[ad_1]

Macro guru Henrik Zeberg believes that the crypto markets is one catalyst away from igniting a contemporary altcoin season.

Zeberg tells his 106,900 Twitter followers that an altseason could also be on the horizon as he believes the Federal Reserve is finished mountaineering rates of interest.

In line with the macro economist, greed will finally kick in as markets worth in a Fed pause.

“Altseason not fairly right here…. but!

Greed must kick in. It would come – as Fed appears to be accomplished.”

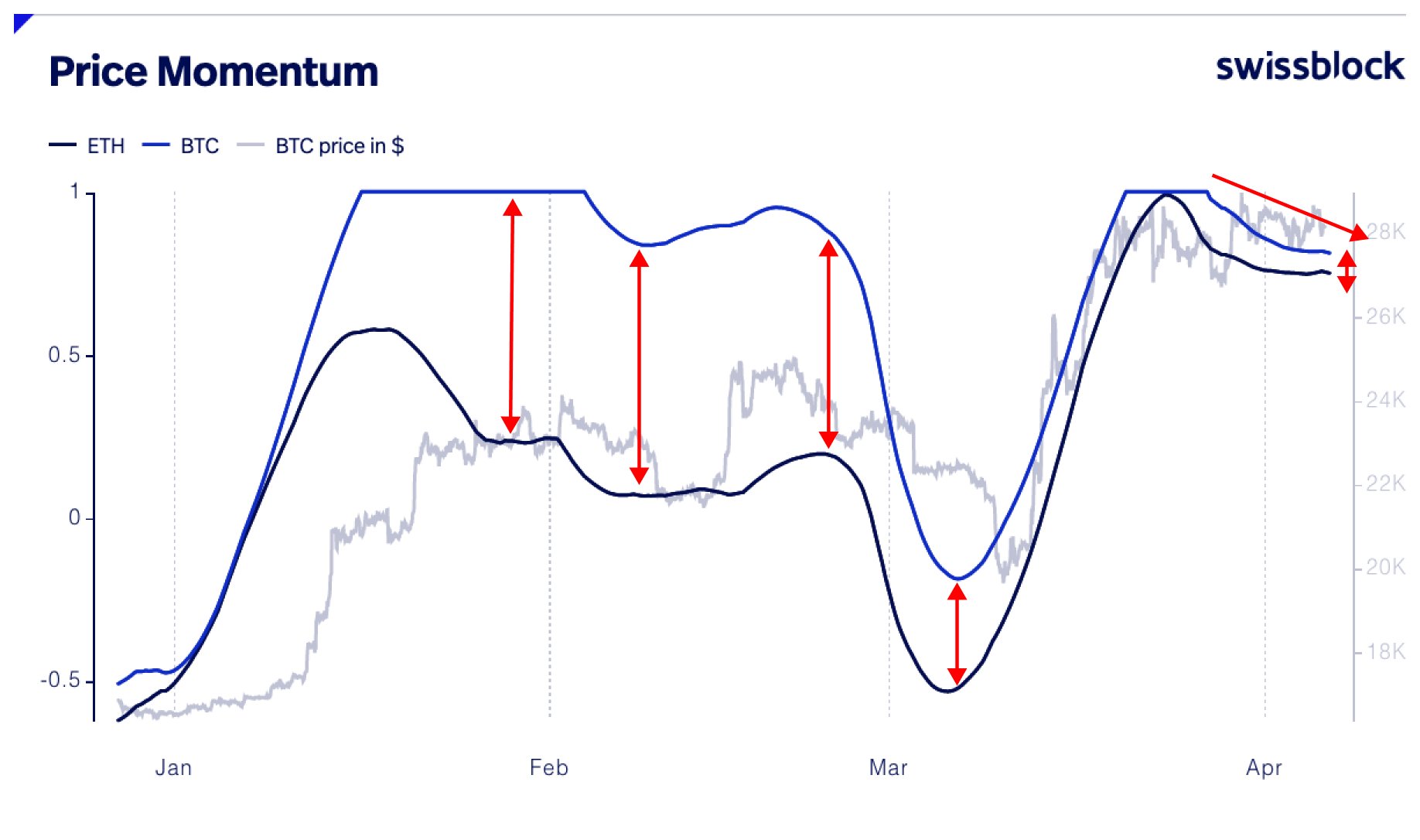

Zeberg additionally shares a chart from crypto-focused hedge fund Swissblock that reveals how momentum has not too long ago slowed down for each Bitcoin (BTC) and Ethereum (ETH).

With momentum taking a breather for Bitcoin, the macro economist believes that BTC might give bulls a “buy-the-dip alternative.”

“As DXY [US dollar index] bounces [in the] coming weeks, we may even see a pullback in Bitcoin.

However this can be an AMAZING OPPORTUNITY to enter lengthy positions.”

Regardless of being short-term bearish on Bitcoin and crypto, Zeberg nonetheless thinks that the asset will soar within the coming months.

“When imminent crash?

The place are the Bears calling for this since October?

Equities and threat property are going to FLY!”

Final month, Zeberg predicted that the inventory market will ignite a large rally this 12 months earlier than witnessing a meltdown by no means earlier than seen in almost a century. In line with the macro guru, Bitcoin will rally alongside the inventory market.

At time of writing, BTC is buying and selling for $28,127.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Test Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Test Newest Information Headlines

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses you might incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney

[ad_2]

Source link