[ad_1]

In a extremely anticipated announcement for the general cryptocurrency market and Bitcoin (BTC), the Federal Reserve (Fed) opted to take care of rates of interest at their present degree, ranging between 5.25% and 5.5%.

The choice aligns with market expectations and indicators a continuation of the Fed’s current coverage stance. Whereas the rate of interest determination had no instant affect on Bitcoin’s worth, cryptocurrency analysts anticipate a possible shift in market dynamics.

Analysts Predict Bitcoin Reversal Following Fed’s Choice

Bitcoin, the main cryptocurrency when it comes to market capitalization, has skilled a interval of consolidation across the essential $27,000 assist degree for the previous two days.

Regardless of the absence of great worth fluctuations instantly following the current rate of interest determination, market specialists consider this stability may doubtlessly signify the start of a pattern reversal.

Famend cryptocurrency analyst Michael Van De Poppe shared his perspective on X (previously Twitter), suggesting that the period of rate of interest hikes might have reached its conclusion.

Van De Poppe went on to point that Bitcoin is prone to embark on an upward trajectory from this juncture, noting the significance of exercising warning when decoding worth actions following main information occasions.

Van De Poppe’s remarks mirror the sentiment amongst BTC fanatics who anticipate the Federal Reserve’s determination to behave as a catalyst for the cryptocurrency’s resurgence.

The prevailing hope is that this determination may mark the tip of the present market downtrend, paving the way in which for Bitcoin to succeed in new yearly highs earlier than the conclusion of 2023.

BTC’s Historic Patterns Recommend Potential Backside Formation

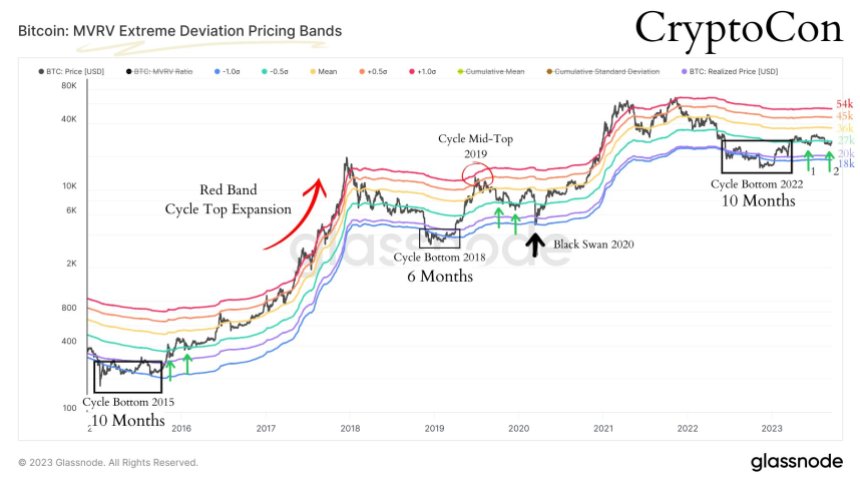

Crypto Con, a famend crypto analyst offered insights into Bitcoin’s worth actions, specializing in its historic patterns and the MVRV (Market Worth to Realized Worth) deviation bands.

Crypto Con’s evaluation highlights the importance of BTC’s current go to just under the inexperienced band, as seen within the chart above, drawing parallels to earlier market cycles.

Drawing on historic knowledge, Crypto Con notes that Bitcoin spent roughly 10 months hovering across the backside purple and blue deviation bands earlier than making its second go to just under the inexperienced band.

In 2016, this specific sample marked an area backside, and in 2019, it might have performed the identical if not for unexpected circumstances such because the black swan occasion.

Evaluating the length spent on the backside throughout the present cycle to that of 2015, Crypto Con highlights a putting similarity. This statement raises the query of whether or not the numerous draw back skilled in 2019 was a consequence of the large worth surge that preceded it, with Bitcoin even reaching the cycle high band.

The present worth of the purple band stands at $54,000, in response to Crypto Con’s evaluation. Nevertheless, he assures that this worth is topic to alter because the market progresses towards “the endgame”.

At current, Bitcoin is buying and selling at $27,100, indicating no change within the 24-hour timeframe. In consequence, the affect of the Federal Reserve’s determination on the cryptocurrency and the broader market within the brief time period stays unsure.

Whether or not this information may have a optimistic impact shortly or show helpful for the rest of the 12 months is but to be decided.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link