[ad_1]

The chapter submitting of FTX resulted in an astonishing 99.5% discount in its worth, with the best provide being a mere $1 million.

FTX’s authorized crew has initiated a lawsuit towards former CEO Sam Bankman-Fried, co-founder Zixiao Wang, and former senior govt Nishad Singh over the $220 million acquisition of stock-clearing platform Embed. The lawsuit alleges an absence of due diligence and misconduct.

In response to the submitting made by FTX on Could 17, the corporate acquired Embed for $220 million by its U.S. subsidiary, claiming to have performed minimal due diligence on the platform.

The founder and former CEO of Embed, Michael Giles, reportedly performed extra intensive due diligence on non-binding indications of curiosity in comparison with different entities. Regardless of submitting a remaining bid, not one of the different 12 entities proceeded with the acquisition after conducting thorough due diligence.

FTX’s attorneys argue that Giles obtained $157 million in reference to the acquisition however made a remaining bid of solely $1 million, topic to reductions at closing.

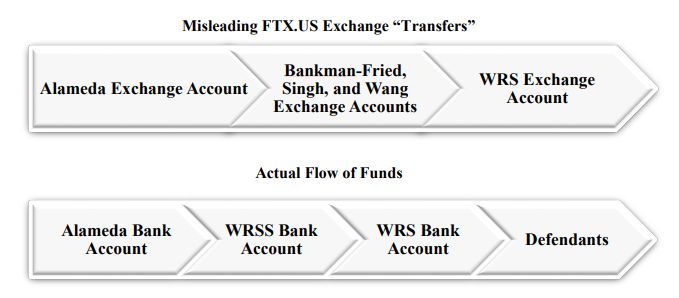

FTX.US Alternate “Transfers”

The insiders at FTX, together with Bankman-Fried, are accused of participating in fraudulent actions through the use of buyer funds to accumulate Embed and conceal its monetary points. They’re additionally alleged to have taken benefit of FTX’s poor record-keeping to perpetrate the fraud. The attorneys declare that the defendants had been conscious of the corporate’s insolvency when approving the deal.

Moreover, the attorneys assert that deceptive data had been created to cover Alameda’s position in funding the Embed acquisition. They declare that FTX entities, together with Singh, Wang, and Zhang, transferred funds to Bankman-Fried, Singh, and Wang, with the data later altered to hide these transactions.

FTX goals to disallow the claims made by the defendants and recuperate the misplaced funds ensuing from avoidable transfers. They request that these claims be labeled as “avoidable fraudulent transfers and obligations, and preferences.”

Since submitting for Chapter 11 chapter on November 11, FTX’s new management has been centered on recovering owed funds and contemplating a relaunch of the corporate.

Learn extra associated articles:

[ad_2]

Source link