[ad_1]

An Optimism-based (OP) decentralized credit score market protocol has been hacked to the tune of hundreds of thousands of {dollars} value of Ethereum (ETH).

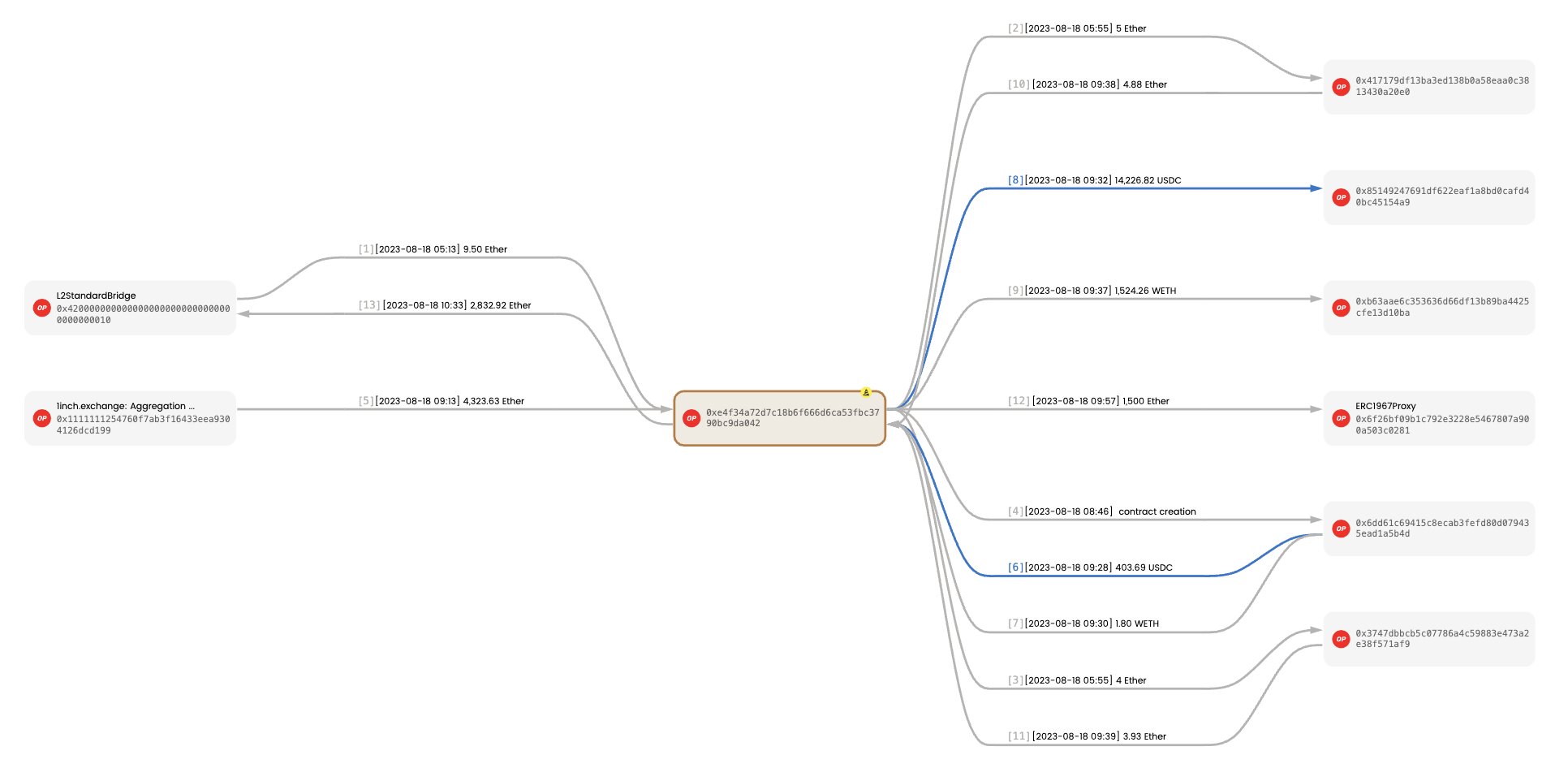

In response to the safety division of web3 protocol De.Fi, dangerous actors have stolen about $7.2 million value of the main good contract platform by exploiting Precisely (EXA), an open-source credit score market venture.

“After an intensive overview of the Precisely protocol hack, now we have concluded that the overall of stolen quantity updated is ~$7.2 million (4,323.6 ETH) Ultimately, they bridged ~1,490 ETH, utilizing Throughout Protocol, and a couple of,832.92 ETH to Ethereum by way of Optimism Bridge.”

In response to Precisely, the protocol has been briefly paused as the problem is investigated, although buyers will nonetheless be capable of withdraw funds.

“We’re actively investigating a safety problem inside our protocol. To make sure person security, the protocol is briefly paused (you possibly can nonetheless withdraw property). Our staff is on prime of this and can share extra particulars as quickly as doable.”

Blockchain safety agency Beosin explains how the hacker discovered a strategy to bypass the protocol’s safety measures.

“Root explanation for the Precisely Protocol exploit: the market deal with in DebtManager contract might be manipulated. The attacker handed in a malicious market contract deal with, bypassing the allow test, and executed a malicious deposit perform to steal the USDC deposited by customers. Lastly liquidated customers’ property to make a revenue.”

Information of the hack had an impression on EXA’s value because the altcoin fell sharply over the past 24 hours. EXA is buying and selling for $4.28 at time of writing, a 32% lower within the final day.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Test Newest Information Headlines

Disclaimer: Opinions expressed at The Day by day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses you might incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in online marketing.

Generated Picture: Midjourney

[ad_2]

Source link