[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

After rising above the essential $2,000 mark in mid-July following the partial authorized win by Ripple Labs in opposition to the U.S. Securities and Trade Fee (SEC), Ethereum launched into a downtrend that was halted at $1,600.

The most important altcoin by market capitalization, ETH has been consolidating above that degree since then. It’s buying and selling 20% under it’s excessive within the current previous at $2,030 with various on-chain metrics and the technical setup pointing to additional losses.

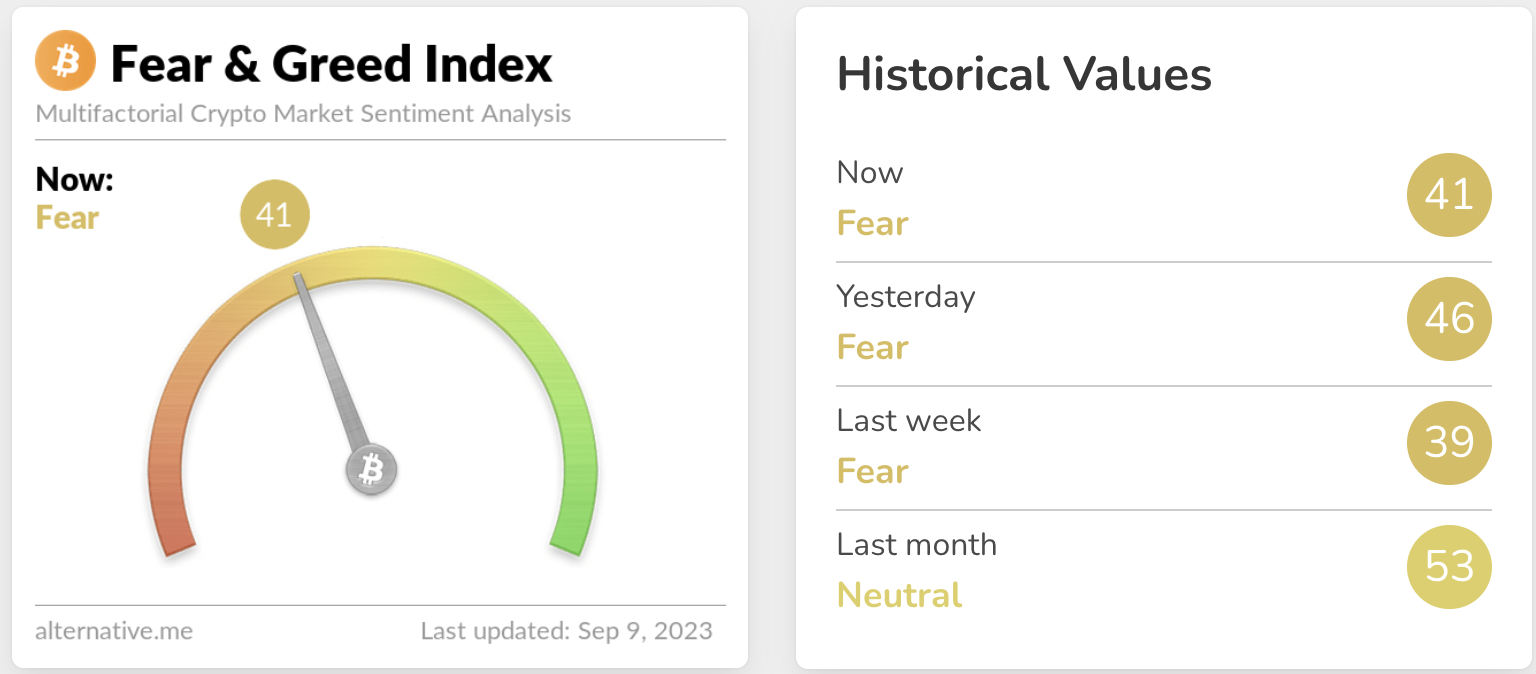

The present bearish sentiment out there is doing little to spark hopes of a sustained restoration within the close to future. Knowledge from Different, a agency that analyzes “feelings and sentiments” within the crypto market, reveals that the Crypto Concern and Greed index is within the “Concern” zone at 41.

This means that traders are apprehensive about their investments they usually could proceed promoting to attenuate losses.

Declining TVL on Ethereum Reinforces the Draw back

Aside from the drab value motion and bearish market circumstances, on-chain metrics level to reducing demand for ETH. Notably, the entire worth locked (TVL) on the Layer 1 community has decreased from a 2023 excessive of $31.5 billion in mid-April to the present worth of $21.44 billion, in accordance with information from DeFiLlama.

Whole Worth Locked On Ethereum

The variety of Ethereum addresses holding a minimal of $1,000 in ETH has hit its lowest level in six months.

This pattern is worrying contemplating that the Ethereum value reached a peak of $2,140 in April, which was anticipated to have attracted extra customers to the community. Equally, the quantity of income generated on the platform has dropped by greater than 84% from $14.43 million in mid-April to $3.3 million on Sept.5. This factors to a scarcity of curiosity amongst traders and builders.

A part of the rationale why there seems to be a scarcity of investor curiosity in ETH is that transaction charges on the Good Contacts community stay excessive. Notice that Ethereum’s common transaction charge has remained above $4 for the previous six months. This retains traders and builders away as they flip to cheaper Layer 2 options. This, in flip, ends in reducing revenues.

On the upside, whales seem like benefiting from the low costs to build up extra. In accordance with Ali Martinez, a well-liked crypto analyst on social media platform X, Ethereum Whales added 260,000 ETH with a staggering $425 million inside 24 hours on sooner or later this week.

#Ethereum whales seem to have bought round 260,000 $ETH throughout the final 24 hours, value almost $425 million. pic.twitter.com/rPRMhnI6oD

— Ali (@ali_charts) September 5, 2023

This follows sturdy ETH whale motion initially of the week. On Monday, two whale addresses moved a complete of 300,000 ETH on Coinbase, the main US-based crypto trade..

Ethereum at Danger of 10% Losses

The Ethereum value is displaying a descending triangle chart sample on the each day chart. It is a extremely bearish technical formation that’s shaped when an asset’s value kinds a collection of decrease highs (forming the triangle’s hypotenuse) and comparatively equal lows (representing the triangle’s x-axis). It’s confirmed as soon as a transparent shut is achieved under the x-axis.

The value goal is reached by measuring the gap between the widest factors within the triangle and including it to the breakout level.

At press time, ETH was buying and selling at $1,632 with bears decided to tug it under the $1,600 help line, embraced by the triangle’s x-axis. If they’re profitable, they might pull the good contracts token decrease towards the $1,550 swing low or the $1,500 psychological degree.

A drop decrease might see ETH drop additional to achieve the pessimistic goal of the prevailing chart sample at $1,471. Such a transfer would symbolize a ten% decline from the present value.

ETH/USD Every day Chart

This detrimental outlook was supported by the down-facing transferring averages. These chart overlay indicators additionally offered areas of stiff resistance on the upside at $1,652, $1,756, and $1,805, the place the 20-day, 50-day, and 100-day Easy Transferring Averages (SMAs) sat respectively.

Additionally validating the grim outlook for Ethereum was the downward motion of the Relative Power Index (RSI). The place of this oscillating trend-following indicator at 38 within the detrimental area suggests that there have been extra bears than patrons out there.

On the upside, if the ETH had been to stage a sustained restoration, it has to show up from the present degree rising above the areas outlined by the 20-day SMAs, embraced by the triangle’s descending trendline.

This is able to affirm an exit from the bearish triangle with the subsequent line of resistance rising from the 50-day and 100-day SMAs respectively. Shattering these boundaries would see Ether’s value rise towards the $1,900 psychological degree. A bullish breakout could be confirmed if the token produces a each day candlestick shut above the $2,000, putting Ethereum on a path to a sustained restoration.

ETH Alternate options

Given the grim outlook for ETH, traders could contemplate different tokens with higher upside potential within the quick time period. The Wall Avenue Memes presale is nearing the tip because the neighborhood awaits itemizing on main exchanges. The group has secured listings on prime buying and selling platforms, which boosts the credibility and authenticity of the undertaking.

The native WSM token is being bought for $0.0337 through the presale section, and greater than $25 million has been raised from early traders. The trade listings might enhance WSM’s worth achieve considerably.

Wall Avenue Memes can also be huge on neighborhood, an important facet of the crypto trade. The undertaking claims help from a vibrant neighborhood as it’s impressed by the Wall Avenue bets neighborhood that rose into reputation due to the GameStop saga.

The group behind Wall Avenue Memes has a stable roadmap because it seeks to empower the neighborhood each step of the way in which. The group goals to achieve a $1 billion market capitalization, achievable given the large curiosity the presale has garnered.

The success of $WSM’s presale has many analysts believing that it has the potential to make greater than 10x returns for early traders.

Associated Information

Wall Avenue Memes – Subsequent Massive Crypto

Early Entry Presale Reside Now

Established Neighborhood of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Greatest Crypto to Purchase Now In Meme Coin Sector

Staff Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link