[ad_1]

The emergence of GameFi, a hybrid of gaming and decentralised finance (DeFi), powered by NFTs and blockchain expertise, has drastically modified the gaming business in recent times.

Aimed to empower gamers by true possession over in-game property, an entire new market of crypto video games has taken form, evaluated at greater than $27B initially of 2022 (based on Footprint Analytics). Regardless of a lower of greater than 85% by EOY 2022, the worth proposition of blockchain gaming has not gone unnoticed by buyers. From $3.8B in 2021, enterprise capital funding elevated to a staggering $5.4B in 2022 (for the Web3 gaming area of interest alone), regardless of the macroeconomic panorama. This was accompanied by a rise within the variety of funding rounds from 181 in 2021 to 295 in 2022, a rise of over 60%.

We are able to see a rising curiosity from buyers within the Web3 gaming house, regardless of the difficult macroeconomic situations. The rise additionally factors to the emergence of recent gamers within the sector, signalling a vibrant and dynamic surroundings ripe for innovation and entrepreneurship.

Additionally it is necessary to notice that AAA-quality Web3 video games haven’t but reached their product/market match part as such initiatives usually take a number of years to be developed.

The rise of play-to-earn gaming

Blockchain gaming has brought on a paradigm shift within the gaming business by introducing the idea of play-to-earn (P2E). Initially popularised by Axie Infinity’s parabolic rise, the P2E mannequin created a brand new avenue for people, particularly in creating international locations, to earn a dwelling by taking part in video games. Within the wake of Axie’s 2021 bullish summer time, a wholly new crypto area of interest was unveiled and have become the most popular narrative out there. Though the play-to-earn (P2E) mannequin skilled a fast rise and fall, it nonetheless marks a major period for Web3. Firstly, it launched a file variety of customers to the idea of a decentralized pockets, primarily by gaming.

Secondly, play-to-earn has extensively showcased an answer to asset possession, a side historically managed by centralized entities in gaming. In Web2 video games, gamers spend numerous hours grinding for digital rewards that usually maintain no real-world worth. 2 outstanding current examples can be Activision-Blizzard closing World of Warcraft servers in China, leaving gamers with out entry to their hard-earned digital property and Valve which banned accounts holding greater than $2M value of weapon skins (in-game cosmetics).

In distinction to Web2, gamers of crypto video games can earn fungible tokens or NFTs for actively collaborating within the recreation or finishing varied quests. In flip, these in-game property could be straight monetised. This new financial mannequin has attracted a large inflow of gamers who now see gaming not simply as a type of leisure, but additionally as a method to generate revenue. Nonetheless, there’s additionally a major a part of the gaming group that opposes NFTs, below the pretext that video games ought to purely signify a passion. Nevertheless, time has confirmed that gaming is a tradition in itself, with folks usually taking this ‘passion’ to extremes (guilds, raiding, senseless merchandise farming, and so forth.).

Play-to-earn economic system

The idea of true possession permits gamers to purchase, promote, and commerce their in-game property freely, giving them a way of management and autonomy. By decentralising marketplaces, gamers are not topic to exorbitant charge cuts from the monopolising distribution platform. For instance, Apple Retailer takes a reduce between 15-30%, which may very well be defined by their overwhelming market share in smartphone and cell app business.

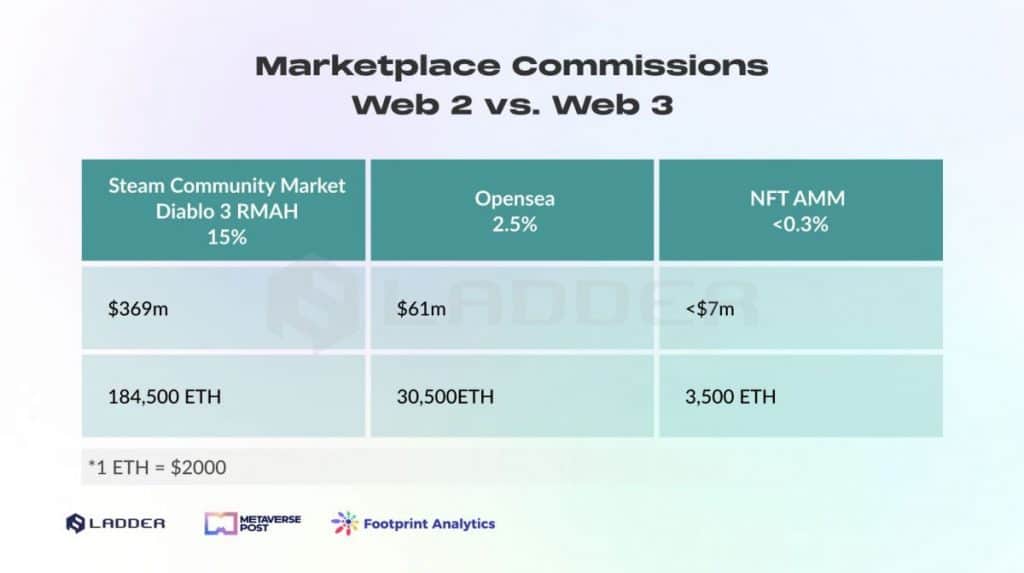

Activision-Blizzard additionally made an try to monetize in-game property by the Actual-Cash Public sale Home (RMAH) launched in Diablo 3. Much like NFTs proper now, it was obtained with combined emotions by the participant base, most contemplating that it paved the way in which for pay-to-win (P2W). Even though Blizzard capped the utmost itemizing worth to $250 and likewise gave gamers the choice to make use of in-game forex as a substitute of actual cash, the RMAH was faraway from the sport in lower than 1 12 months, as a consequence of adverse suggestions. The ultimate nail within the coffin was a hyperinflation of the in-game economic system brought on by merchandise & gold dupes. Extra importantly, Blizzard additionally utilized a reduce of as much as 15% of every sale, which is greater than double that utilized by Opensea, the main NFT buying and selling platform, (2.5%) plus the common quantity of creator royalties (5%).

To raised visualize the affect of platform charges, let’s think about the Bored Ape Yacht Membership NFT assortment for instance. Up till the time of penning this, the gathering generated a complete traded quantity of 1,232,824 ETH, roughly equal to $2.5B at present charges. The chart beneath exhibits the proportion of that quantity that every platform operator would obtain, primarily based on their respective charges. We evaluate conventional web2 marketplaces with the present chief, OpenSea, and an AMM protocol. In contrast to different NFT marketplaces which function on an order guide model of trade, Ladder Protocol makes use of Automated Market Makers and restrict orders. This strategy permits Ladder to supply immediate swaps for NFTs, with minimal slippage and charges in a decentralized method. Subsequently, utilizing blockchain expertise may probably save customers a minimum of 80% of transaction prices, which quantities to greater than $300m USD in absolute numbers.

Diablo 3’s RMAH is a transparent instance that NFTs and blockchain wouldn’t solely present a market various, however they’d additionally assist stop exploits (i.e. dupes, stolen objects, and so forth.) because the transparency and safety provided by blockchain expertise make sure that anybody may confirm an asset’s historical past.

Secondly, the play-to-earn mannequin has opened up new avenues of revenue era, particularly in areas the place conventional job alternatives could also be restricted.

NFT utility will not be restricted to playable property, as they’ll additionally signify fractional possession over non-playable property.

Fungible tokens, alternatively, predominantly function native forex for in-game transactions. Some initiatives have additionally employed a dual-token mannequin, in which there’s a separate token for governance functions.

Incorporating the AMM mannequin can drastically enhance in-game economies. Not solely can it streamline the trade of in-game fungible tokens, however it might probably additionally rework NFT buying and selling by addressing their typical illiquidity. The latter use case particularly targets generally traded NFTs, for which worth resides of their total shortage and never essentially of their particular person rarity. On this situation, utilising an NFT AMM reduces liquidity gaps, making NFT buying and selling extra environment friendly.

Ladder is creating an NFT AMM tailor-made particularly for seamless GameFi integration, and their mainnet launch is rapidly approaching.

Group bootstrapping

Profitable video games have one factor in frequent – a loyal group. Web3 gaming allows a extra environment friendly group bootstrapping by direct incentivization, utilizing the token inflation interval to reward lively members. Aside from this, by transferring possession over in-game property to the gamers, they’re extra inclined to stay by a challenge they imagine in, by thick and skinny. Final however not least, Web2 board member choices are changed in Web3 by DAO governance, a extra clear group voting system that dictates a challenge’s improvement roadmap.

Naturally, in a risky and rising business, as soon as a story begins heating up, there can even be speculators galore. From record-high funding valuations to costly in-game land NFTs, solely time will inform which initiatives handle to achieve mass adoption. NFT worth tags are a subject usually scoffed at, however folks fail to pay attention to equally spectacular digital asset gross sales from the Web2 gaming business (an outdated record could be discovered right here, however with the announcement of Counter-Strike 2, CS:GO pores and skin gross sales have began to go parabolic).

Slowly however absolutely, gamers started to despise the time period ‘play-to-earn’, viewing all merchandise below this class as Ponzi schemes, with no significant gameplay. Because of this, different derivatives have come to life: ‘play-and-earn’, ‘play-to-own’, ‘free-to-own’, and so forth. GameFi is an umbrella time period that encompasses varied facets of Web3 gaming, with a powerful concentrate on in-game economic system.

Nonetheless, there are quite a few Web3 initiatives that even from early improvement levels have attracted excessive numbers of day by day lively customers. Early adoption of rising applied sciences usually presents a possibility for vital advantages, and the Web3 house is not any completely different. Many individuals are interested in initiatives of their early levels due to the potential for vital returns.

Nevertheless, keep in mind that AAA-quality video games haven’t but built-in blockchain expertise, so their gamers are off-chain, therefore in a roundabout way quantifiable.

A report by DappRadar revealed that greater than 50% of whole blockchain transactions have been gaming-related.

Metaverse

A novel sub-niche of Web3 social gaming is represented by metaverse-related initiatives which unlock immersive person experiences, additional enhanced by asset inter-operability. Continually frowned upon, the worth proposition of the metaverse has been acknowledged by Web2 tech giants corresponding to Fb/Meta and, extra just lately, Apple, with their AR/VR headsets.

As metaverse initiatives intention to create digital worlds the place customers can work together and have interaction with one another, opening up prospects for digital actual property, digital commerce, and so forth., investing in these initiatives may very well be a long-term play because the expertise and adoption proceed to develop.

SecondLive, the pioneering metaverse recreation in the marketplace, serves as a compelling case within the blockchain business. Remarkably, after years of operation, it nonetheless has over 10,000 lively customers day by day, based on Footprint Analytics, and this stage of sustained engagement is sort of uncommon within the blockchain world.

The metaverse idea, which permits for immersive person experiences and asset interoperability, has confirmed to be a powerful draw for customers in each Web2 and Web3 video games. Particularly within the Web3 video games, the flexibility to personal actual property additionally supplies a novel worth proposition that has stored customers engaged over the long run.

Distribution platforms

Following within the footsteps of Epic Video games, a key pattern that facilitates entry to Web3 video games is represented by blockchain gaming platforms that provide a variety of video games and providers. These platforms act as a gateway for gamers to entry varied crypto video games, making it simpler for them to find and discover new gaming experiences.

Regardless of Steam’s reluctance to publish video games that combine any kind of blockchain expertise, Epic Video games is actively supporting titles corresponding to Star Atlas, Gala Video games’ Superior, Impostors, and so forth. This integration may probably bridge the hole between conventional gaming and the crypto video games market, bringing blockchain gaming to a wider viewers.

Nevertheless, even with technological developments within the area of blockchain scalability (Layer 2 rollups, primarily zero-knowledge tech changing into significantly extra environment friendly) in recent times, one major bottleneck stays: person expertise (UX).

Immutable is likely one of the corporations that has got down to repair simply that, initially by their layer 2 ZK-STARK-powered market that allowed gamers to transact in a gas-free surroundings (though technically there are nonetheless minimal gasoline charges as transaction proofs must be posted on Ethereum, these may simply be extracted away from the person).

By partnering with Polygon, Immutable has additionally built-in Polygon’s zkEVM rollup in its tech stack. This completely enhances their beforehand used STARK-powered merchandise by including a totally appropriate EVM answer alongside the Cairo language.

The shift to Web3

The Web3 gaming house has not solely captured the eye of massive companies but additionally began attracting high-ranking staff from Web2, corresponding to Ryan Watt, the previous head of gaming at YouTube, who moved to Polygon.

Out of the normal gaming studios, Sq. Enix, the builders of the Last Fantasy franchise, have been among the many first to undertake NFTs, however they have been closely criticised by their group.

Dangers related to Web3 gaming (investing)

Whereas the crypto gaming market presents thrilling alternatives, it’s not with out its justifiable share of challenges and dangers, and most significantly, asset valuation volatility. Secondly, safety considerations are regular for any rising expertise, as hackers and scammers are always on the lookout for vulnerabilities to take advantage of.

Regardless of current filings for spot Bitcoin ETFs, in addition to IMF & FED chair Powell declaring that cryptocurrencies are right here to remain and banning them is detrimental to financial improvements, regulatory uncertainty stays a Web3-native danger, even within the gaming sector.

Final however not least, buyers must discern between groups with recreation improvement expertise and money grabbers/speculators as a profitable recreation can take years to be totally developed.

On the intense facet, with the growing adoption of cryptocurrencies and blockchain expertise, extra buyers are more likely to enter the market, pushing for improvements. VC funding was at file highs in 2022, all through the whole lot of the crypto business, regardless of the raised rates of interest or a looming recession.

One of the vital spectacular raises in blockchain gaming was that of Gunzilla Video games’, which raised over $70M (in a bear market) to carry their imaginative and prescient to life; the primary product to be launched being Off the Grid.

The (vibrant) way forward for blockchain gaming

The normal gaming business is valued at over $250B in 2023 and estimated to almost double by 2030, in comparison with blockchain gaming which, in the intervening time of writing (July 2023), was sitting at a market capitalization of lower than $10B.

What’s much more notable is that VCs are not crypto-native solely, however have piqued the curiosity of Web2-native gaming manufacturers as properly. Razer simply introduced their zVentures Web3 Incubator (ZW3I) which already participated in funding some huge upcoming titles within the Web3 house: Shrapnel, Gunzilla Video games’ Off the Grid, Nyan Heroes, and so forth.

Contemplating the market share ratio of Web2 gaming in comparison with Web3, one may say that the risk-reward steadiness suggestions in favour of outlandish returns even at 8-figure valuations.

Keep in mind that market capitalization for blockchain video games in 2021-2022 was primarily pushed by hypothesis within the wake of Axie’s parabolic development. We anticipate that mainstream adoption and product/market match will result in even greater valuations as soon as macroeconomic situations ameliorate.

As Web2 begins implementing blockchain expertise and Web3-native gaming studios develop AAA-quality video games (favoured by the growing technical capabilities of Unreal Engine 5), gamers are additionally seemingly to offer blockchain gaming one other probability. Finally, as blockchain integrations turn into seamless, Web3 gaming will do away with the ‘Web3’ tag.

What started with NFTs marking crypto’s shopper second, Web3 gaming will push the widespread adoption of blockchain expertise properly past the chances of DeFi. Bull or Bear, players will at all times play.

Moreover, the event of metaverse initiatives holds super potential. As digital actuality expertise continues to advance and turn into bodily slimmer, metaverse initiatives may change the way in which we work together and have interaction with digital worlds. This might pave the way in which for brand spanking new types of leisure, digital commerce and social interplay.

In conclusion, the rise of GameFi and the crypto video games market has ushered in a brand new period of gaming that mixes leisure and monetary alternatives, of which we have now solely seen the tip of the iceberg. With the appearance of blockchain expertise, gamers can now really personal and monetize their in-game property, whereas buyers can capitalise on the rising reputation of this rising market.

Learn extra associated subjects:

[ad_2]

Source link