[ad_1]

On-chain knowledge reveals that Bitcoin short-term holders are depositing 0.82% of their provide to exchanges. Right here’s how these inflows evaluate with previous crashes.

Bitcoin Quick-Time period Holder Inflows Have Been Elevated Lately

The BTC market will be divided into two broad investor teams, one in all which is the “short-term holder (STHs) cohort.” The STHs are buyers who’ve been holding onto their cash since lower than 155 days in the past.

Usually, the Bitcoin holders belonging to this group are the weakest arms out there, as they might simply promote on the sight of any sharp volatility or uncertainty out there.

The alternative cohort is named the “long-term holder (LTH) group,” and it naturally contains all individuals which were carrying their BTC of their wallets since greater than 155 days in the past.

These LTHs often maintain for big stretches of occasions, and they’re the diamond arms within the sector who have to be pushed rather a lot earlier than they begin panic promoting their cash.

Lately, the Bitcoin market has noticed the emergence of FUD out there, on account of the US Securities and Alternate Fee (SEC) suing cryptocurrency exchanges Binance and Coinbase.

The market has acted risky in each instructions, however total the worth of the asset has gone down for the reason that volatility has arrived. Clearly, in occasions like these, the STHs can be the primary ones to interrupt.

In a brand new tweet, the on-chain analytics agency Glassnode has seemed on the trade influx knowledge of the STHs, to see how they’re dealing with the present scenario.

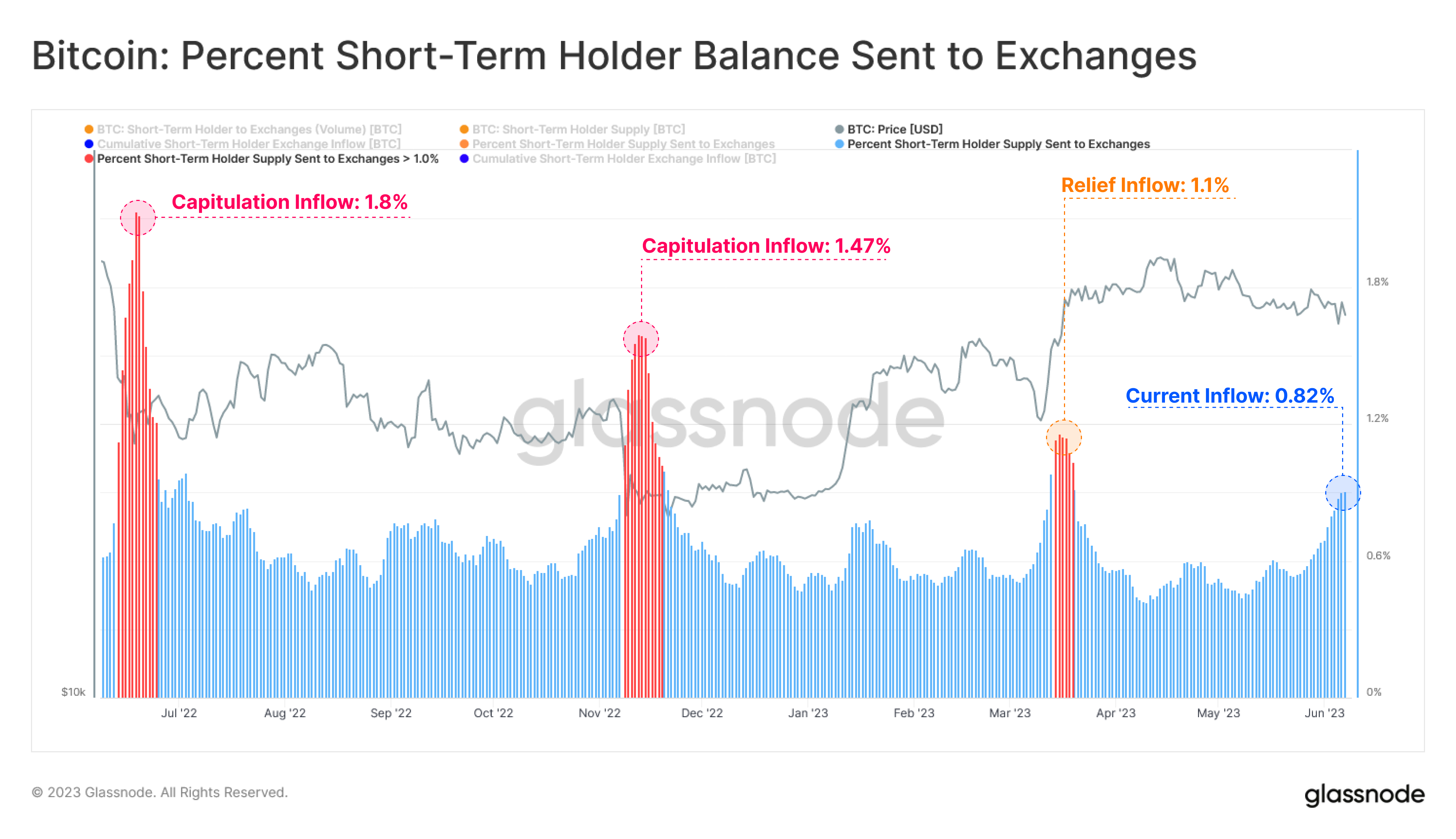

The under chart reveals the development within the Bitcoin trade influx for these buyers over the previous yr:

Appears to be like like the worth of the metric has been a bit excessive in latest days | Supply: Glassnode on Twitter

As you may see within the above graph, the Bitcoin trade influx for the STHs has been climbing just lately and has now hit comparatively excessive ranges. The “trade influx” right here refers to a metric that tracks the quantity of the asset that these buyers have been depositing into the wallets of centralized exchanges.

One of many primary the explanation why buyers switch their cash to those platforms is for selling-related functions, so the trade influx knowledge for these holders can present us with hints about their present promoting conduct.

Within the context of the present dialogue, a modified model of the trade influx is getting used; one which measures the inflows by way of the proportion of the overall STH Bitcoin provide.

The STH trade influx has hit a price of 0.82% just lately, which means that these buyers have just lately been sending round 0.82% of their provide to those platforms.

That is definitely not a small worth, however when in comparison with different panic promoting occasions prior to now yr, particularly the LUNA collapse, the FTX crash, and the aid rally in March 2023 (all marked with crimson on the chart), the present inflows are nonetheless fairly low.

This might imply that the most recent uncertainty within the Bitcoin market hasn’t but been sufficient to push the STHs into capitulating at ranges much like historic capitulation occasions.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,600, down 2% within the final week.

BTC has been consolidating in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link