[ad_1]

Dogecoin (DOGE) is as soon as once more on the middle of pleasure within the crypto house. Over the times, the meme-inspired cryptocurrency skilled a exceptional surge, gaining 25% in simply two weeks. As merchants and buyers carefully watch DOGE’s value actions, a mix of technical indicators and on-chain information provide intriguing insights into what might lie forward for DOGE.

Dogecoin Worth Evaluation

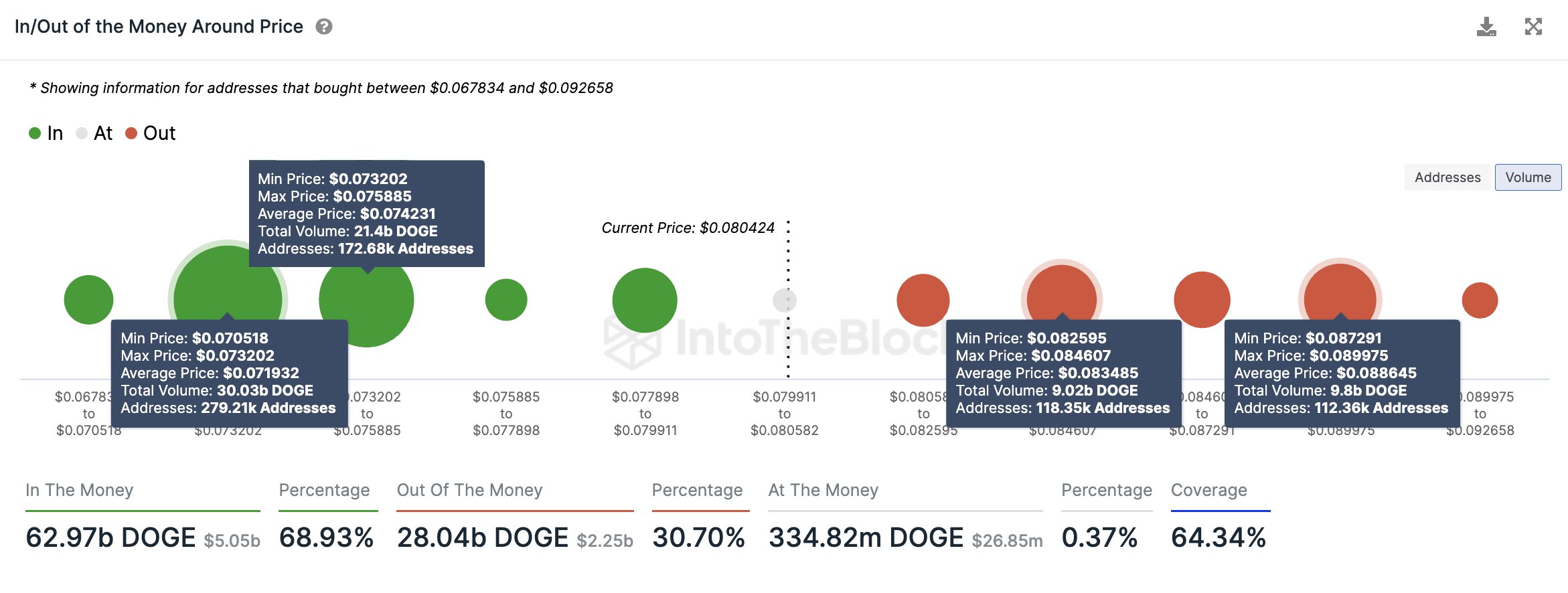

In line with famend analyst Ali Martinez, DOGE’s value motion has established an important help zone between $0.070 and $0.076. Martinez factors out that on this value vary, a staggering 452,000 wallets acquired a major quantity of DOGE, totaling 51.4 billion cash. However, the cryptocurrency faces stiff resistance at $0.083 and $0.088, signaling potential hurdles for additional upward momentum.

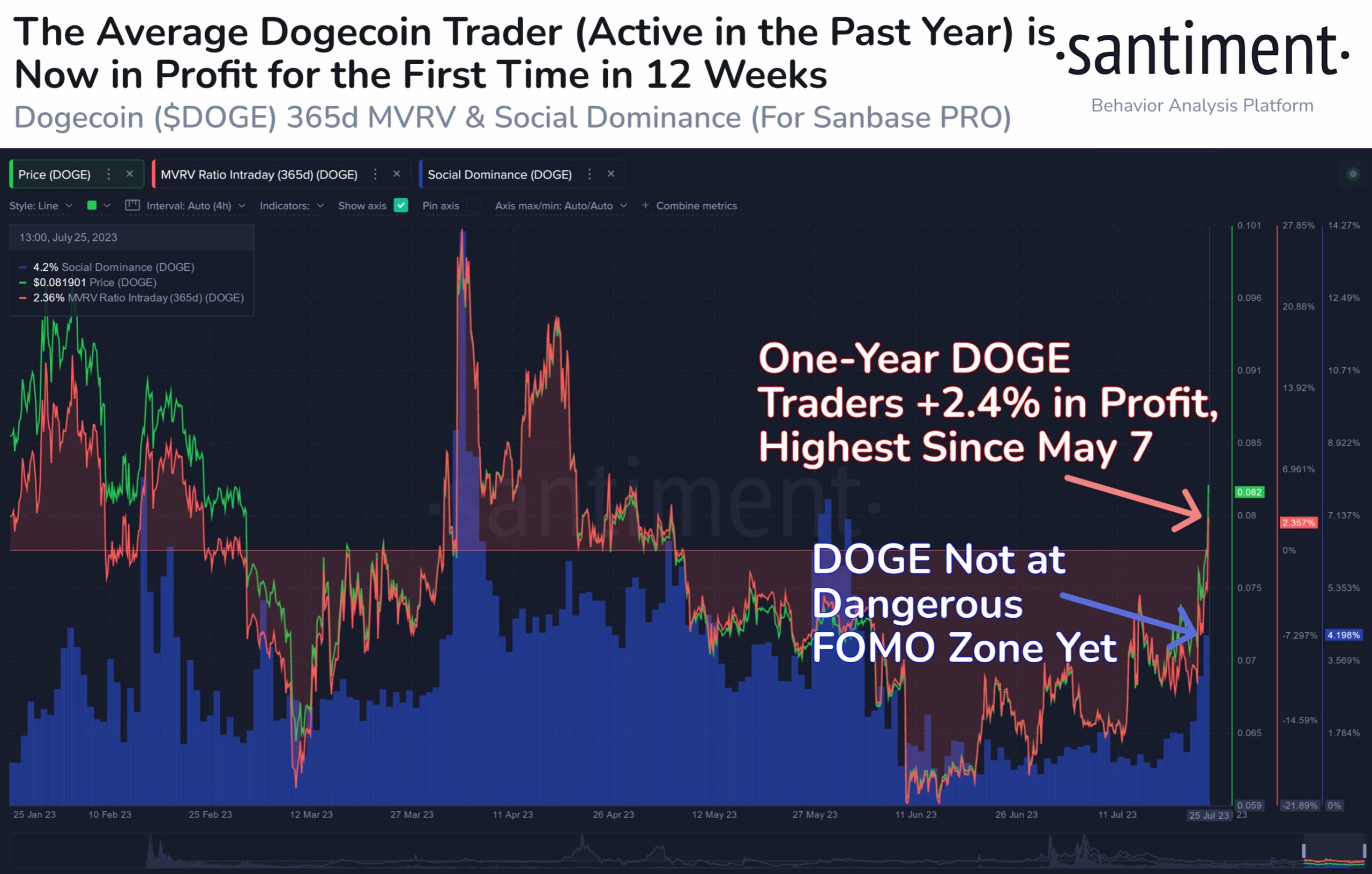

On-chain information agency Santiment provides to the optimism surrounding DOGE, highlighting that the typical DOGE dealer, lively prior to now yr, is now in revenue for the primary time in 12 weeks, displaying a 2.4% acquire. This improvement is taken into account a major milestone and will appeal to extra curiosity from merchants.

However, extra merchants in revenue signifies that profit-taking is extra probably, thus promoting strain may construct up. Furthermore, the DOGE social dominance indicator has not but reached the harmful “FOMO zone,” indicating the potential of an extra upward surge.

Undoubtedly, the present value momentum of Dogecoin is because of Elon Musk. The latest value rally might be attributed to hypothesis that the meme coin might turn into a fee technique on Twitter’s rebranded platform, “X.” Merchants appear wanting to front-run Elon Musk’s resolution on this matter, as he has been a vocal supporter of Dogecoin.

This has fueled roaring hypothesis, leading to a surge within the perpetual futures market tied to DOGE, with notional open curiosity exceeding $512 million for the primary time since April 19. On that day, DOGE traded at $0.0941 and noticed a value drop of about 19% over the subsequent three days.

Whereas the inflow of latest cash into the market is mostly seen as a affirmation of an uptrend, merchants ought to stay cautious. As profit-taking turns into extra probably with extra merchants in revenue, promoting strain may construct up, probably resulting in a brief pullback in DOGE’s value. Nevertheless, at press time, the open curiosity weighted-funding charges have been near zero, suggesting a steadiness between lengthy and quick positions.

DOGE/USD 1-Day Chart

As defined within the final chart evaluation earlier than the pump, DOGE had shaped an ascending triangle formation signaling a development reversal. As predicted, DOGE broke out above the resistance at $0.075 and initially stalled on the 23.6% Fibonacci retracement degree ($0.0785). Nevertheless, after a quick pause, the Dogecoin value continued its rally and climbed to $0.0839, the place the bulls paused in the intervening time attributable to resistance.

Whereas the every day RSI remains to be not overbought at 68.5, one other push larger appears doable. Nevertheless, decrease profit-taking appears to dominate the marketplace for now, so a retest of the 23.6% Fibonacci retracement at $0.0785 could possibly be a probable situation. If the bulls defend this help, DOGE may rise one other 20% to the 38.2% Fibonacci retracement at $0.0937. The subsequent goal would then be the yearly excessive at $0.1044 and the 50% Fibonacci retracement degree at $0.1066.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link