[ad_1]

After the latest enhance within the federal funds fee, the U.S. Federal Reserve is ready to lift the lending fee by 25 foundation factors (bps) to five.25% in three days, in response to expectations. A latest ballot of 105 economists revealed that 94 of them predict a 25bps fee hike will happen in the course of the Might 2-3 Federal Open Market Committee (FOMC) assembly. Whereas economists are anticipating a fee hike in Might, they anticipate that it is going to be the ultimate one in 2023. The vast majority of polled economists imagine that the Fed will preserve the speed at 5.25% for the rest of the yr.

Report Says Subsequent Section of the Tightening Cycle Is Holding Benchmark Fee at Present Ranges

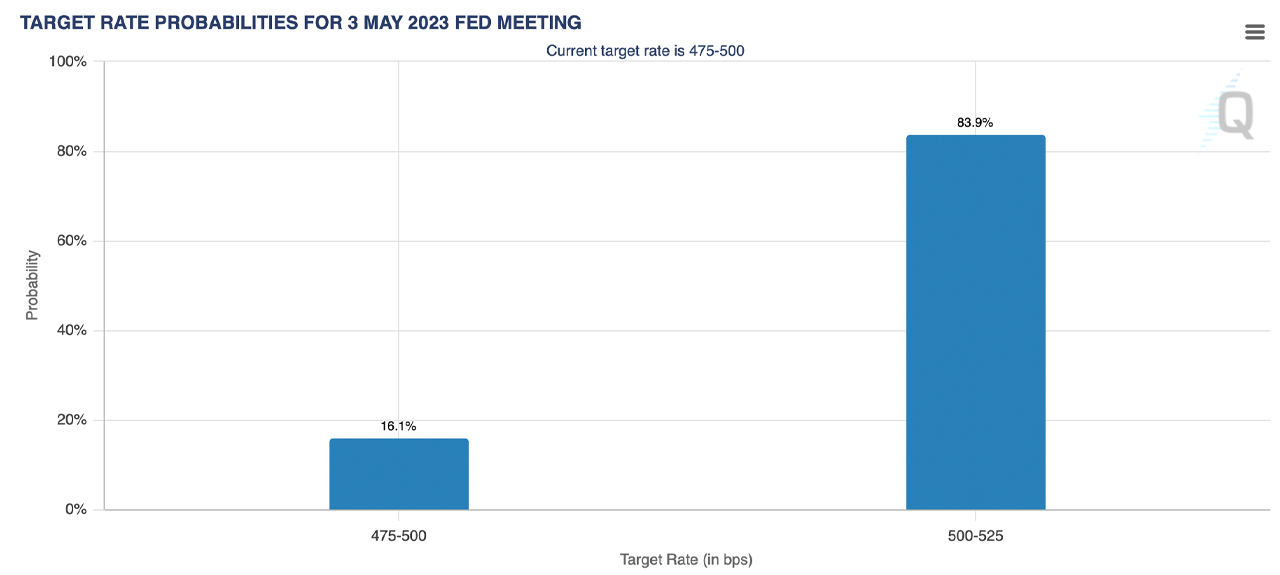

A number of studies and surveys point out that market observers imagine the U.S. central financial institution will enhance the benchmark rate of interest by 25bps on the FOMC assembly this week. The FOMC assembly is scheduled to happen on Might 2-3 and in response to the CME Group Fedwatch software, 83.9% suspect a 25bps fee hike will come to fruition. Alternatively, the Fedwatch software exhibits 16.1% predicts no fee hike for the upcoming Might assembly.

The newest predictions forward of the following FOMC assembly are just like the forecasts economists gave initially of April 2023. Moreover, Bloomberg reported on April 29, that economists the publication talked to additionally imagine a 25bps rise is within the playing cards.

Bloomberg’s economics report states:

Indicators level to the FOMC elevating charges by 25 foundation factors to five.25% within the Might 3 choice — regardless of ongoing turmoil within the banking system — and signaling that this would be the final hike for some time. The subsequent part of the tightening cycle will likely be to carry charges at that elevated stage, whereas watching to see if inflation tendencies down.

Survey Reveals 90% of Economists Suspect a 25bps Rise in Might, BOFA Analyst Says Further Hikes Past Might Unsure

In accordance with a survey from Reuters, a overwhelming majority (90%) of 105 economists polled suspect a 25bps hike. Moreover, 59 of these economists imagine that the federal funds fee will stay unchanged for the remainder of the yr following the expected Might hike, whereas 26 individuals are forecasting a fee minimize. Moreover, a lot of the economists surveyed by Reuters don’t anticipate the inflation fee within the U.S. to achieve the Fed’s 2% goal till 2025. The economists additionally famous that there’s nonetheless a danger of inflation charges spiking once more this yr.

Michael Gapen, the chief U.S. economist at Financial institution of America (BOFA) Securities, commented that an entire lot stays to be achieved earlier than the two% objective can come to a realization. Gapen additionally added that it’s unsure whether or not or not the Fed will hike the benchmark fee after Might.

“On the info entrance, regardless of the slowdown in inflation in March, there’s nonetheless much more work to be carried out to get again to the two% goal,” Gapen stated. “We preserve the primary fee minimize in March 2024. Ought to the stresses within the monetary system be lowered briefly order, we can’t rule out that stronger macro knowledge will lead the Fed to place in extra hikes past Might,” the BOFA government added.

What do you suppose the affect of the anticipated fee hike by the U.S. Federal Reserve could have on the economic system? Share your ideas within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, CryptoFX / Shutterstock.com

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss triggered or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link