[ad_1]

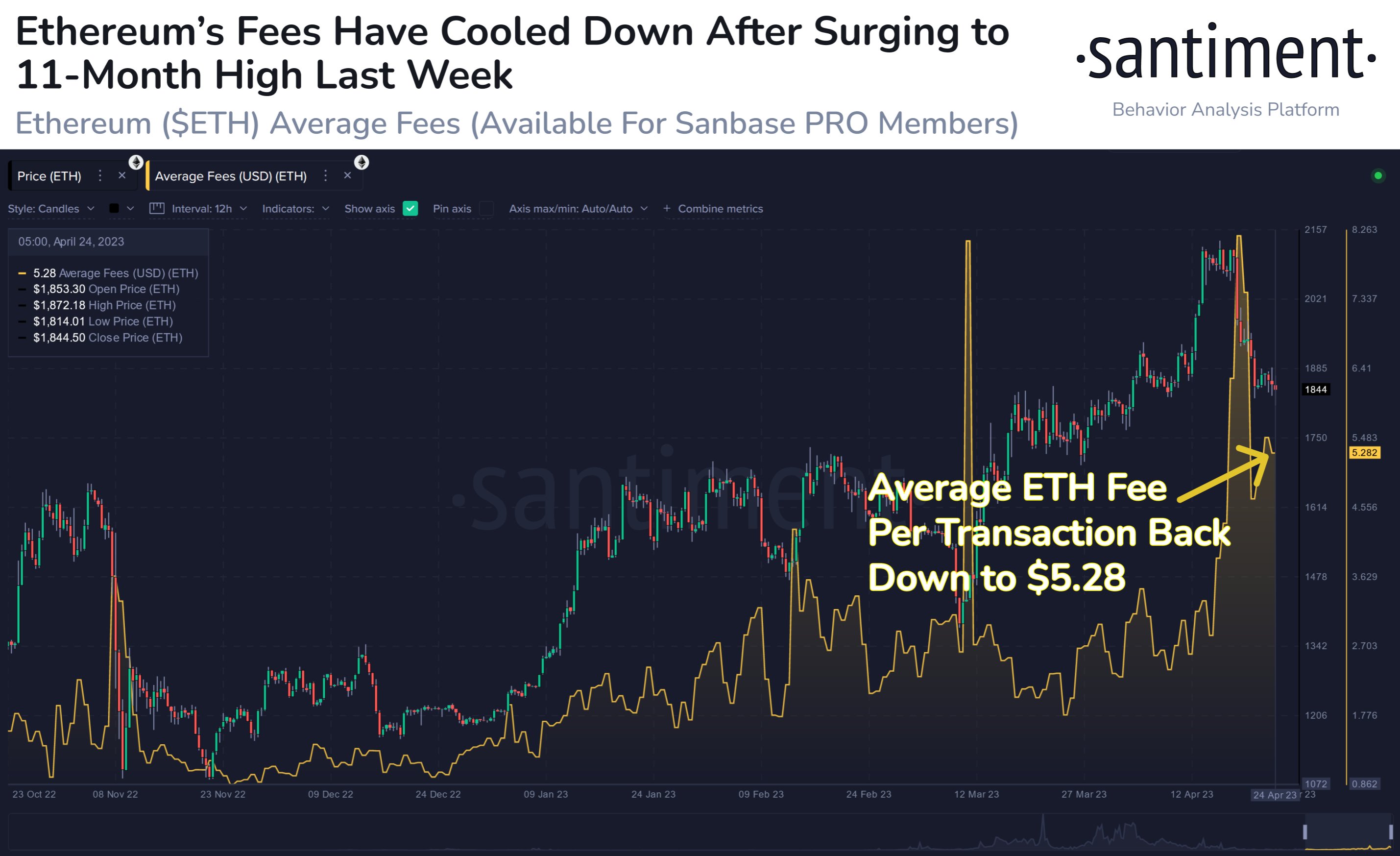

On-chain knowledge reveals the typical Ethereum transaction charges have seen a pointy drop after hitting 11-month highs simply final week.

Ethereum Switch Charges Has Declined By Round 35% In Previous Week

In accordance with knowledge from the on-chain analytics agency Santiment, the charges hit very excessive values when the asset’s worth plunged under the $2,000 stage a couple of week in the past.

The indicator of curiosity right here is the “common charges,” which, as its identify already implies, measures the typical quantity of charges (in USD) that traders are attaching to their transactions proper now. This metric’s worth is especially affected by the density of visitors that the Ethereum community is receiving presently.

When a lot of transactions are going down directly, the mempool (the place the place transfers wait to be added to the block) might get congested. Throughout such instances, a variety of transfers can get caught in ready because the community validators naturally prioritize transactions carrying excessive charges.

Traders that wish to get their transfers by means of quicker then start to connect the next quantity of charges with them. Different holders might then additionally attempt to outcompete these excessive charges transactions by attaching even bigger quantities, and so, on this means, the typical charges can rapidly blow up.

That is solely true when the mempool is congested as a result of when the blockchain is receiving little visitors, there isn’t a lot incentive for traders to connect any important quantity of charges for the reason that community has sufficient capability to deal with all kinds of transactions rapidly sufficient.

Now, here’s a chart that reveals the development within the Ethereum common charges over the previous few months:

Appears like the worth of the metric has been elevated in the previous few days | Supply: Santiment on Twitter

As proven within the above graph, the Ethereum common charges surged to fairly excessive values round every week in the past, when the value of the asset had began sliding off under the $2,000 mark.

It’s not unusual to see the charges exploding throughout such unstable worth motion, as traders normally rush to make their strikes (whether or not for getting or promoting) at any time when the market behaves like this, thus congesting the mempool.

The spike this time was fairly extraordinary, nevertheless, as the typical charges surpassed even that noticed throughout the crash following the collapse of the cryptocurrency trade FTX again in November 2022.

As Ethereum’s drawdown has slowed down in the previous few days, the indicator’s worth has additionally sharply dropped off from its 11-month excessive. Now, the metric’s worth has hit simply $5.28, which is about 35% lower than what was seen final week.

This fast plunge within the common charges means that the demand for transacting on the ETH community has severely dropped up to now week. Although, whereas the blockchain exercise could also be low relative to final week, the present values of the indicator are nonetheless nonetheless fairly important.

ETH Worth

On the time of writing, Ethereum is buying and selling round $1,800, down 14% within the final week.

ETH has taken a plunge in current days | Supply: ETHUSD on TradingView

Featured picture from Michael Förtsch on Unsplash.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link