[ad_1]

Cryptocurrency fee gateways have revolutionised the best way we transact within the digital age. Because the adoption of cryptocurrencies continues to rise, fee gateways play an important position in facilitating safe and seamless transactions. On this article, we are going to discover the rising traits and developments within the discipline of cryptocurrency fee gateways and look at the impression of key elements comparable to decentralised finance (DeFi), central financial institution digital currencies (CBDCs), scalability challenges, and regulatory developments in crypto funds. Let’s dive into the thrilling way forward for cryptocurrency fee gateways, along with key trade traits and developments.

Integration of decentralised finance (DeFi) protocols

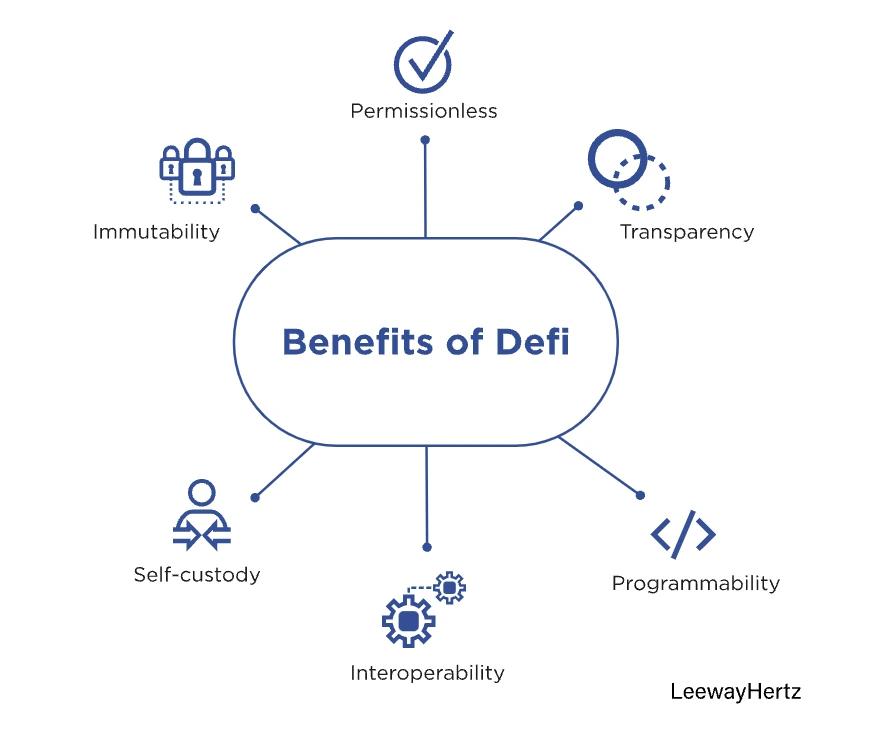

The combination of decentralised finance (DeFi) protocols into cryptocurrency fee gateways is a major pattern that’s reshaping the monetary panorama. DeFi refers to a set of economic functions and providers constructed on blockchain networks, primarily Ethereum, that goal to supply open, permissionless, and decentralised options to conventional monetary methods.

When DeFi protocols are built-in into cryptocurrency fee gateways, it allows customers to seamlessly entry DeFi providers straight from their wallets. This integration presents a number of advantages. For example, DeFi protocols allow people who might not have entry to conventional banking providers to take part in varied monetary actions. By integrating DeFi capabilities into fee gateways, customers can simply have interaction in lending, borrowing, yield farming, and different DeFi providers comparable to peer-to-peer cryptocurrency funds. This enhances monetary inclusivity and permits people to have management over their property.

Furthermore, DeFi protocols function on blockchain networks, which offer safety and transparency via using sensible contracts. By integrating these protocols into fee gateways, customers can reap the benefits of the inherent safety and transparency of blockchain know-how. Sensible contracts robotically execute transactions primarily based on predefined circumstances, lowering the danger of fraud or manipulation.

Additionally, DeFi protocols supply alternatives for customers to earn passive revenue via yield farming, staking, and liquidity provision. By integrating these capabilities into fee gateways, customers can simply discover and reap the benefits of these yield alternatives with out the necessity for separate platforms or advanced processes.

Influence of central financial institution digital currencies (CBDCs)

CBDCs are digital representations of a rustic’s fiat foreign money which are issued and controlled by the central financial institution. In contrast to cryptocurrencies, CBDCs are centralised and backed by the federal government, aiming to mix the benefits of cryptocurrencies with the soundness of conventional fiat currencies. Certainly, proper now, we’re witnessing the primary cryptocurrency fee gateway integrations with conventional monetary methods.

Firstly, CBDCs can enhance the effectivity and pace of digital fee processing. Transactions could be settled in real-time, eliminating the necessity for intermediaries and lowering settlement instances. This allows quicker, extra seamless transactions, notably for cross-border funds.

Then, CBDCs have the potential to boost monetary inclusion by offering people with restricted entry to conventional banking providers and a safe and accessible digital fee resolution. CBDCs can allow the unbanked and underbanked populations to take part within the digital economic system, fostering monetary inclusion and financial empowerment.

After all, we shouldn’t low cost that CBDCs may also help scale back transaction prices related to conventional fee methods. By eliminating intermediaries, streamlining processes, and leveraging blockchain know-how, CBDCs can decrease transaction charges, making digital funds extra inexpensive and accessible to a wider vary of people and companies – one thing extremely vital when contemplating the position of cryptocurrency fee options for rising markets. CBDCs may facilitate seamless interoperability between totally different digital fee methods and currencies, making cross-border transactions extra environment friendly and cost-effective. CBDCs can doubtlessly simplify and streamline the advanced processes concerned in cross-border funds, eliminating the necessity for a number of foreign money conversions and intermediaries.

Lastly, CBDCs present central banks with enhanced regulatory oversight and management over the monetary system. By issuing and regulating CBDCs, central banks can guarantee compliance with regulatory frameworks, stop illicit actions, and preserve monetary stability. This regulatory oversight may also help foster belief and confidence in digital fee methods. Certainly, we must always keep in mind that CBDCs should not meant to switch present fee methods however reasonably coexist with them. The combination of CBDCs with present digital fee methods and infrastructure can present people and companies with extra decisions and adaptability for his or her fee wants. The same evaluation may very well be performed on stablecoins and their impression on fee gateways

Scalability and interoperability in cryptocurrency transactions

Because the adoption of cryptocurrencies continues to develop, the scalability and interoperability challenges inside the cryptocurrency fee gateway trade turn into extra pronounced. Cost gateways must deal with numerous transactions in a well timed and safe method to satisfy the calls for of customers.

Scalability refers back to the potential of a fee gateway to deal with an growing variety of transactions with out sacrificing pace or effectivity. Conventional blockchain networks, like Bitcoin and Ethereum, have limitations by way of transaction throughput and processing pace. As extra customers be a part of the community and interact in transactions, the community can turn into congested, leading to slower processing instances and better charges.

To deal with scalability challenges, varied scaling options for cryptocurrency are being developed. One such resolution is the implementation of layer-two protocols, which function on high of the principle blockchain and deal with a major variety of transactions off-chain. Layer-two protocols, such because the Lightning Community for Bitcoin and the Raiden Community for Ethereum, allow quicker and cheaper transactions by lowering the burden on the principle blockchain.

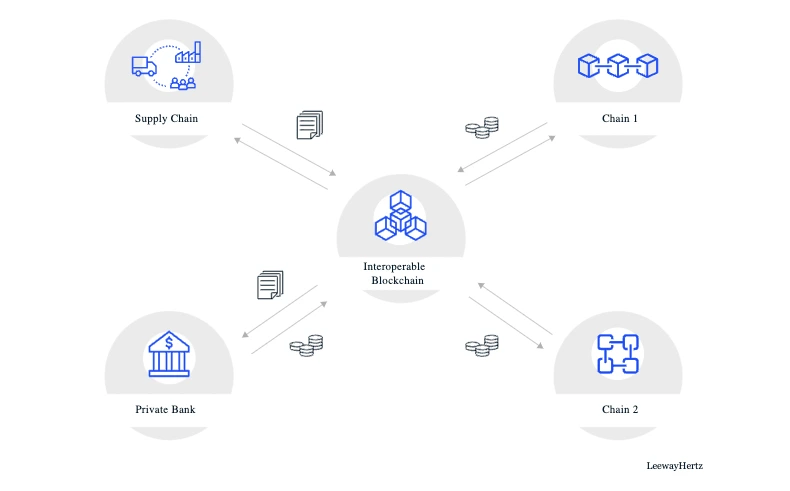

Interoperability is one other problem that arises as totally different cryptocurrencies function on separate blockchain networks. For seamless transactions throughout a number of cryptocurrencies, it’s essential to ascertain interoperability between these networks. Interoperability permits for the switch of property and knowledge between totally different blockchains, enabling customers to transact with varied cryptocurrencies with out the necessity for a number of intermediaries or sophisticated trade processes. This challenge is particularly pertinent once we think about the growing position of privacy-focused cryptocurrencies.

Varied initiatives and initiatives are engaged on reaching interoperability in crypto funds. Some make use of cross-chain bridges or protocols that facilitate the switch of property and knowledge between totally different networks. Others concentrate on creating common requirements or protocols that allow interoperability between disparate blockchains.

By addressing scalability and interoperability challenges, cryptocurrency fee gateways can improve their effectivity, scale back transaction prices, and supply an enhanced person expertise in crypto transactions. These developments are essential for widespread cryptocurrency adoption, permitting for seamless transactions and elevated utility throughout totally different blockchain networks.

Wanting ahead

The way forward for cryptocurrency fee gateways holds immense potential. Tokenization of property, together with safety token choices (STOs) and non-fungible tokens (NFTs), will open up new avenues for commerce and funding. Decentralised exchanges (DEXs) will proceed to evolve, offering customers with better liquidity and management over their property. Regulatory developments in crypto funds will form the panorama, with governments worldwide working in direction of establishing clear frameworks to make sure shopper safety and foster innovation.

Certainly, Cryptocurrency fee gateways are on the forefront of the digital revolution, facilitating safe, environment friendly, and borderless transactions. The combination of decentralised finance protocols, the impression of central financial institution digital currencies, and the decision of scalability and interoperability challenges are shaping the way forward for fee gateways. As companies and shoppers embrace the advantages of blockchain know-how, the world of cryptocurrency fee gateways is about to evolve, unlocking new prospects for international commerce. As such, cryptocurrency fee gateways comparable to CoinsPaid are taking centre stage.

CoinsPaid is the main crypto fee platform that gives a number of revolutionary options for retailers. The service helps funds in Bitcoin, Ethereum and the opposite 18 high cryptocurrencies whereas providing prompt conversion into fiat on the shopper’s request. CoinsPaid creates personalised options for companies that match their particular person wants and necessities. Lastly, CoinsPaid is 100% authorized and safe — it operates primarily based on an EU licence and absolutely complies with AML/KYB laws.

Suppose you’re a service provider seeking to hop on board the bandwagon of crypto funds and settle for cell and contactless cryptocurrency funds this week. In that case, we strongly urge you to decide on a good fee supplier.

[ad_2]

Source link