[ad_1]

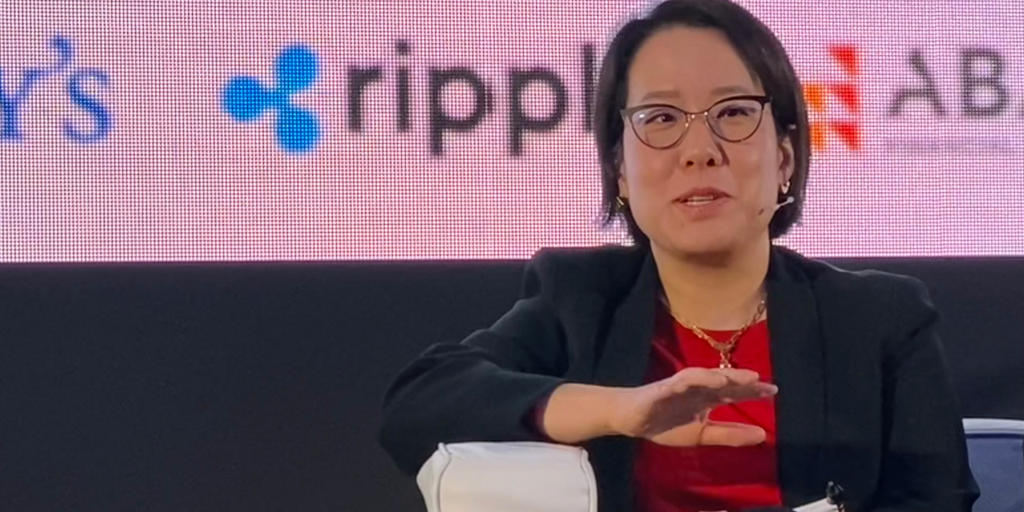

Sandra Lee of the FSOC mentioned that the collapse of FTX might’ve been averted the next month had the suggestions of a report from final October been extra carefully studied.

Talking at a Monetary Occasions panel on crypto regulation this morning, Lee mentioned “final fall, the council printed a report on digital belongings and instability and recognized numerous dangers and potential suggestions.”

The FSOC was established in 2010 by the Dodd-Frank Act and it really works beneath the U.S. Treasury. It contains fifteen members, ten of which vote, they usually symbolize the highest monetary regulators, together with the Fed, the SEC, and the CFTC. Their major purpose is to convene and determine rising dangers to U.S. monetary markets and make coverage suggestions.

“I do suppose a few of the themes and dangers recognized within the report have been borne out by what was noticed with FTX,” Lee mentioned, including for example that there have been “market integrity points previous to regulation impacting customers. That positively, sadly, got here to go.”

As soon as one of many trade’s largest cryptocurrency exchanges, FTX collapsed final November after it was hit by a multi-day financial institution run.

Within the technique of unraveling, it got here to gentle that FTX executives had been misusing buyer funds to make entire its buying and selling arm Alameda Analysis, which had been over-leveraged resulting from dangerous trades and a bear market prompted by the collapse of Terra earlier that yr.

Former CEO Bankman-Fried now faces 13 felony expenses—with eight expenses from an earlier indictment—together with wire fraud and conspiracy to commit cash laundering. His case has additionally prompted U.S. regulators to tighten their crackdown on crypto firms.

In keeping with Lee, the FSOC had already made suggestions that might have helped too, “one of many suggestions within the report talks concerning the significance to supervisors and regulators of having the ability to see into associates and subsidiaries of sure cryptoasset companies.”

The FSOC and crypto

Their October report was launched in response to President Joe Biden’s govt order from March 9, 2022, “Making certain Accountable Growth of Digital Belongings.”

Whereas removed from being as complete because the EU’s recently-passed MiCA invoice, it offered potential regulators with some basic ideas and steerage from the White Home.

The report flagged 4 key points in crypto: “amplified instability” throughout the ecosystem, costs pumped by hypothesis somewhat than elementary underlying financial utility, “repeated important and broad declines,” and—most related to FTX—tokens issued by or related to entities with “dangerous enterprise profiles and opaque capital and liquidity positions.”

Looking back, the FSOC’s wording right here can neatly be utilized to FTX’s native FTT token.

A financial institution run on FTT catalyzed FTX’s demise. It began when rival Binance CEO Changpeng Zhao declared he would transfer to liquidate his trade’s complete FTT holdings citing “current revelations” about FTX allegedly lobbying “in opposition to different trade gamers behind their backs.”

As the value of FTT plummeted, it grew to become obvious that FTX was massively overleveraged.

Inside per week, the agency had filed for chapter, taking 130 affiliated firms with it in a large number so massive that regulators and trade alike are nonetheless making an attempt to parse it via the wreckage.

Keep on prime of crypto information, get every day updates in your inbox.

[ad_2]

Source link