[ad_1]

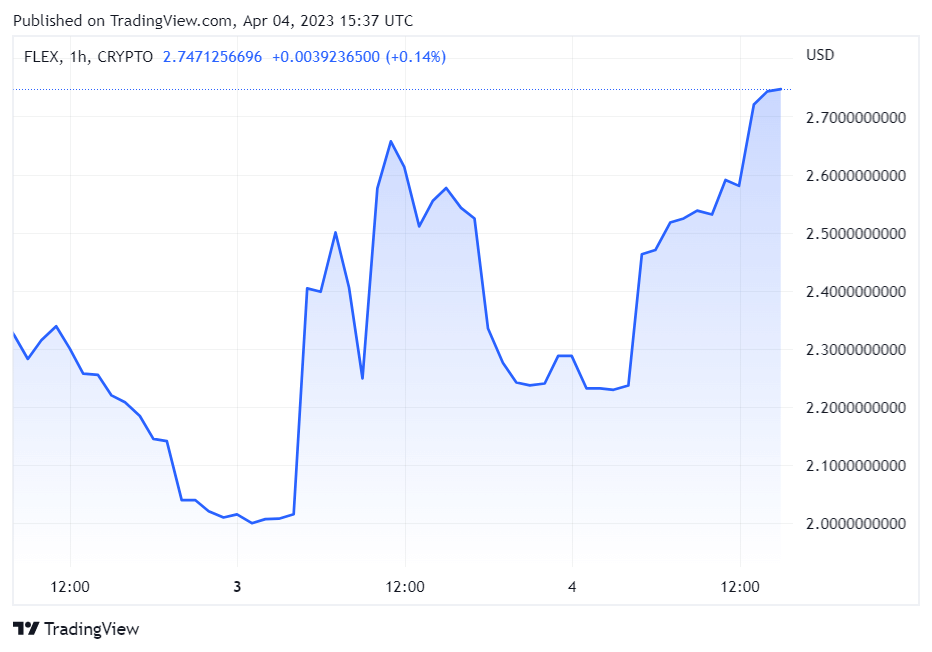

CoinFLEX’s FLEX token elevated by greater than 7% to $2.73 after Three Arrows Capital’s (3AC) cofounders — Kyle Davies and Su Zhu’s — new Open Trade (OPNX) went stay earlier.

OPNX is a specialised trade that permits customers to commerce claims of bankrupt crypto corporations. The trade adopted the FLEX token as its native asset, permitting holders to stand up to 50% low cost on buying and selling charges.

A go to to the trade’s web site confirmed that spot and futures buying and selling choices have been out there for cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), USDC, and Dogecoin (DOGE).

Nonetheless, chapter claims buying and selling is predicted to turn out to be out there at an unannounced date.

The trade is described because the “first public market for crypto claims” and has drawn heavy criticism resulting from its hyperlink with the 3AC cofounders and the struggling CoinFLEX trade.

In a video shared on Twitter, OPNX CEO Leslie Lambs stated they’re constructing the trade to assist the business. She added that there are greater than 20 million claimants affected by the chapter of a number of crypto companies like FTX and others.

In response to its phrases of service, OPNX isn’t out there for customers within the U.S. and different chosen areas. The trade isn’t additionally out there for former authorities officers or “politically uncovered individuals” as outlined by FATF’s 40 Suggestions.

FLEX rallies

Since OPNX adopted the FLEX as its utility token, the asset has risen by greater than 5000% within the present yr, in accordance with CryptoSlate’s information.

The digital asset traded for round 5 cents in January however shot over $2 after OPNX’s adoption.

Going by this, it has outperformed different notable digital property like Bitcoin and Ethereum throughout the identical interval.

The put up FLEX jumps 7% as 3AC cofounders OPNX trade goes stay appeared first on CryptoSlate.

[ad_2]

Source link