[ad_1]

newbie

Within the swiftly evolving world of cryptocurrency, staying on high of your tax obligations can really feel like an inconceivable job. From my private expertise, understanding the tax implications of crypto transactions shouldn’t be solely essential however might be fairly difficult, given the unstable nature of this area. That’s why, on this article, I wish to overview the fundamentals of crypto taxes, notably with reference to MetaMask, a broadly used Ethereum pockets.

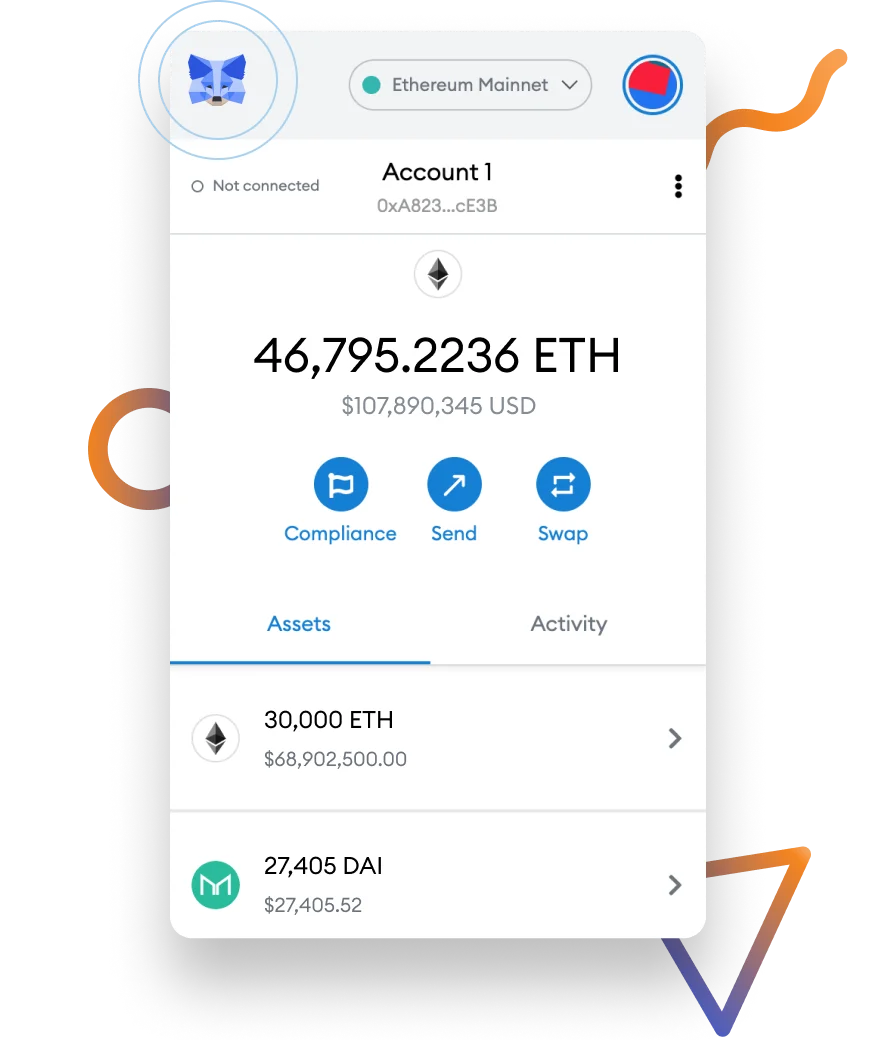

For my part, MetaMask has revolutionized the way in which we work together with the Ethereum blockchain. Its user-friendly interface allows simple administration of your ETH pockets and a handy approach to conduct varied forms of transactions. However with the comfort of digital foreign money comes the duty of reporting it accurately. Your MetaMask transactions are capital property, and any capital acquire or loss from these transactions can immediately affect your tax legal responsibility.

On this article, I’ll have a look at crypto taxes and the way they could concern your utilization of the MetaMask pockets from the attitude of a US citizen. Please keep in mind that tax legal guidelines can differ considerably from nation to nation. All the time seek the advice of with a neighborhood tax skilled to know your obligations.

This text doesn’t represent monetary recommendation.

What’s MetaMask?

MetaMask is a software program cryptocurrency pockets used to work together with the Ethereum blockchain. It permits customers to entry their Ethereum pockets by way of a browser extension or cellular app, which might then be used to retailer, ship and obtain Ether and ERC20 tokens.

Wanna get extra ETH tokens? You should purchase Ethereum at honest charges and with low charges on our platform.

MetaMask pockets is a gateway to many decentralized purposes (dApps) on the Ethereum blockchain, which positions it as a key participant within the crypto ecosystem. By managing your personal keys regionally, it offers a user-friendly interface for crypto transactions whereas additionally guaranteeing your digital property’ safety.

How Do Cryptocurrency Taxes Work?

Understanding how cryptocurrency taxes work is essential for anybody concerned within the crypto area. In the US, the Inner Income Service (IRS) views cryptocurrency as property, making it topic to crypto earnings and capital positive aspects tax.

Taxable Occasions within the Crypto Market

A taxable occasion is any occasion or transaction that ends in a tax consequence for the person or enterprise that executes the transaction. Within the crypto market, taxable transactions would possibly embody buying and selling cryptocurrency for fiat foreign money (like US {dollars}), utilizing crypto to buy items or providers, and buying and selling one crypto for an additional.

Incomes crypto as earnings, whether or not by way of mining, staking, or getting paid in digital property, additionally constitutes a taxable occasion. Every of those transactions might end in capital positive aspects or losses which have to be reported in your tax return.

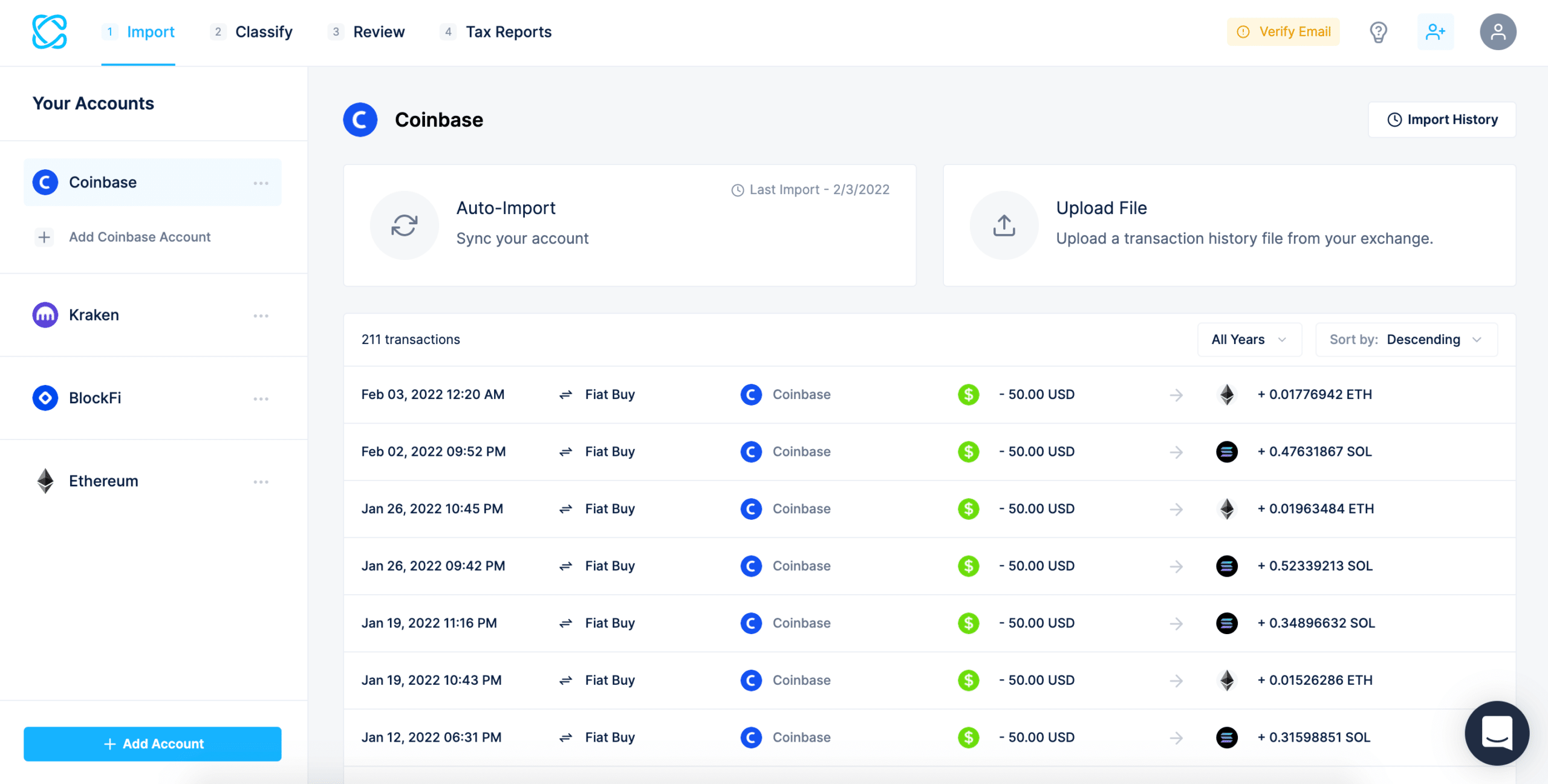

Crypto Tax Software program

To simplify the advanced technique of monitoring and calculating tax implications out of your crypto exercise, you would possibly think about using a crypto tax software program. These platforms will let you mixture transactions from varied sources, calculate positive aspects and losses, and generate needed tax reviews. They supply a complete and environment friendly answer for crypto buyers, notably through the busy tax season.

Crypto Taxes Across the World

Though this text primarily appears at crypto taxes from the attitude of a US citizen, let’s additionally take a short detour and see how cryptocurrency investments and transactions are taxed in different international locations.

Within the UK, as an illustration, the HM Income and Customs (HMRC) treats cryptocurrencies as overseas foreign money for most people. Which means capital positive aspects tax and earnings tax guidelines apply, relying on the forms of transactions concerned. When you’re mining crypto, as an illustration, the exercise is likely to be thought-about a commerce, and any crypto earnings can be taxed accordingly.

In the meantime, in Canada, the Canada Income Company (CRA) considers cryptocurrency as a commodity. Therefore, any earnings from promoting or shopping for crypto is taken into account a enterprise earnings or a capital acquire.

Down below in Australia, the Australian Taxation Workplace (ATO) classifies cryptocurrency as property and applies capital positive aspects tax to any income created from buying and selling.

In distinction, some international locations like Germany provide a tax exemption for cryptocurrencies held for greater than a 12 months.

It’s clear that the panorama of crypto taxes is as numerous as it’s advanced. Whereas MetaMask simplifies transacting along with your ETH pockets, it doesn’t monitor your MetaMask transaction historical past for tax functions. Therefore, it’s important for customers to take care of correct data of their transactions and perceive tax rules of their particular jurisdictions.

Does MetaMask Report To the IRS?

At the moment, MetaMask doesn’t report your crypto transactions to the IRS. Not like conventional banks or inventory exchanges, most crypto exchanges and wallets, together with MetaMask, don’t present a 1099 kind for his or her customers. Which means the duty of recording and reporting taxable earnings falls on the person taxpayer.

How To File Your MetaMask Taxes

To file your MetaMask taxes, begin by exporting a complete record of your crypto transactions made by way of MetaMask. Since MetaMask interacts with the Ethereum blockchain, each transaction made is publicly out there and might be traced utilizing your public Ethereum deal with.

Subsequent, you’ll have to calculate your positive aspects or losses for every taxable occasion. This includes figuring out the fee foundation of your crypto (how a lot you initially paid when buying the asset) and subtracting it from the sale worth. Bear in mind, the IRS distinguishes between short-term capital positive aspects (held for lower than one 12 months) and long-term capital positive aspects (held for a couple of 12 months), every with totally different tax charges.

After your capital positive aspects and losses are calculated, the online result’s what must be reported in your tax varieties. You’ll report your positive aspects on IRS Kind 8949 and Schedule D. When you’ve earned crypto as earnings, it needs to be reported as extraordinary earnings.

Conclusion

It’s vital for customers of platforms like MetaMask to know the tax implications of their crypto transactions. Because of the lack of direct reporting from such platforms, buyers should preserve diligent data and maybe search skilled tax recommendation. Additionally, relying on the character of your transactions, it’s possible you’ll be eligible for a tax deduction – don’t miss out on that!

FAQ

How can I get a MetaMask pockets?

Getting a MetaMask pockets is kind of simple. First, you’ll want to obtain the MetaMask app, which is accessible as a browser extension for Chrome, Firefox, and Courageous, or as a cellular app for iOS and Android units. After downloading, you’ll be guided by way of the method of organising a pockets, together with backing up your seed phrase which is essential for restoration functions.

As soon as arrange, you’ll be given a pockets deal with the place you possibly can obtain and ship Ethereum and ERC20 tokens. The MetaMask API additionally offers builders a approach to create, handle, and work together with the pockets programmatically.

Does MetaMask report back to IRS?

MetaMask doesn’t immediately report your crypto holdings or transactions to the IRS or every other tax authorities. It’s the consumer’s duty to maintain monitor of their crypto property and transactions for tax functions. Negligence may doubtlessly result in tax evasion expenses, that are taken very severely.

Are fuel charges taxed?

Fuel charges, that are the prices of transactions on the Ethereum community, are certainly taxable. When you use the MetaMask fuel charge calculator to find out the price of your transaction, this quantity is taken into account part of the fee foundation in a taxable occasion.

Can the IRS monitor Belief Pockets?

Whereas the IRS doesn’t immediately monitor Belief Pockets, they’ll doubtlessly hint transactions by way of public blockchain information if required. As all the time, it is suggested to adjust to tax rules and report all related actions in your crypto tax report.

Who owns MetaMask?

MetaMask is owned by ConsenSys, a world blockchain firm specializing in Ethereum merchandise and instruments. They’ve been a serious participant within the crypto area, contributing to the Ethereum ecosystem and past.

Disclaimer: Please be aware that the contents of this text aren’t monetary or investing recommendation. The knowledge offered on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native rules earlier than committing to an funding.

[ad_2]

Source link