[ad_1]

Listed below are the pricing mannequin strains that Bitcoin may need to remain above if the bullish momentum of the cryptocurrency has to proceed.

These Bitcoin Pricing Fashions Are At the moment Close to The Spot Value

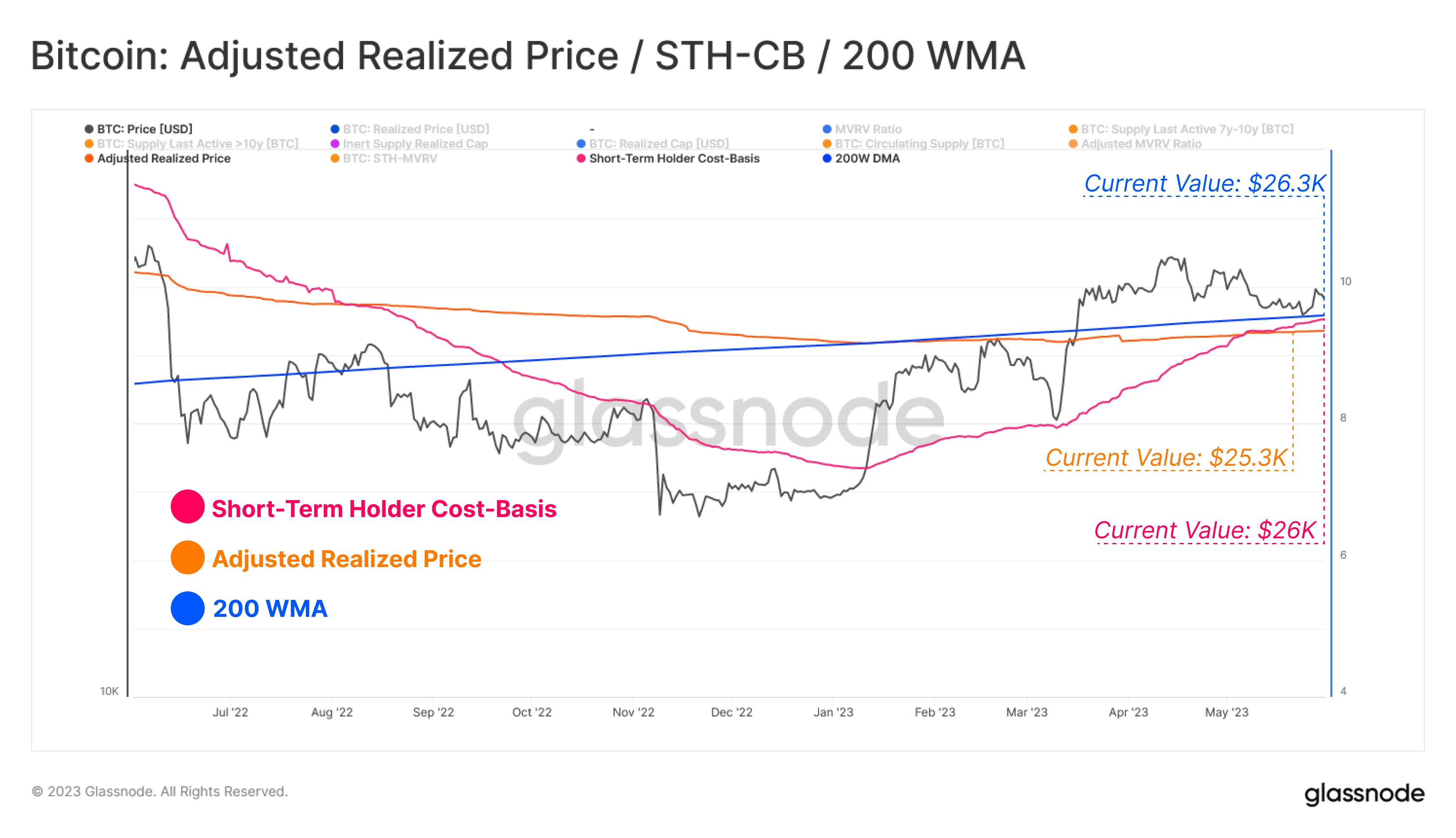

In a brand new tweet, the on-chain analytics agency Glassnode has identified how the three pricing fashions, the adjusted realized worth, the short-term holder value foundation, and the 200-week MA, are all near the asset’s worth proper now.

To know the primary and second fashions right here, the “realized worth” must be checked out first. The realized worth is a pricing mannequin derived from the realized cap, which is a capitalization mannequin that assumes that the “actual” worth of every coin within the circulating provide shouldn’t be the spot worth, however the worth at which it was final moved.

When this cover is split by the whole variety of cash in circulation, the typical value foundation or acquisition worth available in the market is obtained. This worth, which the typical holder on the community purchased their cash at, is named the realized worth.

Now, the primary pricing mannequin, the “adjusted realized worth,” is a modification of this indicator that drops from the information all holders who haven’t moved their cash since greater than seven years in the past.

Such previous provide often consists principally of the cash which were misplaced (maybe as a result of pockets keys now not being accessible), which signifies that this a part of the availability wouldn’t be related to the present market, therefore why the indicator cuts it out.

As for the second mannequin of curiosity right here, the “short-term holder (STH) value foundation,” this metric retains observe of the realized worth of particularly the buyers who’ve been holding their cash since lower than 155 days.

Here’s a chart that exhibits how these Bitcoin pricing fashions have in contrast with the spot worth through the previous yr:

The worth appears to be simply above these fashions for the time being | Supply: Glassnode on Twitter

As displayed within the above graph, the Bitcoin adjusted realized worth at the moment has a worth of $25,300, whereas the short-term holder value foundation has a worth of $26,000.

Traditionally, these fashions have acted as each resistance and assist for the worth, relying on the broader development. In bullish durations, they often act as assist so it’s attainable that if the worth drops deep sufficient to hit them, a rebound might occur.

The third line on the chart, the 200-week shifting common (MA), is a mannequin that goals to seek out the baseline momentum of the 4 yr Bitcoin cycle. This line has additionally had some comparable interactions with the worth as the opposite two fashions.

The 200-week MA has a worth of $26,300 proper now, implying that it’s at the moment the closest line to the spot worth. It now stays to be seen how the worth interacts with these strains, beginning with the 200-week MA, if a drawdown prolonged sufficient occurs.

A profitable retest of those strains would naturally be a optimistic signal for the rally, however a drop below them could also be a sign {that a} transition again in the direction of a bearish regime has occurred.

BTC Value

On the time of writing, Bitcoin is buying and selling round $27,000, up 1% within the final week.

Appears to be like like BTC hasn’t moved a lot lately | Supply: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link