[ad_1]

The FTX debtors stated that they had paid the 14 consultancy corporations and the regulation corporations dealing with its chapter case over $100 million as of April 30, in keeping with a Could 30 court docket submitting.

Sullivan & Cromwell is prime earner

In line with the submitting, FTX paid regulation agency Sullivan & Cromwell (S&C) $39.58 million for its companies, making it the best earner amongst these corporations.

S&C is the corporate’s restructuring counsel and has performed an energetic function in FTX’s chapter case. The regulation agency beforehand described its companies to the bankrupt trade as “one of the vital difficult, multi-disciplinary workouts by any regulation agency.”

The agency was initially met with stiff opposition from Sam Bankman-Fried, who accused the regulation agency of pressuring him to authorize submitting for chapter within the days following FTX’s implosion. S&C’s involvement within the proceedings has additionally been challenged by U.S. lawmakers Thom Tillis, Elizabeth Warren, John Hickenlooper, and Cynthia Lummis, who cited its earlier relationship with FTX in a Jan. 9 letter to the court docket.

One other top-earning agency within the FTX’s chapter case is Alvarez & Marsal North America, performing as a monetary advisor to the chapter case. The agency has earned $32.7 million.

Others like Landis Rath & Cobb, Quinn Emanuel Urquhart & Sullivan, AlixPartners, Kroll, Jefferies LLC, and others have earned between $257,149 and $5.01 million.

FTX has $2.03B in financial institution

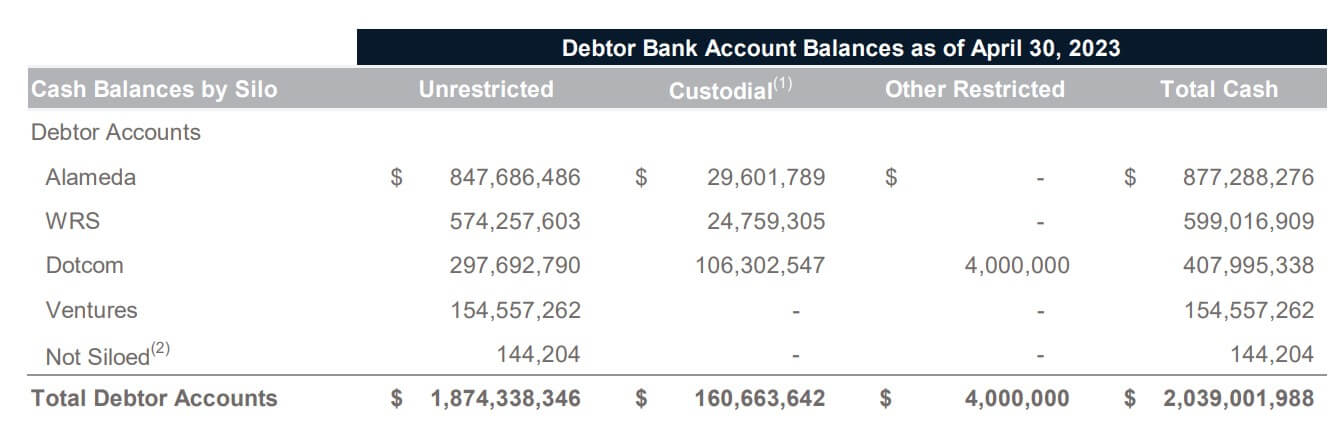

The debtors in FTX’s chapter reported that the 4 siloes of the bankrupt crypto empire held $2.03 billion in unnamed banks as of April 30.

A breakdown of those checking account balances confirmed that the Alameda silo, which contains the principal buying and selling agency Alameda Analysis and its subsidiaries, had $877.28 billion in banks. In distinction, the West Realm Shires silo — which incorporates FTX US and Ledger X — had 599.01 billion within the banks.

The Dotcom silo, which contains FTX.com and different exchanges, had $407.99 billion in banks, whereas the FTX Ventures held $154.55 billion in these conventional monetary establishments.

Moreover, Deck Applied sciences, Inc—a separate entity and never one of many 4 silos making up FTX’s fundamental accounts — has $144,204 in banks.

The FTX debtors stated they maintained accounts in foreign currency throughout quite a few entities. The bankrupt agency didn’t present additional data on the names of those banks or the quantity held at every.

Stories revealed a number of U.S. banks’ ties to the bankrupt trade earlier within the yr. A lawsuit alleged that the defunct Signature Financial institution aided and abetted the FTX fraud by “allowing” the commingling of the trade customers’ funds by means of its Signet community.

FTX earned $105M

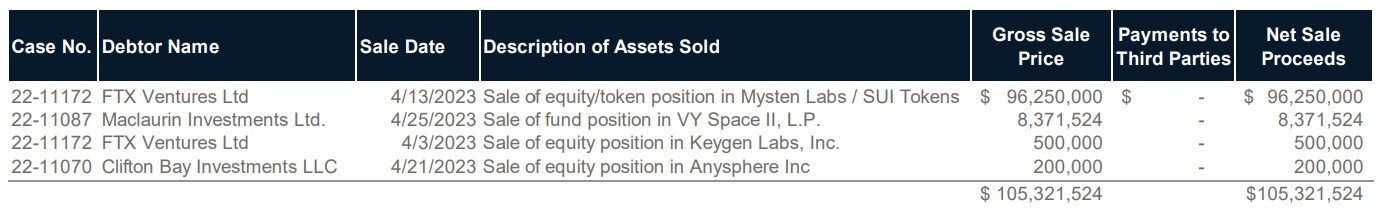

The monetary assertion additional confirmed that the bankrupt agency acquired $105.32 million by means of the gross sales of 4 totally different belongings.

In line with the submitting, the trade earned $96.25 million from the gross sales of its fairness and token place in Mysten Labs’ SUI Tokens. CryptoSlate reported that the bankrupt trade had undervalued its SUI holdings by roughly 1,000 occasions, because the tokens would have been value over $1 billion.

In the meantime, the agency offered its fund place in VY Area for $8.3 million on April 25 and its fairness place in Keygen Labs and Anysphere for $500,000 and $200,000, respectively.

Different updates

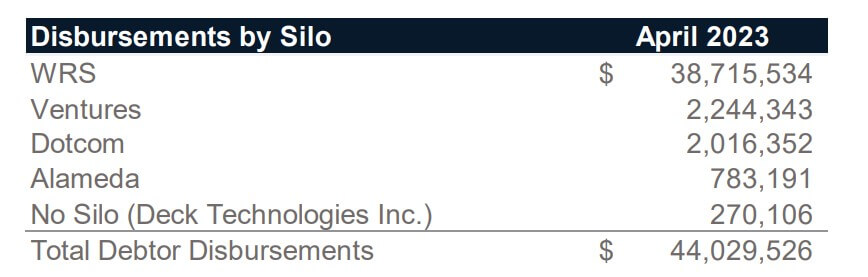

In line with the court docket submitting, FTX made $44.02 million in disbursements in April. The submitting didn’t embrace particulars on when these funds had been made and to whom they had been made.

Moreover, FTX stated it has 107 full-time staff, down from the 320 staff it had when it filed for chapter and paid a complete post-petition taxes of $386,033 in April.

[ad_2]

Source link