[ad_1]

Arguably crucial takeaway from yesterday’s FOMC assembly was that the U.S. Federal Reserve (Fed) is now not forecasting a recession, which led to a cautious rally in Bitcoin and crypto markets in the present day. Fed Chairman Jerome Powell’s assertion in the course of the FOMC press convention appears to have eased investor considerations, resulting in a swift restoration in each tradfi and crypto. Nonetheless, historic knowledge means that warning could also be warranted because the potential for recession stays a looming concern (though Powell mentioned in any other case).

Alerts For A Recession Stay Robust

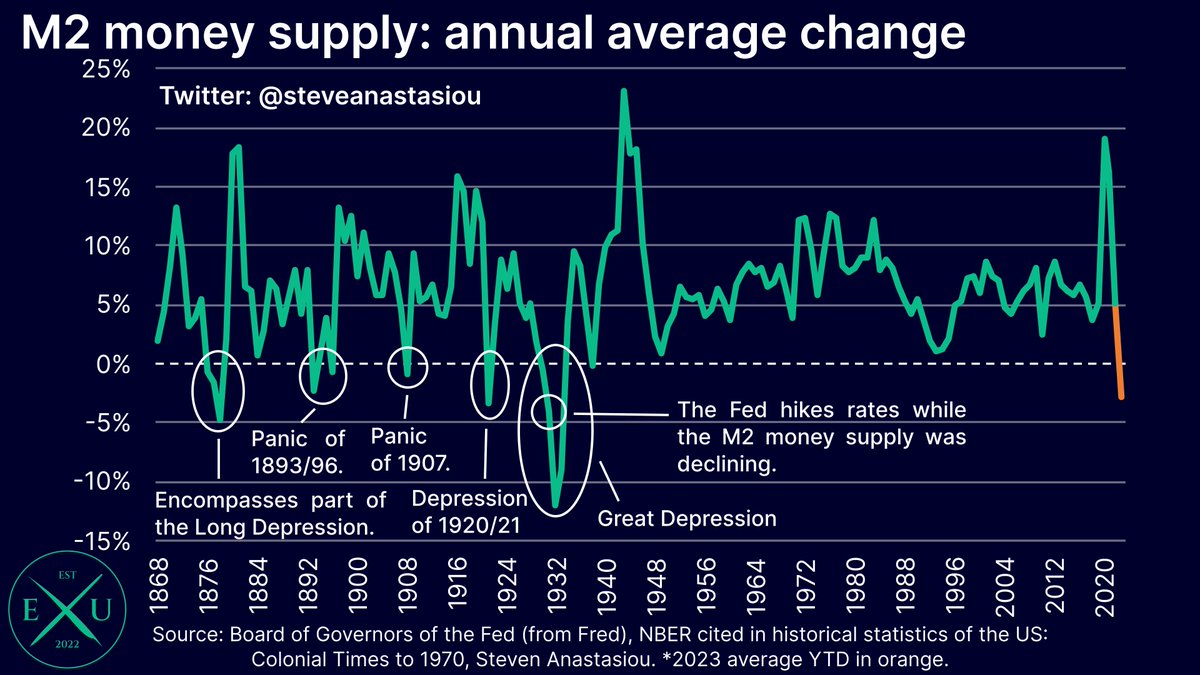

Outstanding monetary specialists have raised their voices in regards to the present financial scenario. Steven Anastasiou, a famous economist, warns in regards to the significance of the latest decline within the annual common M2 development, which stands at -2.7% YoY. He attracts parallels with a few of the most difficult financial intervals in historical past, stating, “With M2 falling, historical past means that persevering with with aggressive tightening is a harmful proposition… a falling M2 cash provide has usually been correlated with financial depressions & panics.”

Anastasiou additionally highlights the deflationary pressures within the financial system, as mirrored by the 12 consecutive month-to-month declines within the US Shopper Value Index (CPI) development fee. Drawing parallels to a deflationary bust seen in 1920-21, he emphasizes that “now isn’t the time to be delivering any further tightening.” As we all know, Powell did the other yesterday, elevating the federal funds fee to a stage not seen in 22 years.

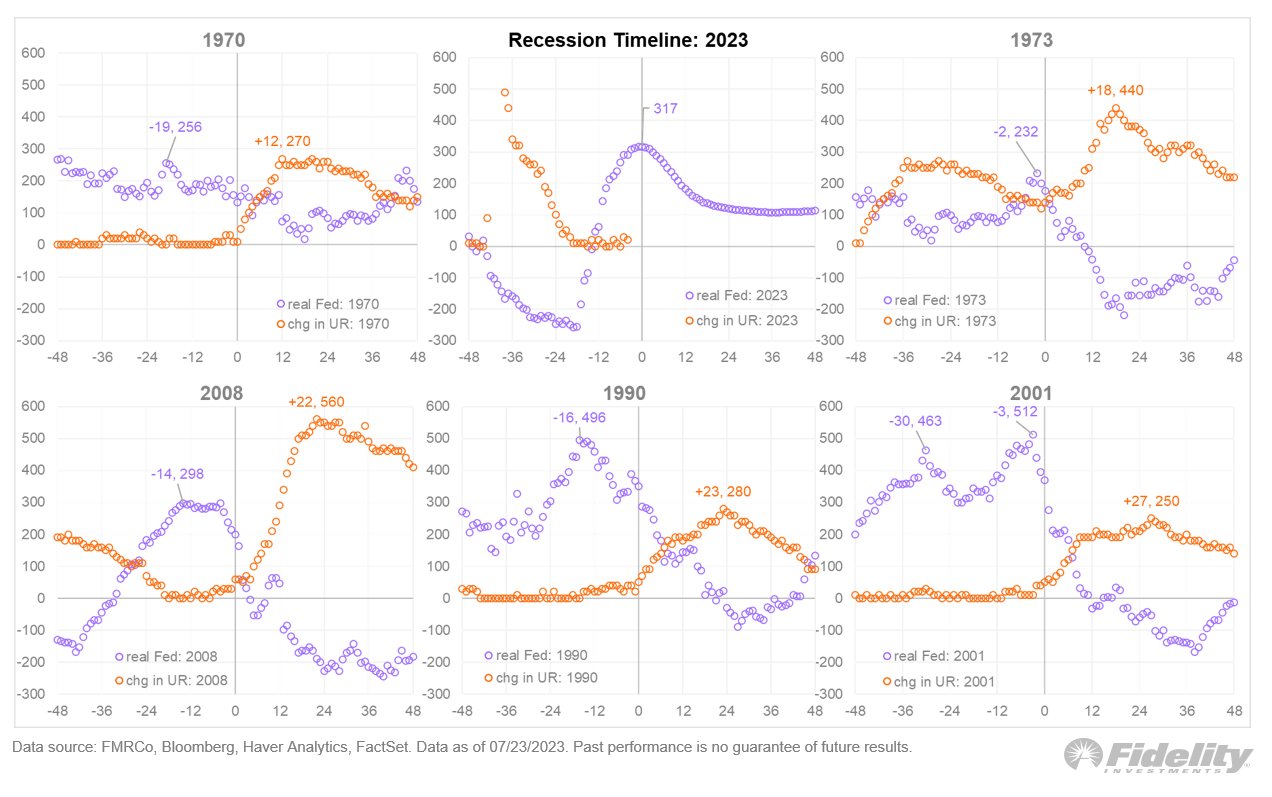

Jurrien Timmer, director of world macro at monetary big Constancy, shared insights from historic knowledge on recessions. He notes that the lead occasions between modifications in financial coverage and the next financial penalties can range considerably. Taking a look at previous cycles, he observes, “The financial coverage cycle tends to steer the financial penalties to various levels.” The lead time ranged from 2 months to as a lot as 19 months, relying on the financial circumstances.

Through the 1970 cycle (when structural inflation was getting underway and the Nifty Fifty was born), “peak coverage” led the recession by 19 months. In 1973-74, it was solely 2 months. In 1990, (the S&L disaster), it was 16 months. In 2001, (tech bubble) it was 3 months, and in 2008 (GFC) it was 14 months.

One other warning sign is the inverted yield curve, identified for reliably foreshadowing financial recessions. The inverted yield curve is at the moment hitting ranges unseen in over 40 years (since 1981), screaming recession. Gold bug Peter Schiff due to this fact remarked:

The speaking heads on CNBC all agree that if the U.S. enters recession, will probably be a child recession. Not solely is recession a certainty, but it surely received’t be a child. Will probably be the grand daddy of recessions. Will probably be so giant {that a} extra applicable time period to make use of might be a despair!

Affect On Bitcoin And Crypto

Amidst these financial considerations, the crypto is writing inexperienced numbers throughout the board. Nonetheless, a recession is which means uncertainty for Bitcoin. Not like conventional belongings, Bitcoin has not skilled a recession, leaving buyers unsure about its resilience in occasions of financial turbulence. Whereas some tout Bitcoin’s “secure haven” potential, others argue that it’d behave extra like a danger asset, making it much less engaging throughout a recession.

Macro analyst Henrik Zeberg and the founders of Glassnode, Yann Alleman and Jan Happel, imagine that “we’re going to have the biggest Disaster since 1929. First Deflation – later Stagflation. However first – #BlowOffTop”. On this state of affairs shares, Bitcoin and crypto might rally arduous earlier than a recession “all of a sudden” hits the market.

Nonetheless, nobody is aware of how the financial system will react this time. Due to this fact, the approaching two months and their macro knowledge (CPI, PCE, jobs, unemployment fee, incomes, and so forth.) might be indicators for Bitcoin and crypto buyers to comply with (simply as J-Pow tirelessly repeated yesterday – “knowledge dependency”).

At press time, the Bitcoin value continued its gradual grind up, buying and selling at $29,523.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link