[ad_1]

On-chain knowledge exhibits the Bitcoin HODLers have continued to build up just lately as they increase their holdings at a charge of 194,500 BTC monthly.

Bitcoin’s Illiquid Provide Has Continued To Go Up Not too long ago

In keeping with knowledge from the on-chain analytics agency Glassnode, the BTC illiquid provide is presently rising at charges close to the cycle excessive. The “illiquid provide” right here refers back to the mixed pockets quantities held by Bitcoin entities which have little to no historical past of spending their cash.

An “entity” here’s a single tackle or a set of addresses that Glassnode has decided by means of its evaluation to belong to the identical investor. The entities which have participated in a low quantity of promoting could be the high-conviction BTC traders, popularly referred to as the “HODLers.”

The availability of those HODLers might also be tracked utilizing the “long-term holder (LTH) provide” metric, the place LTHs are traders who bought their cash greater than 155 days in the past.

Nonetheless, the LTH provide indicator can lag behind, as solely cash which have aged not less than 155 days in the past are included in it. So, if some traders who’re planning to carry for prolonged intervals do some shopping for, the LTH provide wouldn’t register them till 155 days later.

The illiquid provide considerably mitigates this drawback because it counts all cash which are prone to mature into the LTH cohort primarily based on their consumers’ previous expertise. Naturally, this technique isn’t completely correct, however it could possibly nonetheless nonetheless present us an concept in regards to the shopping for or promoting conduct of the HODLers.

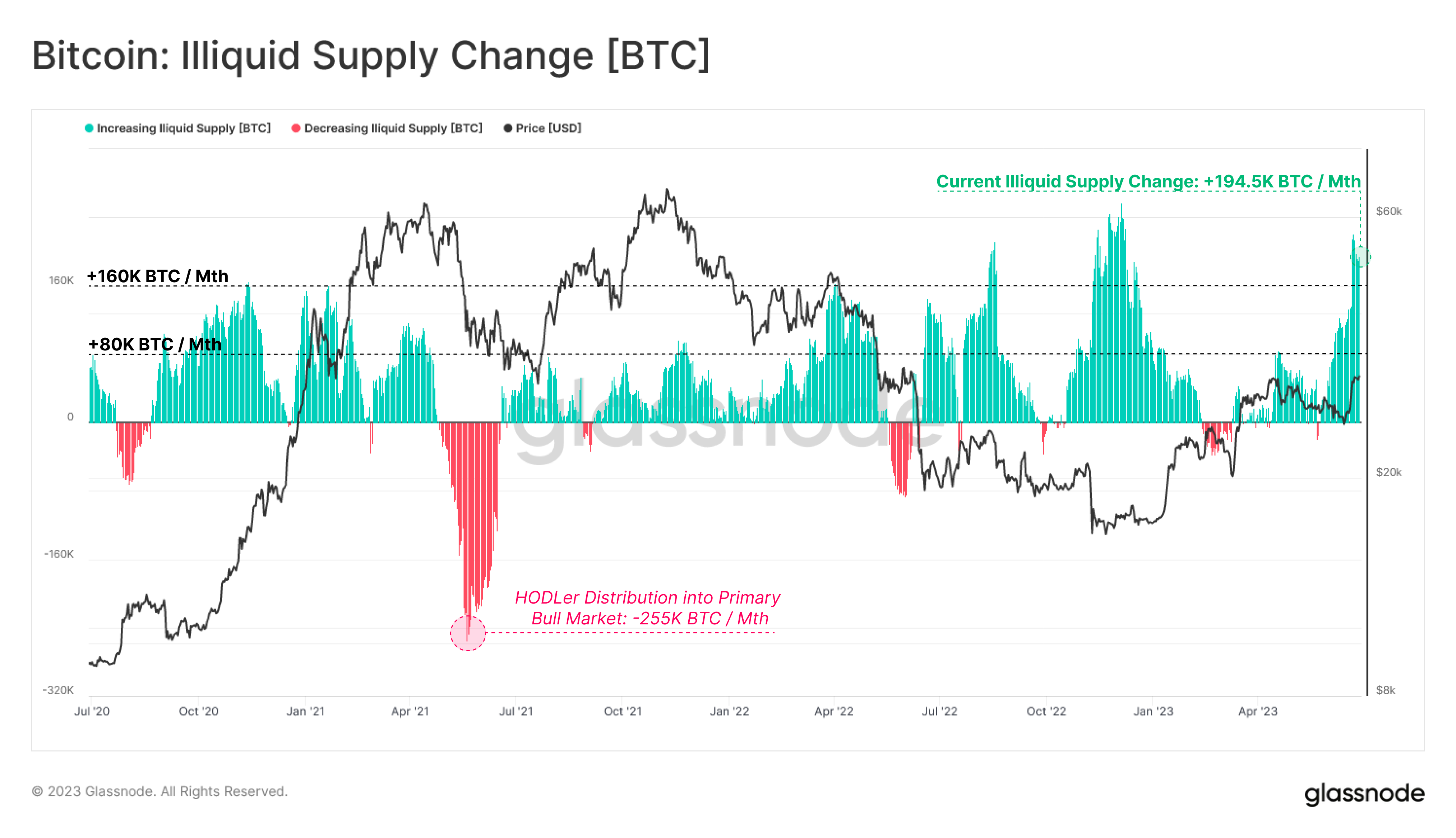

Now, here’s a chart that exhibits the development within the Bitcoin “illiquid provide change” metric, which measures the 30-day adjustments happening on this provide:

Seems like the worth of the metric has been fairly excessive in current days | Supply: Glassnode on Twitter

As displayed within the above graph, the Bitcoin illiquid provide change has surged to extremely constructive values just lately, implying that the holdings of the traders who’re identified to HODL for lengthy intervals have been increasing.

From the graph, it’s seen that the indicator’s worth has truly been constructive for an extended whereas now, excluding a couple of transient intervals. Again in February-March, for instance, these traders had been distributing. Curiously, the native high within the asset coincided with this promoting and BTC then adopted up with a pointy decline.

With the restoration rally from this crash, the HODLers went again to accumulating, however their shopping for remained comparatively gentle. Not too long ago, nevertheless, these traders have ramped up their buying, because the illiquid provide change has now neared the cyclical highs that have been seen throughout the consolidation interval that preceded the January rally.

In keeping with the present worth of the indicator, these traders are shopping for at a charge of 194,500 BTC monthly. Whereas this accumulation could not essentially present bullish gasoline by itself, the truth that these HODLers have continued to purchase by means of the newest leg within the Bitcoin rally is a constructive signal.

BTC Value

On the time of writing, Bitcoin is buying and selling round $30,700, up 2% within the final week.

BTC has remained stagnant just lately | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link