[ad_1]

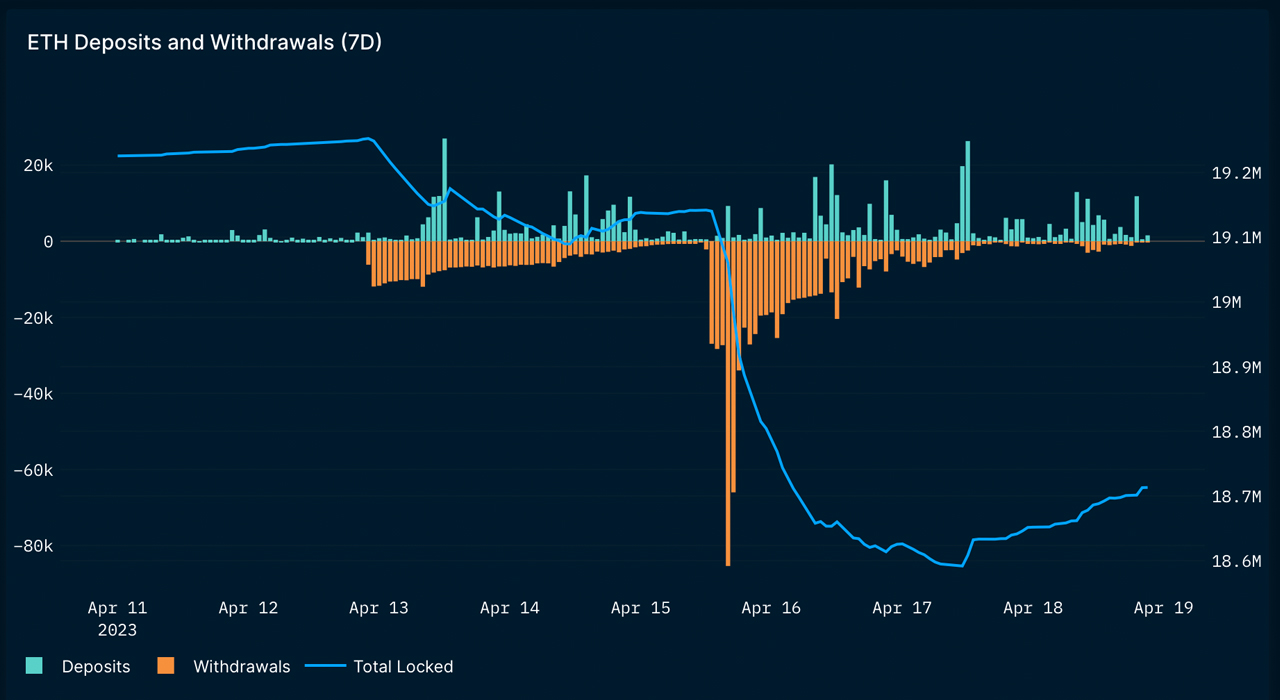

It has been every week since Ethereum’s Shapella onerous fork, and statistics point out that ethereum deposits on April 18 have exceeded withdrawals for the primary time because the improve. At current, 929,999 ether value $1.94 billion is pending withdrawal, and over the previous three days, 112,568 ether has been added to liquid staking protocols.

Simply Beneath a Million Ether Value Near $2B Waits to Be Withdrawn; Common Community Charge Jumps Over $12 Per Switch

Because the Shapella improve, market members have been carefully monitoring Ethereum withdrawals as there was a whole lot of debate prior to now over whether or not there could be large promote stress in the marketplace. Nonetheless, as of April 18, 2023, that has not been the case. Ethereum (ETH) is up 9% towards the U.S. greenback over the previous seven days.

Throughout the week, withdrawals and people ready to withdraw have continued to climb, and presently, slightly below one million ether, or 929,999, is in line to withdraw. On Tuesday, Nansen.ai statistics present that deposits have outpaced withdrawals, a primary since Shapella was carried out on April 12.

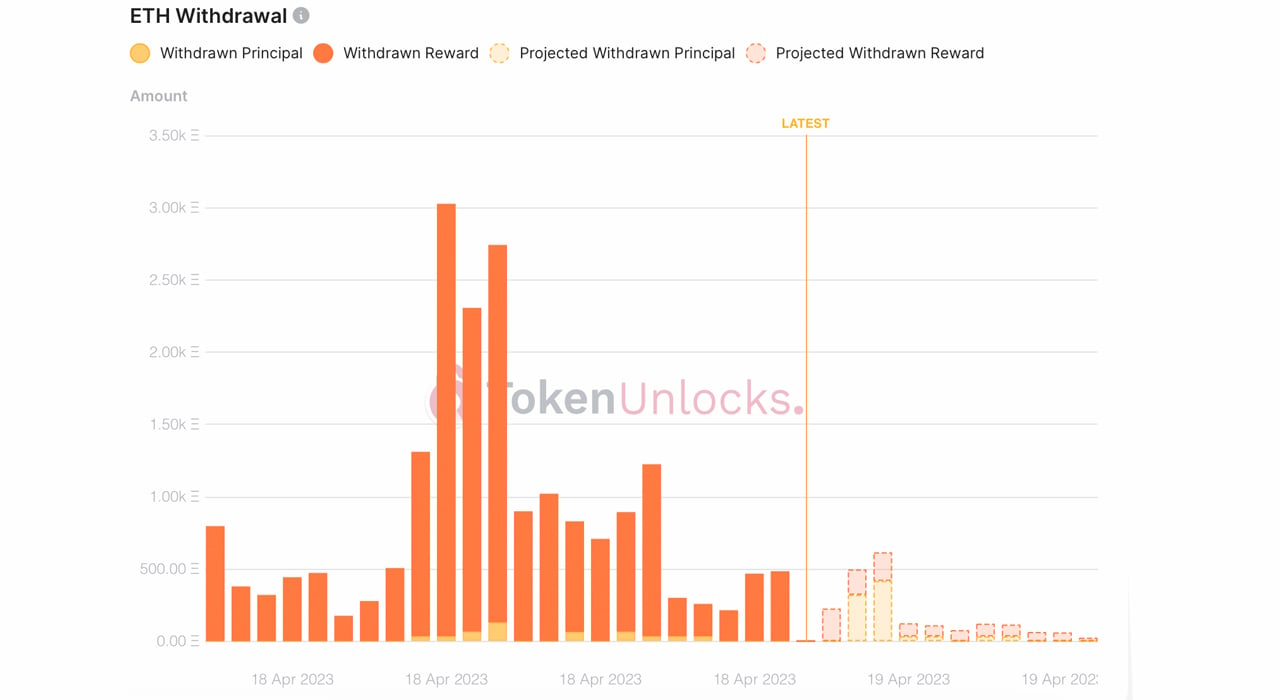

Shapella enabled ethereum stakers to withdraw each the total steadiness of a validator or a validator’s consensus layer rewards. When a full validator removes their 32 ether, they’re deactivating their validator place as an entire, whereas partial withdrawals enable stakers to easily withdraw rewards earned over the interval they began staking.

The withdrawal queue can take days for individuals, and statistics presently present that some unstaking members will wait shut to twenty days to unlock their funds. On Tuesday, knowledge confirmed that deposits moved above withdrawals, with ether being added to liquid staking protocols like Frax, Lido, and Rocketpool this week.

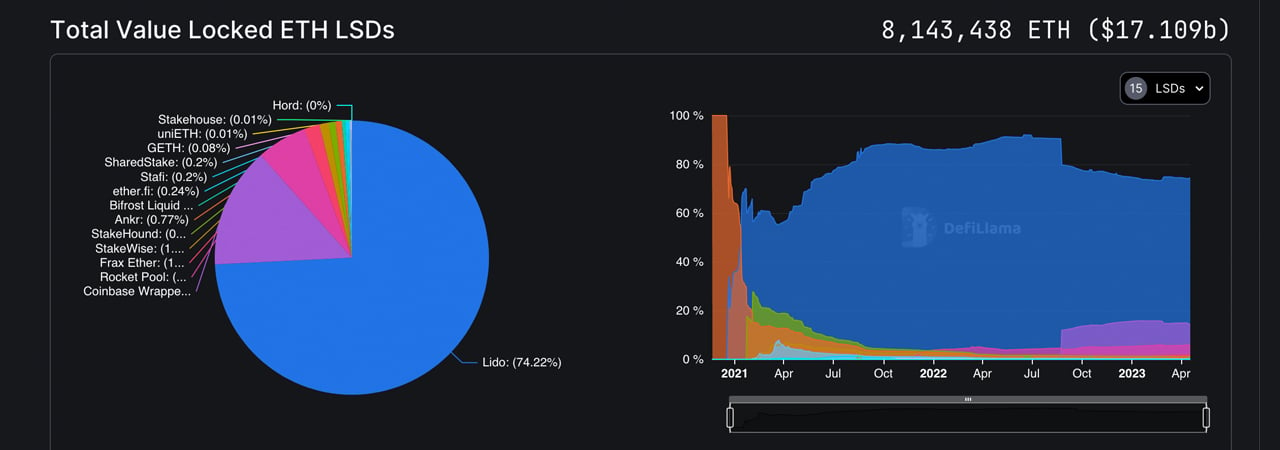

In response to liquid staking metrics from defillama.com on April 15, 2023, 8,030,870 ether was locked into liquid staking derivatives platforms. As of as we speak, that quantity has elevated to eight,143,438 ether value $17.10 billion utilizing present ETH alternate charges. The entire worth locked (TVL) within the liquid staking protocol Lido is $12.65 billion, which has elevated by 1.86% over the past seven days.

When it comes to the 8.14 million ether staked, Lido accounts for 74.22% of the market share with 6,044,058 ETH staked. Whereas Coinbase’s Wrapped Staked Ether protocol shed 2.84%, Rocket Pool recorded a 4.37% improve. Seven-day metrics additionally present that Frax Ether’s protocol TVL elevated by 13.01%.

Information exhibits that the annual share fee (APR) for staking ethereum is presently 4.87%, in accordance with token.unlocks knowledge. Statistics point out a bounce in greater Ethereum community charges in the course of the week, as bitinfocharts.com knowledge exhibits the common Ethereum community transaction price is 0.0059 ETH or $12.45 per switch, whereas the median-sized Ethereum community transaction price is 0.0025 ETH or $5.30 per switch.

Etherscan.io’s gasoline tracker software says a high-priority transaction will get by way of for 51 qwei or $2.92 per transaction. An Opensea sale prices $10.10, a Uniswap v3 swap prices $26.02, and to ship an ERC20 like Tether (USDT) will price an estimated $7.63 per switch.

Do you assume the pattern of accelerating deposits will proceed? Share your ideas about this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any harm or loss brought on or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link