[ad_1]

Fast Take

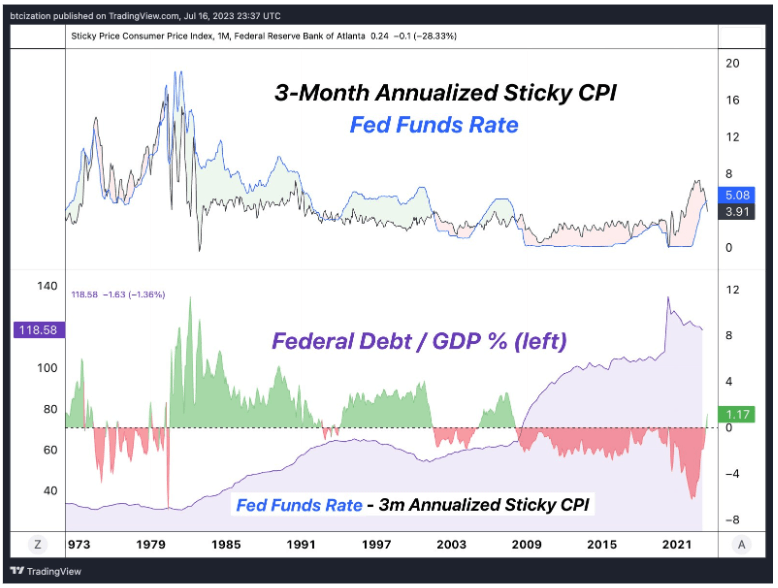

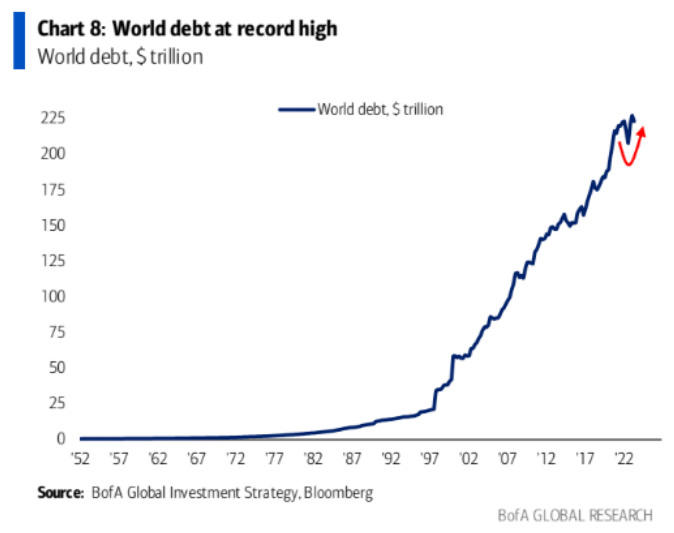

Dylan LeClair, an analyst at Bitcoin Journal, sheds mild on the present U.S. debt to GDP state of affairs. He reveals that the ratio is roughly 119%, a lower from a quick peak of 134%. This example outcomes from inflation compounding at a fee of 5.7%. LeClair additional suggests a possible resolution to scale back the debt to GDP ratio: adopting unfavorable actual yields, whereby bond yields fall under inflation.

Understanding Methods to Scale back Debt to GDP

Jeroen Blokland, of analysis agency True Insights, proposes a number of methods to mitigate the rising debt to GDP ratio. These strategies embody:

Austerity: This strategy implies authorities frugality, i.e., spending much less. Nevertheless, Blokland notes that austerity typically results in lowered GDP development.

Elevated GDP Progress: This may be achieved by way of improved productiveness and a bolstered labor drive, although this is perhaps adversely affected by rising rates of interest.

Decrease Curiosity Charges: This technique permits for much less coupon and extra reimbursement, consequently lowering the debt.

Inflation: By inflating the debt away, it turns into cheaper to repay.

Debt Cancellation or Jubilee: Whereas this can be a extra radical strategy, it serves as a doable final resort resolution.

With the present rates of interest sitting at 5% within the U.S. and rising throughout the western world, the debt continues to turn into dearer to repay. This problem could be additional exacerbated by a diminishing labor drive.

The publish World debt now over two occasions higher than the worldwide financial system appeared first on CryptoSlate.

[ad_2]

Source link