[ad_1]

The most important cryptocurrency by market cap, Bitcoin (BTC), dropped after a chronic interval of consolidation across the $29,000 mark. The failure to maintain this degree has resulted in a decline to $26,000.

Curiously, Bitcoin’s current reversal has coincided with speculations of an imminent bull run, with many believing that the cryptocurrency winter is over and that lower cost ranges won’t be revisited.

Nonetheless, this sentiment shifted on July 14th when the US Greenback Index (DXY) initiated a sturdy rally, surging from 99 factors to its present degree of 103.

Because the DXY started its ascent, Bitcoin’s trajectory turned downward, resulting in a downtrend that triggered the cryptocurrency to relinquish a good portion of its 2023 features. Conversely, earlier than July, BTC skilled a surge to its yearly excessive of $31,800, whereas the DXY declined.

Regardless of this growth, Glassnode co-founder Yan Allemann means that within the coming months, it will likely be Bitcoin’s flip to reclaim the highlight and assert its dominance as soon as once more.

BTC’s Final Consolidation Part?

Glassnode co-founder Yan Allemann has shared insights on the present market situations and predicts an imminent surge in Bitcoin’s worth because the autumn approaches.

Allemann’s evaluation means that the US Greenback is anticipated to achieve a peak degree of 106, which can catalyze a first-rate setting for Bitcoin.

Traditionally, the inverse correlation between the Greenback and Bitcoin has been noticed, the place a stronger Greenback tends to place downward strain on the cryptocurrency’s worth. Conversely, a peak within the Greenback usually coincides with a positive setting for Bitcoin to thrive.

This stated, Allemann believes that Bitcoin is projected to achieve the $37,000 degree earlier than embarking on a big upward motion through the autumn season.

This anticipated surge in worth aligns with the patterns noticed in earlier market cycles, the place Bitcoin has skilled notable worth rallies through the latter a part of the 12 months.

It stays to be seen how this narrative unfolds, however one factor is obvious: the dynamics between Bitcoin and the US greenback proceed to form the cryptocurrency panorama.

Historic Knowledge Reveals September Struggles For Bitcoin

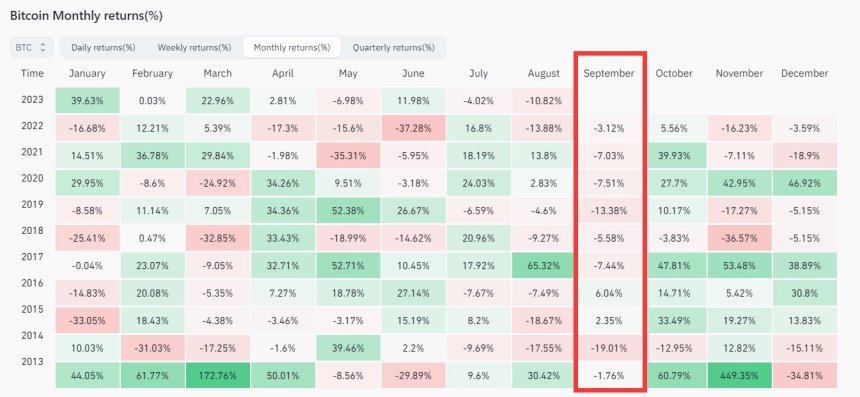

In keeping with information by CoinGlass, August, and September have traditionally offered challenges for Bitcoin, making them infamous months for the cryptocurrency’s efficiency.

With 10 days remaining till the month-to-month shut, August has already confirmed to be a tough month for Bitcoin, experiencing a 12% decline over the previous 30 days. Nonetheless, this downtrend could not come to a halt simply but, as historic information signifies that September may pose extra obstacles to Bitcoin’s worth trajectory.

Inspecting the chart above, it turns into evident that September has traditionally been a difficult interval for Bitcoin.

In some cases, the cryptocurrency has witnessed substantial worth drops, reaching as excessive as 19%. This means that the approaching month may probably be characterised by additional downward strain on Bitcoin’s worth.

Nonetheless, you will need to word that historic tendencies additionally point out the opportunity of extra modest declines. In 2013, for instance, Bitcoin’s worth solely decreased by 1% throughout September, defying the broader detrimental sentiment related to the month.

This demonstrates that whereas September has a historic fame for issue, it doesn’t assure a big downturn for Bitcoin in each occasion.

Whereas Bitcoin has confronted headwinds in August and traditionally in September, it’s value remembering that the cryptocurrency has demonstrated resilience and the flexibility to recuperate from downturns prior to now.

Market situations, macroeconomic components, and regulatory developments can all contribute to the value fluctuations of Bitcoin and different cryptocurrencies.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link