[ad_1]

Billionaire hedge fund supervisor Stanley Druckenmiller has a dire prediction for the U.S. economic system: a recession is looming, and it’s doubtless set to hit this June. Druckenmiller’s forecast comes as American shopper spending stays low, and is essentially pushed by bank card utilization. Druckenmiller, a seasoned funding mogul, warns that it might be silly to disregard the opportunity of a “actually, actually dangerous” situation unfolding.

Druckenmiller Cites Drop in Client Spending and Banking Business Turmoil as Recession Indicators

On the 2023 Sohn Funding Convention in San Francisco, Stanley Druckenmiller sounded the alarm on the U.S. economic system. Whereas others could also be optimistic a few “gentle touchdown,” the seasoned hedge fund supervisor is bracing for affect, predicting a “exhausting touchdown” as an alternative.

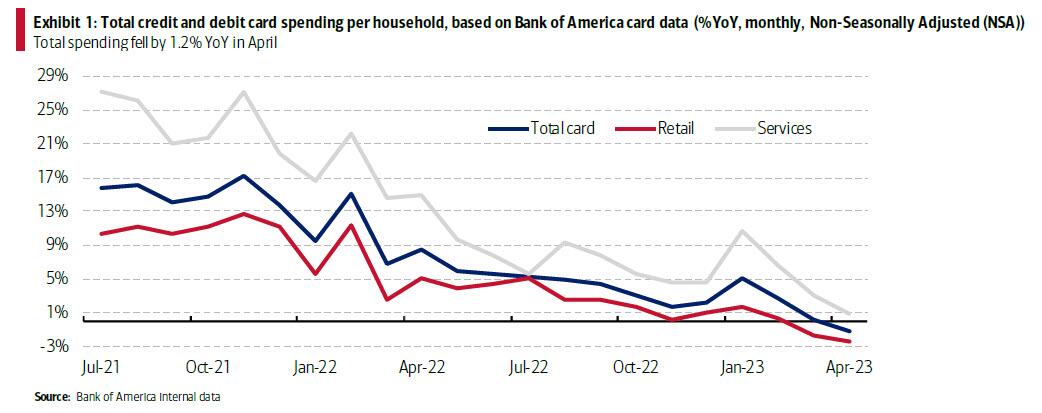

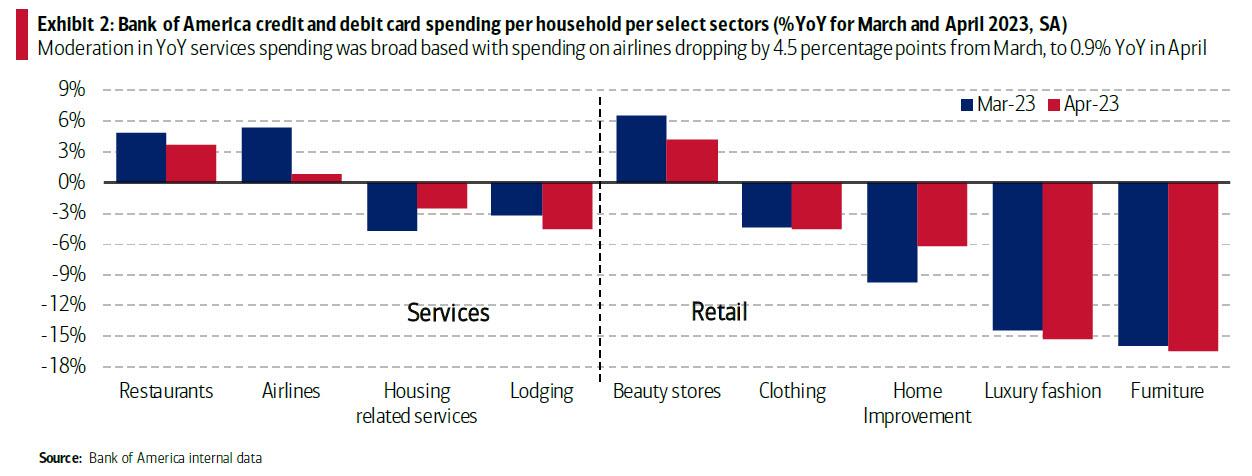

Druckenmiller, who has loved 30 years of success within the hedge fund business, cited the sharp drop in shopper spending and the latest banking business turmoil as key components behind his forecast. Druckenmiller’s warnings in regards to the U.S. economic system are echoed by different notable figures within the monetary world.

Different famed buyers, together with Barry Sternlicht, David Rosenberg, and Jeffrey Gundlach, have additionally expressed issues a few “exhausting touchdown” in the USA. On the Sohn convention, Druckenmiller elaborated on his prediction, citing rising unemployment, a 20% drop in enterprise income, and a surge in bankruptcies as key indicators of a recession.

Nonetheless, he was fast to make clear that he doesn’t anticipate a disaster worse than the 2008 monetary meltdown. Druckenmiller mentioned:

I’m not predicting one thing worse than 2008. It’s simply naive to not be open-minded to one thing actually, actually dangerous occurring.

Druckenmiller Stays Optimistic About Publish-Recession Alternatives

Whereas some specialists, reminiscent of Goldman Sachs World Funding Analysis and Wendy Edelberg of The Hamilton Venture, are predicting a “gentle touchdown” for the U.S. economic system, Druckenmiller has a completely completely different outlook. Druckenmiller is bracing for a recession, however he’s additionally optimistic in regards to the future.

In actual fact, he believes that there can be “unbelievable alternatives” within the coming years, significantly within the discipline of synthetic intelligence (AI). Druckenmiller sees the post-recession panorama as a fertile floor for revolutionary applied sciences and cutting-edge options “current themselves.”

Druckenmiller acknowledged:

AI may be very, very actual and could possibly be each bit as impactful because the web — AI might ultimately spawn $100-billion [in] firms.

On the Sohn Funding Convention, Stanley Druckenmiller didn’t mince phrases when it got here to his opinion of the Federal Reserve’s present coverage. Druckenmiller believes that the U.S. central financial institution has exhausted its sources within the battle in opposition to inflation and recession. “We mainly wasted all our bullets,” he lamented.

What do you consider Stanley Druckenmiller’s predictions for the U.S. economic system? Do you agree along with his evaluation, or do you have got a distinct outlook? Share your ideas within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss induced or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link