selling and spinoff legal guidelines. The worldwide crypto alternate was accused of offering spinoff buying and selling providers to U.S.-based clients with out acquiring a spinoff license.

All this permits Hongkong to take over because the centre for cryptocurrency firms to develop at drastic speeds, which is now beginning to appear to be an actual risk.

Hong Kong’s Current Web3 Pageant Might Assist in Attracting Firms

On the Web3 Pageant, Hong Kong officers made a daring declaration of their dedication to crypto and the broader digital asset sector. Whereas the Western world’s stance on crypto continues to develop extra antagonistic, Hong Kong is taking a web page out of Singapore’s e-book by pinning its hopes on this rising sector to revitalize its ailing financial system. In 2020, the previous British colony suffered a extreme setback when Beijing launched the controversial Nationwide Safety Regulation, which prompted a mass exodus of expats, worldwide companies, and rich locals.

The brand new initiative goals to treatment this by providing clear regulatory steerage on digital property, with the purpose of luring crypto companies to arrange store within the metropolis. In doing so, Hong Kong hopes to usher in a recent wave of tax income, expertise, and monetary exercise, thereby restoring its standing as a thriving financial hub.

Hong Kong will clearly be going through stiff competitors from not simply Singapore but additionally Dubai in its quest to safe a slice of the profitable crypto tax income. With the latest issuance of licenses to crypto exchanges, Dubai has already emerged as a formidable challenger within the race for dominance on this house. As an example, Bybit, a serious participant within the crypto trade, has not too long ago established its world headquarters in Dubai. Due to this fact, the nation is certain to face an uphill battle in attracting crypto companies and producing tax income from this thriving sector.

For these apprehensive concerning the ban on cryptocurrencies in China, final week’s newly introduced laws replicate the “One Nation, Two Programs” precept, which dictates that Hong Kong stays part of China whereas retaining some extent of autonomy. As is customary with Hong Kong, it has been granted sure coverage exemptions. Within the case of the crypto trade, whereas mainland China continues to ban cryptocurrencies, Hong Kong has seemingly been given permission to brazenly appeal to and regulate the sector.

Learn Extra:

Ecoterra – New Eco Pleasant Crypto

CertiK Audited

Doxxed Skilled Workforce

Earn Free Crypto for Recycling

Gamified Environmental Motion

Presale Reside Now – $1.5M+ Raised

Yahoo Finance, Cointelegraph Featured Venture

Be a part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link