[ad_1]

Good friend Tech (FT), the web3 social token platform that noticed a resurgence in person exercise just lately, has seen a rise in “sniper bots,” which have been inflicting vital shifts in share costs.

Based on an in depth evaluation carried out by X person @unexployed_ of Fort Capital, these bots, past their usually anticipated performance, are deploying a way of ‘sniping’ to achieve management over high-value profile shares.

Within the case of DappRadar’s current registration on FT, Unexployed revealed that the share costs began at an unusually excessive level of 0.26 ETH. This was not triggered by a registered account however seemingly by a sniping tackle interacting instantly with the sensible contracts, demonstrating the affect of those bots available on the market.

Digging deeper into basescan.org, Unexployed was capable of hint the chronological order of patrons and sellers. Throughout the first 4 blocks, there have been already 65 shares available on the market. And DappRadar was not alone. Different entities, resembling Moonshilla and Rektdiomedes, additionally confronted an identical scenario the place snipers gained fast management over their FT provide.

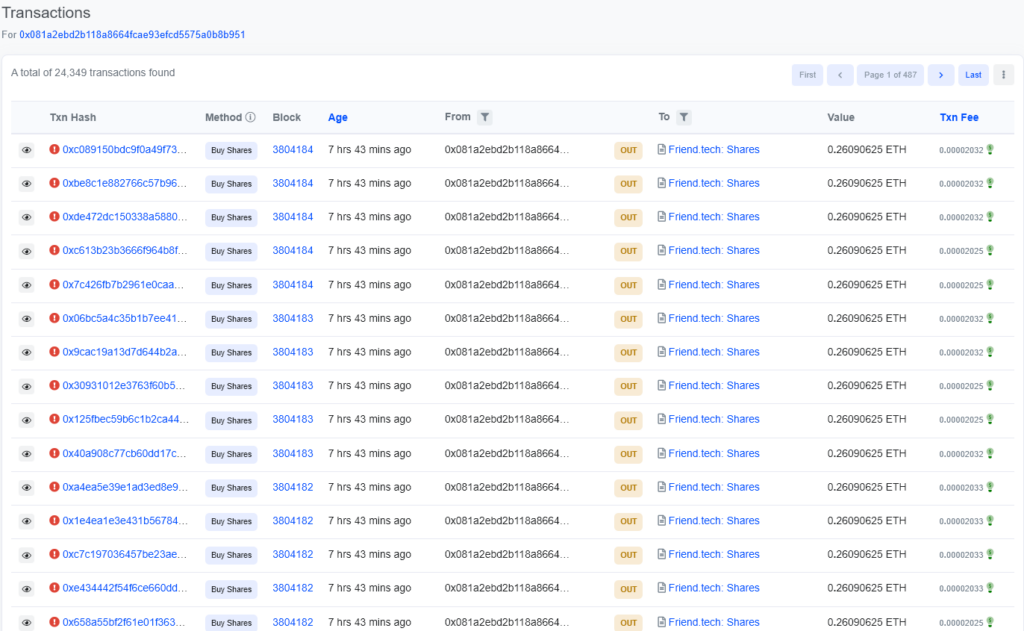

The first sniper, recognized as 0x081…951, executed over 20,000 transactions to amass the shares. The primary 46 transactions failed with the error “Fail with error ‘Inadequate fee” and had been reverted, in line with Basescan.

A CryptoSlate evaluation of the transactions revealed that the account tried to buy the shares earlier than the proprietor of the account had bought the primary share (a requirement of FT.) The transaction log states Fail with the error, “Solely the shares’; topic can purchase the primary share”

Such spamming conduct was already evident through the first week of FT. Based on Bert Miller from Flashbots, spamming the chain and mempool leaks are key elements resulting in this phenomenon.

The sniper’s large management over the provision allowed them to earn a revenue of 1.84 ETH by promoting their shares. Nonetheless, the bot’s actions led to a major discount in provide, and one other sniper incurred a lack of 0.5 ETH, illustrating the aggressive nature of those bots.

Within the wake of those revelations, considerations are being raised concerning the equity of the platform for particular person customers and high-value profiles. Unexployed suggests FT ought to contemplate options resembling permitting creators to buy extra of their shares upon registering to mitigate the consequences of those bots.

FT resurgence in person exercise.

It’s clear that regardless of the drastic drop in preliminary hype and challenges with ‘sniper bots,’ the platform is making appreciable strides. The income surged to $5.6 million on Sept. 9, showcasing a 30-day excessive for the blockchain-based social community.

The income spike was propelled by constant development in use over the earlier two weeks, which is an encouraging sign up mild of the substantial lower in preliminary pleasure that adopted after its launch.

The platform’s every day energetic customers tally reached 9,000, with 2,000 new sign-ups recorded on Sept. 9. The identical day witnessed a buying and selling quantity of $12.3 million, positioning it because the third-highest buying and selling day since its inception. Moreover, FT collected charges amounting to $1.23 million, making it one of many highest fee-generating days for any dApp within the crypto market.

Nonetheless, the rise in ‘sniper bots’ has been inflicting vital shifts in share costs, with the impression unidentified presently.

It’s price noting that FT’s beta model made fairly a splash when it debuted on Coinbase’s layer-2 Base on Aug. 11. Inside ten days, the platform’s charges skyrocketed — surpassing Uniswap and the Bitcoin community. Regardless of this short-lived success, FT is clearly demonstrating resilience and adaptableness within the face of challenges.

Because the phenomenon of accelerating bots on FT unfolds, it stays to be seen the way it will reply to the bot exercise.

[ad_2]

Source link