[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

Ethereum worth (ETH) has been unable to interrupt above the $2,200 resistance stage even after the Shanghai/Capella (Shapella) improve. In keeping with on-chain metrics, there are regarding indicators as stakers stay positioned for sell-action. Holders at the moment are anxious about whether or not ETH may lose its present assist stage across the $2,000 space.

Following an preliminary constructive response to the profitable Shapella improve, the most important altcoin now faces an unsure short-term future. Primarily based on information from IntoTheBlock, there’s a surge within the quantity of huge Ethereum transfers within the wake of the Shanghai Capella improve.

The amount of huge #ETH transactions has been growing steadily this week. From 708k $ETH on April ninth to over 2.2M $ETH yesterday https://t.co/VN2Nxw1H6C pic.twitter.com/TulGVyn84J

— IntoTheBlock (@intotheblock) April 14, 2023

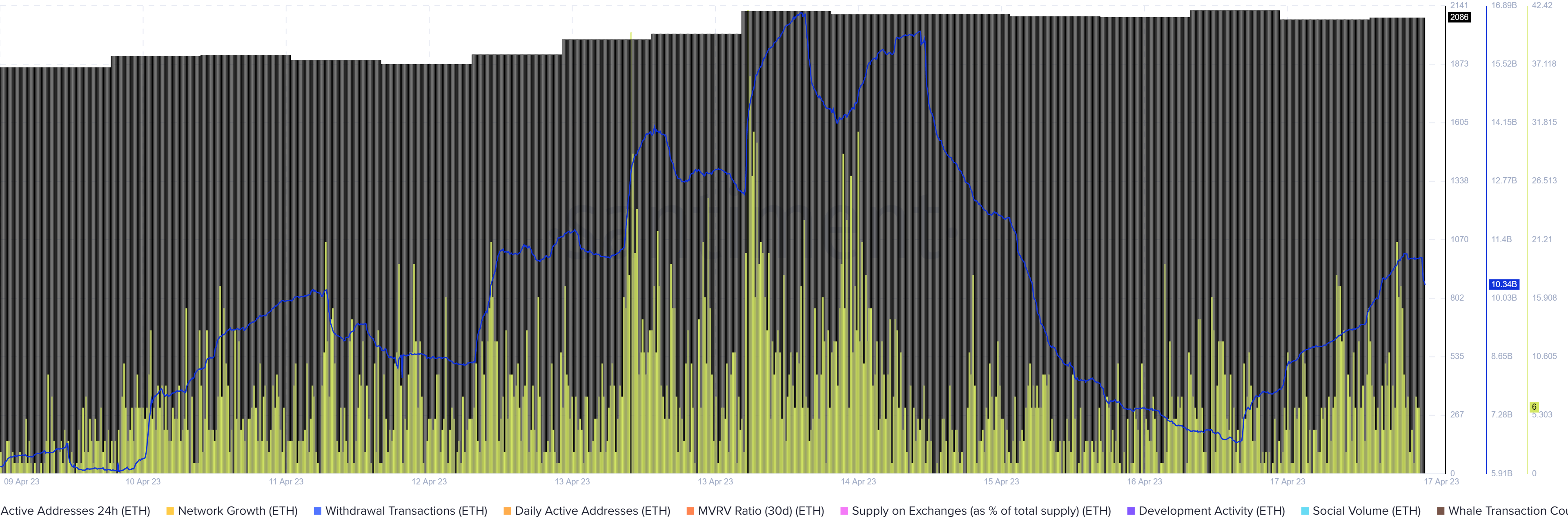

The identical has been corroborated by Santiment information, displaying that ETH quantity elevated by over 80% from 6.08 billion to 10.96 billion between April 9 and April 17. Equally, whale transaction depend above $1 million additionally famous a sizeable enhance.

As ETH 2.0 stakers began in search of different avenues for deploying their newly-withdrawn holdings, worry lingers on whether or not this might damage Ethereum worth.

Ethereum stakers load up their wagons

Knowledge in response to Glassnode reveals that the provision of cash deposited on exchanges has soared by 100,000 ETH since April 10, indicating that buyers searching for to promote their ETH holdings can now achieve this quicker and simpler. As proven within the chart beneath, Ethereum Steadiness on Exchanges surged 0.6% from 18.09 million cash on April 13 to 18.20 million cash on April 17.

Notably, when an alternate holds extra cash, these cash are available for buying and selling, and with ETH 2.0 stakers pulling out their cash, they might quickly accumulate on promoting stress. Such an end result may provoke a possible worth pullback within the subsequent few days.

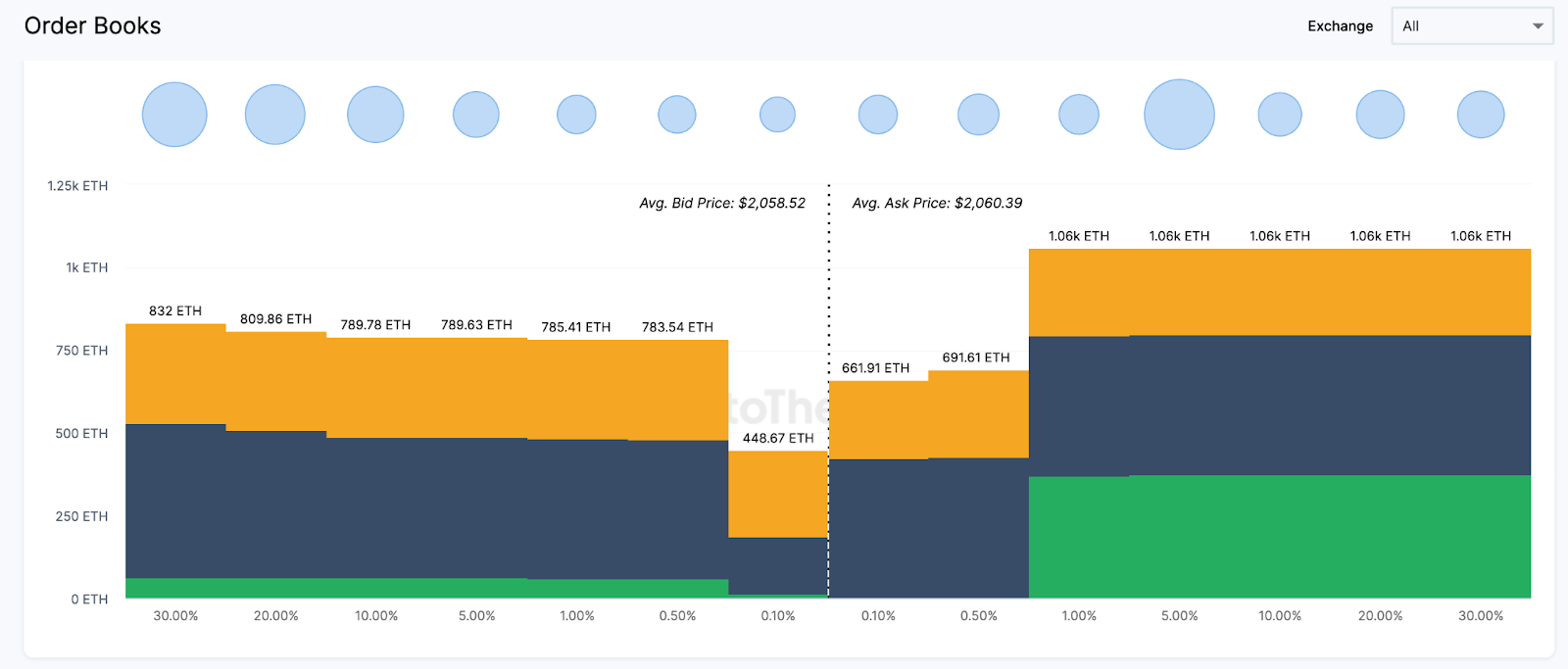

Furthermore, an analysis of the combination order books from sure exchanges reveals that the variety of ETH out there on the market in the meanwhile is excess of the demand across the prevailing market charges. Knowledge analyzed by IntoTheBlock reveals that there are open sell-orders for six million ETH across the +/-30% worth boundaries. Nonetheless, because it stands, patrons have solely positioned orders for round 5.2 million ETH.

Throughout situations when alternate order books document extra promote order quantity in contrast to purchase orders, it’s sometimes interpreted as extra provide than demand for the involved asset. Such a place may compel a worth drop as sellers may have to scale back their costs to entice buyers.

Accordingly, the inflow of Ethereum cash on exchanges, presumably promoting momentum accrued resulting from newly unstaked cash, and unbalanced alternate order books may all come collectively, triggering a correction in Ethereum worth.

Ethereum worth may right in the direction of $2,000

On the time of writing, Ethereum worth is $2,078 after dropping round 2.22% within the final 24 hours.

Ethereum worth may retrace towards the $2,000 stage, with International In/Out of Cash Round Worth (GIOMAP)displaying that there was strong assist between the $1,748 and $2,053 stage as this was the zone the place 7.01 million addresses purchased 13.13 million ETH at a mean worth of $1,864.

On the flip aspect, if bulls invalidate the bearish thesis and Ethereum worth breaks above the $2,100 resistance stage, 7.46 million addresses holding roughly 7.58 million ETH may pose a formidable roadblock between the $2,147 and $2,892 zone.

Learn Extra:

Love Hate Inu – Latest Meme Coin

Decentralized Polling – Vote to Earn

Early Entry Presale Stay Now

Ethereum Chain

Featured in Yahoo Finance

Mint Memes of Survey Outcomes as NFTs

Staking Rewards

Viral Potential, Rising Group

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link