[ad_1]

At this time is the day, the long-awaited launch of the following “Ethereum killer” SUI is happening at 8:15 am EST (12:15 UTC). From a purely technical standpoint, SUI does a number of issues otherwise in comparison with Ethereum, and subsequently the expectations are excessive. Along with the bankrupt change FTX, the venture has quite a few notable backers, together with Circle, Binance Labs, and Electrical Capital.

The designated proof-of-stake (dPoS) blockchain has a completely new structure that’s alleged to outshine even the “high-speed” blockchain Solana. A lot of Sui’s builders beforehand labored on the Meta (Fb)-launched venture Diem, which was scrapped a while in the past resulting from regulatory headwinds.

The builders behind Sui, Mysten Labs, are certainly one of two spinoffs from Diem, the second being none aside from Aptos, which celebrated its mainnet launch final October. The previous Meta workers based Mysten Labs again in 2021 to develop Sui.

Why Sui Is Being Hyped

One of many issues that units the Sui blockchain aside is its great processing velocity of information, which no different layer-1 blockchain can match. In testing, Sui already introduced it to greater than 300,000 transactions per second (tps). This far exceeds even Solana (65,000 TPS). Likewise, Sui has an enormous velocity benefit in transaction affirmation time.

Whereas Solana wants round 20 seconds, Sui’s is simply 450 milliseconds. When it comes to scalability, Mysten Labs says that the system design is designed to permit horizontal scalability, which isn’t capped.

Along with Sui’s excessive throughput and low latency, the venture additionally touts a 3rd benefit: the flexibility to course of arbitrary quantities of information on chain. To do that, SUI makes use of a storage fund that redistributes charges for previous transactions to future validators.

In different phrases, customers pay upfront charges for each computation and storage. When storage necessities on-chain are excessive, validators obtain extra rewards to offset their prices. Conversely, when storage necessities are low.

These three advantages are supposed to take the use circumstances of blockchain expertise to the following degree.

Tokenomics

Whereas IOUs had been already buying and selling on smaller exchanges forward of the official launch of the blockchain at 8 am EST (2 pm CET), well-known crypto exchanges equivalent to Binance, OKX, KuCoin, and ByBit have introduced the itemizing of the brand new token as quickly as liquidity necessities are met.

Binance, for instance, mentioned it anticipated to start buying and selling SUI/BTC, SUI/USDT, SUI/TUSD and SUI/BNB at 8:15 am EST.

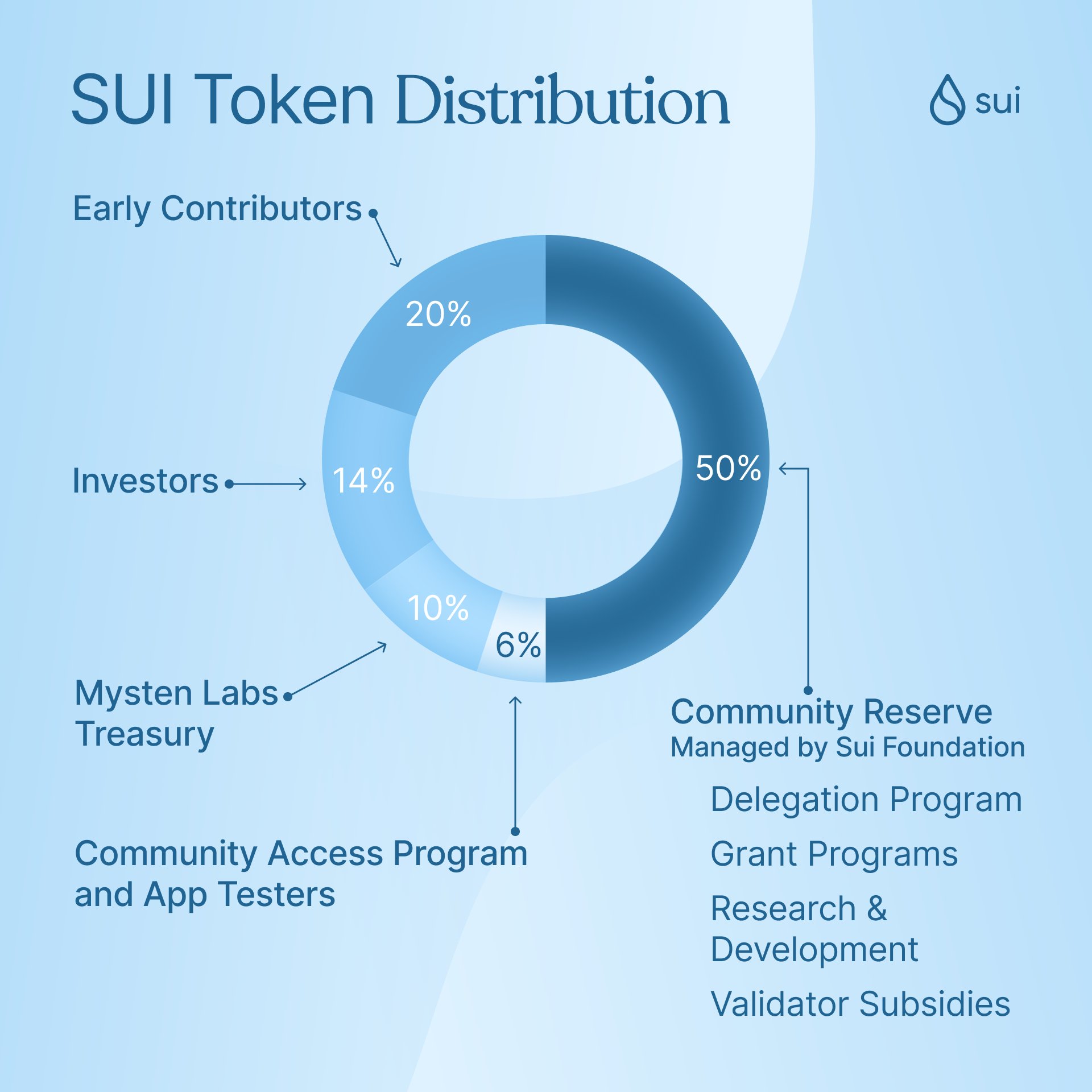

SUI’s token provide has a cap of 10 billion tokens. As acknowledged by the Sui Basis, a portion of the whole provide is predicted to be liquid when the mainnet launches in the present day. The remaining tokens might be transferred or distributed as future reward grants for shares within the coming years.

Within the Sui economic system, the token has 4 functions. It may be used to take part within the proof-of-stake mechanism. It’s the asset required to pay gasoline charges to conduct transactions and different operations.

Moreover, the token is an asset that helps the complete economic system with its worth. Finally, the token performs an necessary function in governance because it serves as the suitable to take part in voting on-chain.

Featured picture from PixelPlex

[ad_2]

Source link