[ad_1]

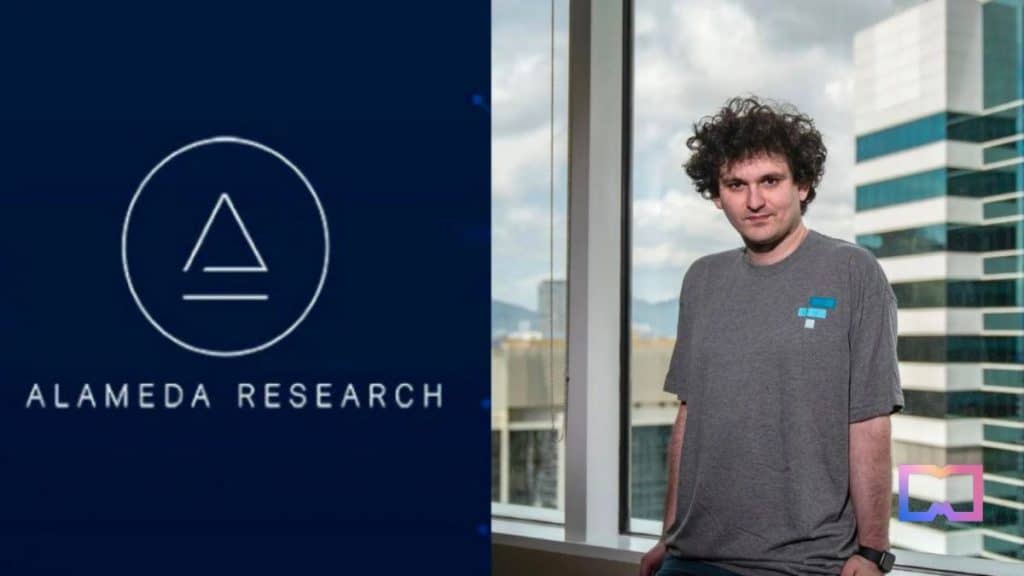

Aditya Baradwaj, a former engineer at Alameda Analysis, not too long ago turned to Twitter to disclose the reality behind the internal workings of crypto firm FTX.

After a tumultuous downfall of FTX, a crypto alternate linked to Alameda, and the arrest of its founder, Sam Bankman-Fried (SBF), Baradwaj selected to recount his difficult journey.

As an engineer at Alameda Analysis, I had my total life financial savings stolen from me by my former boss: Sam Bankman-Fried.

Now, after months of recuperation from the craziness of the FTX collapse, I’m prepared to inform my story.

Let’s begin firstly:

(1/25) 🧵#SBF #FTX pic.twitter.com/x5wKvT0Dy2

— Adi (e/acc) (@aditya_baradwaj) August 23, 2023

SBF’s Guarantees and Authorized Implications

Sam Bankman-Fried, the founding father of Alameda Analysis and the driving power behind FTX, not solely had a pivotal position but in addition maintained deep interconnections between the 2 corporations, sharing bodily places of work and social occasions, as noticed by Baradwaj.

What struck Baradwaj most was SBF’s expansive imaginative and prescient for FTX, extending past the bounds of a typical cryptocurrency alternate.

SBF spoke passionately about topics starting from vaccine factories within the Bahamas to political contributions and rising applied sciences. He introduced an organization portrait that transcended mere revenue, specializing in catalyzing constructive international change.

As soon as a billionaire below 30, FTX’s founder Sam Bankman-Fried championed a “radical new imaginative and prescient for the longer term.” Nevertheless, in line with Adi, this imaginative and prescient exhibited haphazard danger administration and monetary negligence.

Technical debt that might make any software program engineer shed a tear.

Adi famous

Baradwaj started recognizing worrisome patterns of reckless conduct inside the firm, encompassing insufficient danger administration and substantial technical obligations.Regardless of formidable visions and commitments, the corporate achieved minimal progress.

Sam is basically able to implement huge darkish plans. At some point, he unveiled his formidable concept to maneuver all of FTX’s operations to a secluded island within the Caribbean. Sam detailed his plans for the Bahamas and it was clear that he had accomplished in depth analysis on the topic.

Bankman-Fried presently faces imprisonment, charged with breaking home arrest phrases. This has resulted within the abandonment of FTX’s incomplete headquarters and vital monetary misery for stakeholders.

The Finish of A Decept?

SBF has additionally been accused of breaching home arrest phrases. His grandiose plans for vaccine factories, malaria eradication, and different lofty concepts have crumbled, leaving workers, traders, and clients in monetary turmoil.

The FTX headquarters challenge stays unfinished.

Regardless of the corporate’s obvious collapse and its founder’s authorized troubles, quite a few questions linger unanswered. The FTX narrative imparts a lesson to traders and business consultants relating to the hazards of unchecked enlargement and inadequate governance.

With huge sums and myriad stakeholders at stake, the FTX case unveils a intriguing narrative of ambition, opulence, and downfall, upsetting reflection on the sustainability and ethics of speedy innovation inside the crypto area.

Particular Notice: This text relies on accounts and statements by a former Alameda Analysis engineer, Adi. Though efforts have been made to validate this info, it presents the point of view of a single particular person and will not wholly embody the experiences of others affiliated with FTX or Alameda Analysis.

Learn extra:

[ad_2]

Source link