[ad_1]

Tax season is lastly upon us, with April 18 marked because the official due date for U.S. federal particular person earnings tax returns. Sadly, it’s a day that brings confusion for almost everybody. However over the past yr, it’s change into particularly exhausting for folks reporting beneficial properties from NFTs.

Don’t let the nerves get the perfect of you, although, as a result of tax professionals have sought to prepared themselves (and people within the NFT house) to deal with a broad number of 2023 crypto tax wants. Hopefully, this yr, these making last-ditch Google searches for “NFT tax loopholes” have already discovered a wealth of knowledge on reporting NFT property, beneficial properties, and losses.

After all, that doesn’t imply NFT taxes would be the best factor you’ve ever accomplished or that you simply shouldn’t take them significantly. In any case, missteps may be pricey, however there are solutions. So, earlier than you declare huge losses since you offered your PFPs far under market worth, listed here are the important thing issues that creators and collectors must find out about taxes and NFTs.

How are NFTs taxed?

It’s important to know how the IRS sees NFTs in 2023. Sadly, the U.S. tax code doesn’t formally handle how NFTs ought to be taxed. However there are some guiding ideas which have allowed specialists to kind of suss out how issues work.

To start with, there’s a powerful argument to be made that NFTs shouldn’t be claimed as “collectibles” in line with the U.S. tax code. However NFTs are collectibles, proper? So, why aren’t they taxed as such?

As a result of collectibles below IRC Part 408(m)(2) embody:

Any murals,Any rug or vintage,Any steel or gem (with restricted exceptions, under),Any stamp or coin (with restricted exceptions, under)Any alcoholic beverage, orAny different tangible private property that the IRS determines is a “collectible” below IRC Part 408(m).

The usage of “different” within the final merchandise on the listing makes it clear that collectibles have to be tangible private property. So whereas NFTs could also be artwork, they positively aren’t tangible. The jury continues to be out on this, however it appears fairly clear that, given their monetary connotation, NFTs aren’t taxed as collectibles.

But others, like U.S. Senators Cynthia Lummis and Kirsten Gillibrand, wish to see NFTs taxed as one thing fully exterior the scope of collectibles. Based on a proposed 2022 crypto invoice penned by the 2 by which “digital property” and “digital forex” is strictly outlined, NFTs may do properly to be handled as commodities (like petroleum, cotton, soybeans, and so on.) relatively than as securities.

Because of this NFTs would fall below the purview of the Commodity Futures Buying and selling Fee (CFTC) relatively than the Securities and Alternate Fee (SEC). However whereas the aforementioned invoice makes an attempt to control digital asset exchanges, taxpayers gained’t be feeling any of its ripples whereas reporting their NFT taxes from the 2022 season.

So, for essentially the most half, specialists assume NFTs ought to be handled extra merely and regarded adjoining to the infrastructure that already exists for fungible cryptocurrencies like Ether and Bitcoin. But when we take one other step down the ladder, we are able to’t low cost that crypto is usually considered the identical as shares — extra like property.

In brief, in line with the IRS, NFTs are additionally taxed alongside crypto as property. Whereas we may proceed to invest for an additional yr whether or not tokens ought to or shouldn’t be thought of collectibles or commodities, merchants merely must know that NFTs are topic to capital beneficial properties tax.

Capital beneficial properties taxes and NFTs

In essence, a capital beneficial properties tax is a tax positioned on earnings earned from the sale of any asset that has elevated in worth over a holding interval. That…is a little bit of a mouthful. A better method to put this is perhaps to say: If you happen to mint an NFT at 0.08 ETH after which promote it for two.5 ETH a couple of months later, that creates a taxable capital acquire since you made cash (or capital).

Sure, shopping for an NFT low, holding for a couple of months, then promoting excessive is taxable. However this is applicable to losses as properly. So, when you bought an NFT for two.5 ETH and offered it at 0.08 ETH for a remaining lack of 1.7 ETH. Guess what? That’s a capital loss.

So whether or not you’re a creator or a collector who dabbles in buying and selling NFTs, that you must know that capital beneficial properties and losses don’t simply occur whenever you trade crypto for fiat forex. They occur whenever you purchase and promote NFTs. Positive, which may appear a bit contradictory, contemplating the decentralized ethos of the NFT house. However because the IRS outlined in Discover 2014-21, the worth change of any given cryptocurrency can create a capital acquire or loss.

Whether or not you’re promoting an NFT, swapping one coin for an additional (like ETH → APE), or cashing out crypto for USD, most of your transactions are prone to be thought of taxable occasions. And these beneficial properties can accrue a severe markup when it comes time to settle up with the IRS. However right here’s the factor: Within the eyes of the IRS, the size of time you’ve held onto an NFT makes an enormous distinction in how it’s taxed. That is the place the size of the HODL turns into essential.

Say you maintain an NFT for lower than a yr after which promote it for greater than you paid. That is referred to as short-term capital acquire. These are typically taxed on the similar charge as your common earnings. Based on the 2023 tax brackets established by the IRS, that can be someplace between 10 to 37 %.

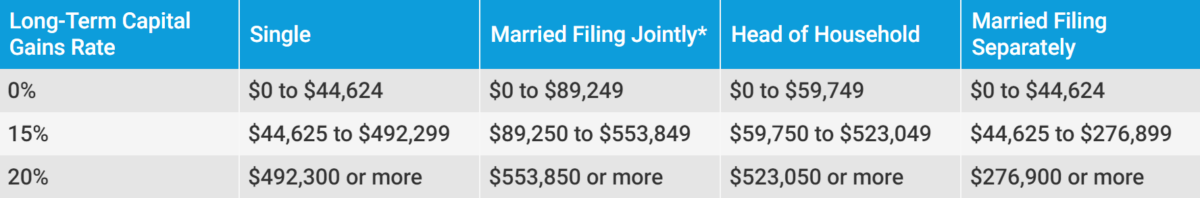

Lengthy-term capital beneficial properties, alternatively, are taxed much less. Since NFTs have solely been fashionable for the higher a part of two years, this one’s a bit tough. If you happen to did find yourself holding an NFT for greater than a yr, that’s a long-term capital acquire and is taxed at zero, 15, or 20 %, relying on the worth.

Dictated by the 2023 capital beneficial properties tax threshold set by the IRS, the tax charge on web capital beneficial properties for most people isn’t any greater than 15 %. See Bloomberg’s outlines of the charges within the picture under. For essentially the most half, this 15 % vary is the place basic NFT merchants can be, with the apparent omission of those that, say, made a six- or seven-figure killing this yr. Seek the advice of Kind 8949 (particularly “Gross sales and Different Tendencies of Capital Belongings”) for extra on this.

How one can calculate your NFT taxes

To the IRS, the circumstances of your NFT purchases all matter. As lawyer Jacob Martin explains in his NFT Tax Information, you’ll want to think about issues just like the size of time you held your crypto earlier than shopping for an NFT, what the worth of your most well-liked coin was whenever you purchased in vs. whenever you bought the NFT with it, how lengthy you held the NFT, the worth distinction whenever you purchased the NFT vs. whenever you offered it, how lengthy you held the crypto post-sale, and so forth (hopefully, you get the thought).

Additionally, remember to verify whether or not you bought an NFT with USD as a substitute of crypto. This can be a non-taxable occasion and one which has been growing in recognition with the appearance of bank card checkout by way of platforms like Nifty Gateway.

However, whereas the mode of buying an NFT can dictate whether it is taxable, promoting an NFT is at all times a taxable occasion. NFTs are thought of offered anytime they’re traded for USD, different tokens (ETH), or used to buy one thing else. And sure, this is applicable to pawning NFTs, fractionalizing NFTs, and even swapping an NFT for an additional NFT.

NFT taxes for creators

What we’ve talked about within the first half of this information principally applies to NFT collectors. Whether or not you establish as a collector or dealer (or not), when you’re shopping for and promoting NFTs, the above information may assist you perceive what kind of data that you must have readily available for submitting taxes. For NFT creators, although, issues are a bit completely different.

If you happen to’re buying and selling NFTs, which most artists do along with creating and promoting, you’ll want the knowledge above. However there’s extra to know with regards to beneficial properties accrued by means of the sale of your authentic artwork. Thankfully for artists, although, it’s all quite simple from right here.

Creating an NFT isn’t a taxable occasion, however promoting that NFT is. The final rule of thumb to comply with as an NFT artist/creator is: whenever you promote an NFT, you’ll have to pay taxes on the earnings. Income for NFT creators are usually not thought of beneficial properties; relatively, they’re earnings. And this earnings can be taxed at your common earnings tax charge. For self-employed people, this charge is 15.3 %. Even when you have been paid in crypto peer-to-peer and never by way of a market transaction, that is thought of earnings (identical to promoting a print of one among your works) and is taxed as such.

It’s essential to notice that self-employment tax is completely different out of your common earnings tax charge of 10 to 37 %. You’ll want to find out how a lot of your web earnings from the yr are topic to self-employment tax. For a bit extra on this subject, NerdWallet has an ideal explainer to assist any self-employed particular person get the bounce on taxes.

If you happen to’ve engaged in any NFT-related charitable giving all year long, for instance, by donating one among your NFTs to a museum or an public sale home for a superb trigger, issues get a bit stickier than easy self-employment taxes. On this case, remember to seek the advice of our full, lawyer-authored article on the subject right here.

In any other case, do not forget that self-employment taxes are the way in which to go, and NFTs you acquire or offered however didn’t create can be topic to the capital beneficial properties tax defined earlier on this information.

Are you prepared for Tax Day?

So, taxes aren’t so scary…proper? They’re positively sophisticated and can take a little bit of time to finish — particularly when you’re an energetic dealer with plenty of transactions — however all in all, they’re doable. In case your 9,999 fellow PFP homeowners can do it, so are you able to.

If you happen to’re nonetheless a bit confused although, take into account doing a bit extra analysis into NFT taxes by yourself. Martin’s aforementioned NFT Tax Information is a good place to begin — though you will have to spend a little bit of ETH minting an NFT to realize entry to the complete information. Or higher but, ask across the NFT group to see if somebody will mortgage you their information for some time.

On the finish of the day, one of the simplest ways to do your NFT taxes in 2023 will at all times be to seek the advice of a tax skilled. Keep in mind, nft now isn’t providing you tax or monetary recommendation, however corporations like ZenLedger, CoinTracker, and Taxbit supply providers to assist these throughout the crypto, NFT, and DeFi areas with their taxes.

And the perfect half is, even when you’ve waited till the previous couple of days to do your taxes (as you certainly have when you’re studying this in April), most providers supply plug-and-play performance, with non-obligatory skilled assistance on the facet. This implies you’ll be able to import your wallets and/or trade account information, rectify any discrepancies, and be in your method to a refund placing a cap in your tax stress till subsequent yr.

[ad_2]

Source link