[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

Jacobi Asset Administration listed Europe’s first spot Bitcoin ETF on Euronext Amsterdam, placing the area forward of the US, the place corporations from BlackRock to Constancy are hopeful of getting comparable funding automobiles up and working within the close to future.

BREAKING: Jacobi lists Europe’s first spot Bitcoin ETF on Euronext Amsterdam with Article 8 classification with assist from @euronext @DigitalAssets @FlowTraders @DRWTrading @JaneStreetGroup @collascrill @MidshoreConsulting @zumopay @Wilshire pic.twitter.com/Wp18jnoIrY

— Jacobi Asset Administration (@JacobiAssetMgt) August 15, 2023

Regulated by Guernsey Monetary, Jacobi FT Wilshere Bitcoin ETF will commerce underneath the ticker “BCOIN”. Jacobi stated that Constancy Digital Belongings will present custody, and working because the market maker would be the buying and selling agency Move Merchants.

Spot Bitcoin ETF for Institutional Buyers – Jacobi CEO

“It’s thrilling to see Europe transferring forward of the US in opening up Bitcoin investing for institutional traders who need secure, safe entry to the advantages of digital belongings utilizing acquainted and controlled constructions like our ETF,” stated Martin Bednall, CEO of London-based Jacobi.

Jacobi had received approval for the spot Bitcoin ETF again in 2021. Nonetheless, as a result of onset of crypto winter led by the Terra crash and the next dampening of curiosity in Bitcoin attributable to FTX’s collapse, the asset administration agency deferred its launch.

Racing Forward of the US

US corporations are additionally racing to get spot Bitcoin ETFs accredited with BlackRock, Constancy, and Ark Make investments amongst these within the queue.

The street to approval might not be easy, as seen within the SEC’s choice to delay its choice on the appliance filed by Ark Make investments to January 2024. Nonetheless, Ark Make investments’s Cathie Wooden was anticipating the delay and stated she is hopeful the SEC will approve a number of spot Bitcoin ETFs concurrently.

An Environmentally Acutely aware Spot Bitcoin ETF

Jacobi’s spot Bitcoin ETF can be the primary digital asset fund grievance with SFDR Article 8, which aligns with the agency’s decarbonization technique.

Jacobi’s Wilshire Bitcoin ETF will supply an ESG-aligned digital asset resolution, permitting eco-conscious patrons to contemplate Bitcoin ETF as an applicable funding.

Kirsteen Harrison, Environmental Supervisor of Zumo, stated, “The decarbonisation of crypto is among the most urgent challenges going through the nascent digital asset sectors.”

“We’ve been working intently with Jacobi Asset Administration to assist them construct out an ESG-aligned, future-proofed crypto providing for his or her prospects,” she added.

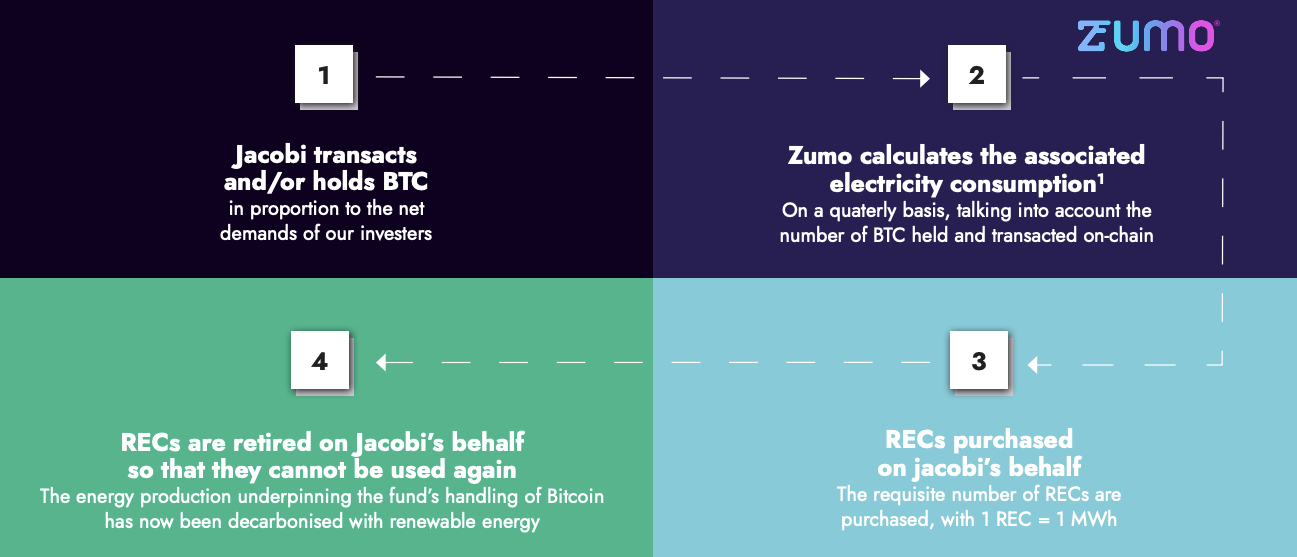

This partnership between Zumo and Jacobi includes procuring Renewable Power Certificates (RECs). Jacobi FT Wilshire ETF’s brochure states that this resolution will work to offset the electrical energy consumption associated to the fund’s Bitcoin holdings.

It explains a four-step course of that includes Jacobi transacting and holding the BTC, for which Zumo will calculate the electrical energy consumption. Based mostly on that, a set variety of RECs will probably be purchased by Zumo on Jacobi’s behalf, which can then be retired and rendered ineffective.

Associated

Wall Avenue Memes – Subsequent Huge Crypto

Early Entry Presale Dwell Now

Established Neighborhood of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Finest Crypto to Purchase Now In Meme Coin Sector

Staff Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link