[ad_1]

On-chain knowledge exhibits the Ethereum trade deposits have hit an 8-month excessive, an indication that might be bearish for the cryptocurrency’s worth.

Ethereum Lively Deposits Metric Has Noticed A Surge Lately

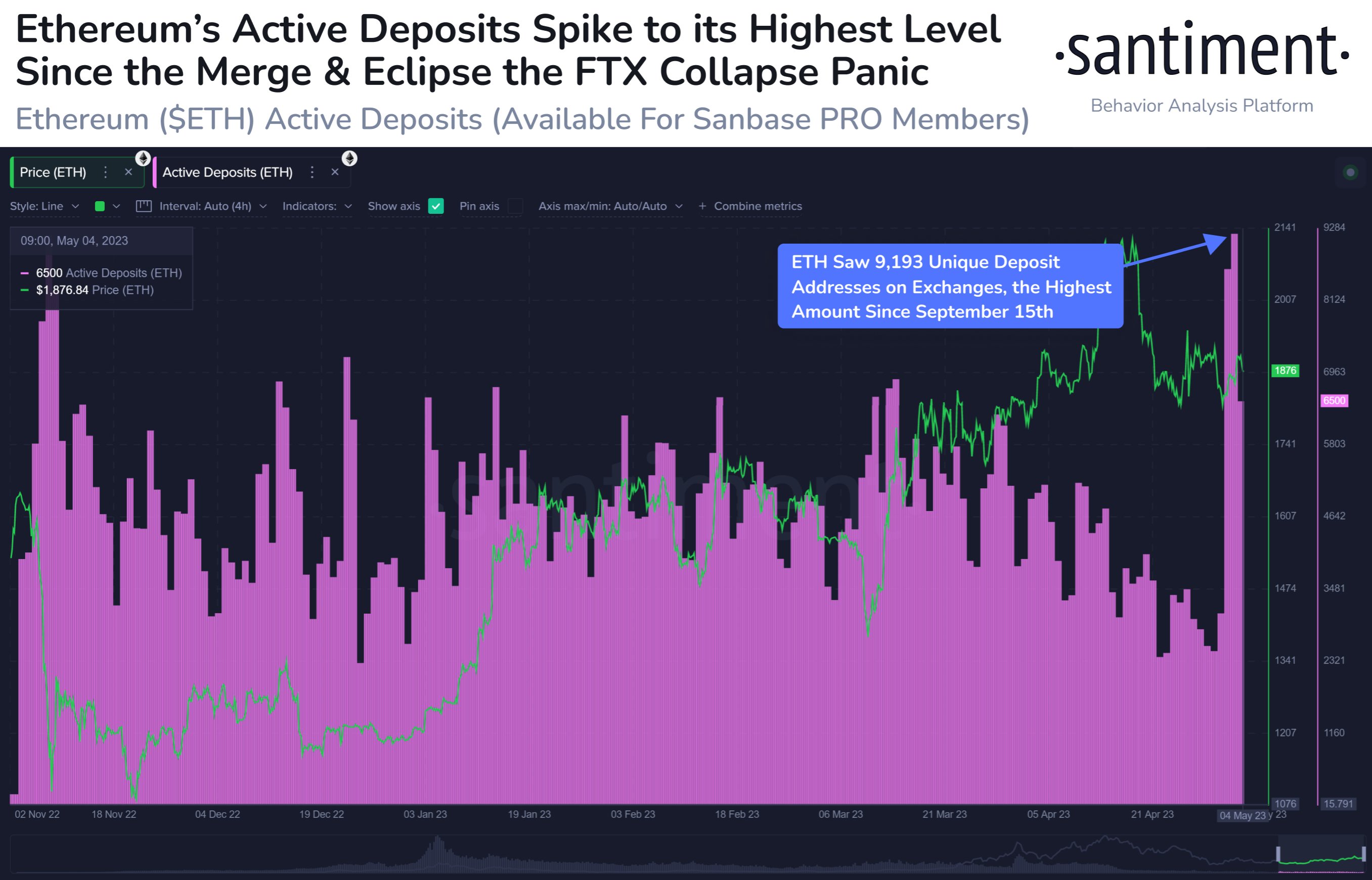

Based on knowledge from the on-chain analytics agency Santiment, the present values of the indicator are the very best for the reason that Merge again in September 2022. The “lively deposits” is an indicator that measures the entire variety of Ethereum addresses which are collaborating in an trade deposit transaction.

This metric solely tells us in regards to the distinctive variety of such addresses, which means that if an deal with takes half in a couple of deposit transaction, its contribution to the indicator’s worth remains to be just one.

Setting this restriction supplies a extra correct illustration of the pattern within the wider market, because the distinctive variety of addresses might be considered the variety of customers collaborating in these transfers. With out this limitation, only a few merchants making a lot of forwards and backwards transactions might skew the metric.

When the indicator has a excessive worth, it means a lot of addresses are getting concerned in deposit transactions proper now. As one of many major the reason why buyers deposit to those platforms is for selling-related functions, this type of pattern can have bearish penalties for the worth.

Alternatively, low values of the metric suggest not many buyers are making deposit transfers at present. Such a pattern can counsel there aren’t many sellers available in the market in the intervening time.

Now, here’s a chart that exhibits the pattern within the Ethereum lively deposits over the previous few months:

Appears to be like like the worth of the metric has shot up over the past couple of days | Supply: Santiment on Twitter

As displayed within the above graph, the Ethereum lively deposits have spiked throughout the previous few days. This implies that a considerable amount of customers have began making deposit transactions to the exchanges just lately.

Earlier than this spike, the metric had been in a decline and had hit comparatively low values, implying that the urge for food for utilizing exchanges had been shrinking again then. This surge within the lively addresses thus indicators a change available in the market mentality.

On the peak of this spike, the indicator assumed a price of 9,193, which means that there have been 9,193 distinctive deposit addresses on exchanges. This degree is the very best the metric has been for the reason that September 2022 “Merge,” which transitioned the community in the direction of a Proof-of-Stake (PoS) consensus system.

The present values of the lively addresses are additionally akin to these noticed throughout the FTX crash again in November 2022. Each these occasions noticed the worth turning into fairly unstable, so the indicator having such excessive values proper now may imply that Ethereum might face comparable bearish volatility within the close to future.

ETH Worth

On the time of writing, Ethereum is buying and selling round $1,900, down 1% within the final week.

ETH has stagnated just lately | Supply: ETHUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link