[ad_1]

In a current word that has caught the eye of each conventional monetary markets and the Bitcoin group, Goldman Sachs economists, together with the famend Jan Hatzius and David Mericle, have made a big prediction concerning the Federal Reserve’s financial coverage. The word means that the Federal Reserve might start a sequence of rate of interest cuts by the tip of June 2024.

“The cuts in our forecast are pushed by this need to normalize the funds charge from a restrictive stage as soon as inflation is nearer to focus on,” the Goldman economists wrote. This assertion underscores the financial institution’s perception that the Federal Reserve’s present stance on rates of interest could also be too restrictive, particularly if inflation charges proceed to development in direction of the central financial institution’s goal.

The word additional elaborates: “Normalization isn’t a very pressing motivation for slicing, and for that cause we additionally see a big danger that the FOMC will as a substitute maintain regular.” This cautious tone means that whereas Goldman Sachs is predicting a charge reduce, additionally they acknowledge the unpredictability of the Federal Reserve’s choices.

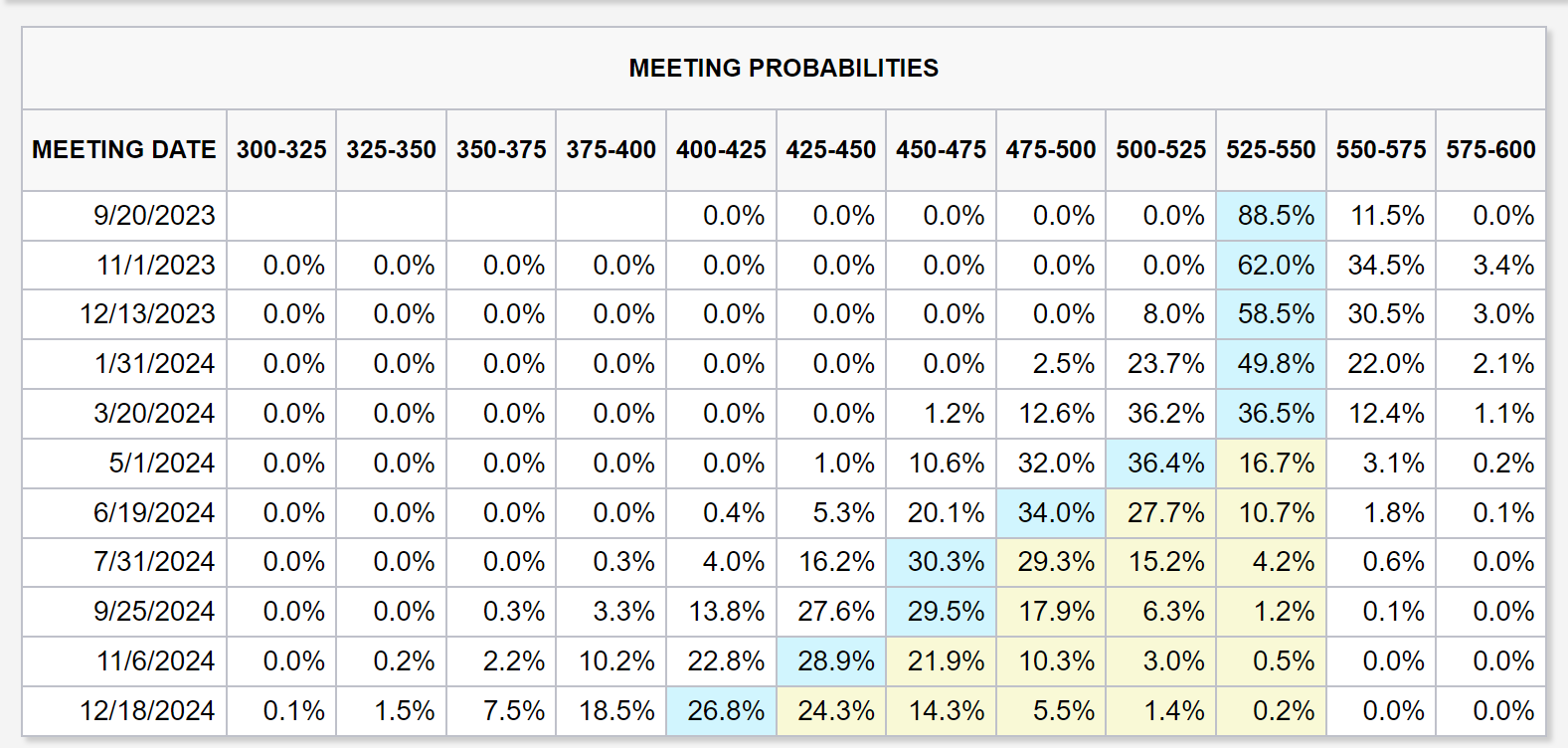

The current information, which confirmed US inflation rising at a slower-than-expected charge of three.2%, with the core client value index at a 4.7% annual tempo, additional complicates the image. With the Fed’s benchmark charge presently set between 5.25% to five.5%, Goldman Sachs expects it to stabilize round 3 to three.25%.

What Does This Imply For Bitcoin Value?

Expectations of a charge reduce from Goldman Sachs are in keeping with market expectations based on the CME FedWatch Instrument. In Could 2024, 68% already count on there to be a minimum of a 25 foundation level (bps) charge reduce.

Nonetheless, it stays to be seen whether or not macro occasions will affect the Bitcoin value once more. In the previous couple of months, BTC more and more decoupled from macro occasions whereas the inventory market rallied in direction of all-time highs and stagnated across the $30,000 mark.

Curiously, the timing might be very constructive for the Bitcoin market. On the one hand, March 15, 2024 is the ultimate deadline for spot Bitcoin ETF filings from BlackRock, Constancy, Investco, VanEck, and WisdomTree; then again, Bitcoin halving is developing on the finish of April (presently anticipated on April 26).

The excessive expectations for these two occasions, coupled with a dovish financial coverage from the Federal Reserve, might be an enormous catalyst for the Bitcoin value.

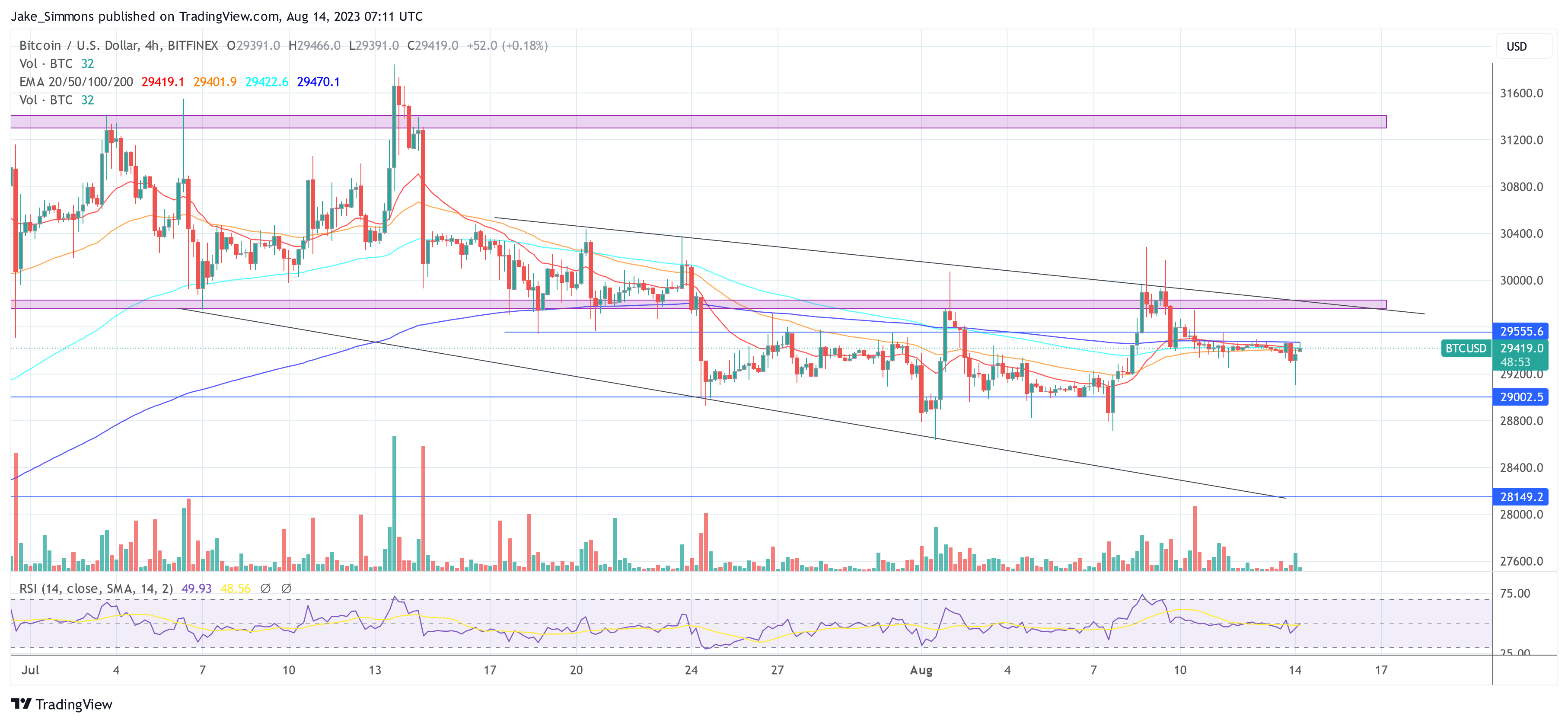

At press time, BTC traded at $29,426 and noticed one other calm weekend amid the liquidity summer season drought. Breaking above $29,550 is essential to determine any bullish momentum to provoke one other push in direction of $30,000.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link