[ad_1]

In recent times, Decentralized Exchanges (DEXs) have skilled important progress attributable to their capability to offer customers with a excessive degree of safety and freedom.

The collapse of FTX, one of many largest centralized cryptocurrency exchanges on this planet, has additional elevated the demand for protected and complex methods to commerce digital property.

Not like centralized exchanges, DEXs should not have a central level of management or third-party involvement, permitting customers to commerce freely, securely, and with out exterior interference.

Transactions on DEXs are executed utilizing sensible contracts on the platform, enabling people to purchase and promote cryptocurrencies instantly. This setup permits each events to keep up full management over their personal keys, making certain the safety of their wallets with out disclosing any private info.

Kine Protocol is a well-liked DEX that establishes general-purpose liquidity swimming pools supported by customizable digital property. By eliminating the entry limitations for current peer-to-pool buying and selling protocols, Kine Protocol permits third-party liquidation and expands the collateral area to incorporate any Ethereum-based property.

This text explores the Kine Protocol, its operational mechanics, and its distinctive benefits in comparison with different DEXs.

TL;DR:

Kine Protocol is a multi-chain DEX that helps on-chain staking. It doesn’t cost gasoline charges and affords higher buying and selling situations for derivatives.

Kine Protocol creates versatile liquidity swimming pools utilizing a singular mixture of digital property. These swimming pools permit merchants to open or shut spinoff positions based mostly on dependable value inputs, all with out the necessity for a counterparty.

Kine makes it simpler for folks to take part in peer-to-pool (also called peer-to-contract) buying and selling protocols. It does this by permitting third-party liquidation and increasing the vary of Ethereum-based property that can be utilized as collateral.

What’s the Kine Protocol?

The Kine Protocol is a decentralized derivatives platform working on the Ethereum blockchain. It permits customers to swiftly, transparently, and conveniently execute spinoff trades whereas establishing a derivatives market with limitless liquidity.

The platform employs a peer-to-peer pool engine to boost capital effectivity by means of optimum leverage, cross-margining, and cutting-edge know-how.

Kine Protocol has developed a multi-chain infrastructure to accommodate numerous person wants. This built-in multi-chain buying and selling ecosystem positions it as probably the most complete decentralized derivatives buying and selling platform out there.

Kine Protocol’s goal is to function a decentralized derivatives buying and selling platform for a variety of property. This starkly contrasts the present state of “monotonous” buying and selling in crypto-asset derivatives.

Kine believes that property like gold, US shares, and different commodities usually tend to acquire recognition from conventional monetary market buyers and contributors in comparison with cryptocurrencies, that are nonetheless comparatively new.

The platform’s purpose of “buying and selling the whole lot” aligns with the achievements of different DeFi protocols, resembling Mirror, Synthetix, and UMA, which have created monetary property with broad consensus within the blockchain sphere.

Nonetheless, it adopts an strategy that allows not solely crypto buyers but in addition conventional merchants to take part in DeFi. The protocol seeks to dismantle entry limitations and supply a platform for buying and selling artificial property, thereby unlocking quite a few alternatives for contributors.

Kine employs the “peer-to-pool” mannequin to achieve “infinite liquidity” for DeFi derivatives. This mannequin addresses the problem of excessive collateral necessities and accelerates the utilization of funds, akin to what Synthetix and Mirror have achieved prior to now.

An Overview of kUSD

Kine Change is a peer-to-peer derivatives buying and selling platform that completely makes use of kUSD as its foreign money. This digital foreign money, kUSD, is instantly tied to the worth of the US greenback and is backed by a considerable liquidity pool. Customers can mint kUSD so long as they’ve out there debt limits.

One essential a part of Kine’s ecosystem is the connection between kUSD and the KINE token. KINE tokens function governance and utility tokens within the Kine Protocol.

When Kine Change earns income from buying and selling actions, these earnings are collected in kUSD. To align group pursuits and improve the ecosystem, kUSD earnings are transformed into KINE tokens utilizing a third-party DEX like Uniswap.

This mechanism ensures that KINE token holders actively take part within the platform’s progress. KINE tokens additionally produce other vital features within the Kine ecosystem. They are often staked to offer liquidity for Kine’s lending and borrowing markets, permitting customers to earn rewards within the type of transaction (gasoline) charges.

Moreover, KINE tokens can function collateral inside the Kine Protocol, enabling customers to interact in superior buying and selling methods and entry monetary providers.

The synergy between kUSD and KINE tokens ensures the steadiness and progress of the Kine Protocol, providing customers a flexible and highly effective monetary platform.

Key Options of the Kine Protocol

Social and Enjoyable Modules:

Loyalty Factors and Airdrop Occasions: Kine Protocol’s most important web site incorporates partaking modules like Loyalty Factors and Airdrop Occasions to boost person participation. These options present extra freedom and incentives to devoted platform supporters.

Instructional Modules:

Video games and Particular Rewards: Kine affords entertaining and academic modules, together with video games and particular rewards, to assist new customers perceive how the protocol operates. These interactive instruments information newcomers in constructing their portfolios and greedy complicated buying and selling ideas resembling perpetual futures.

Membership Tiers:

Bronze, Silver, and Gold Ranges: Kine’s web site introduces “Kine Membership” with three distinct membership ranges: Bronze, Silver, and Gold. Every tier affords a set of advantages, together with reductions on buying and selling charges, Loyalty Factors (LP) airdrops, greater leverage levels, beta-test precedence, and extra.

Membership Upgrades:

Incomes Exp Factors: To advance their membership standing, customers should accumulate Exp factors, indicating their membership degree. Exp factors could be earned by means of each day check-ins, growing buying and selling capital, and fulfilling KYC necessities.

Play-to-Earn Module:

Sport Middle and Loyalty Factors: Kine introduces a “Play-to-Earn” module referred to as “Sport Middle and Loyalty Factors.” This function offers customers with an fulfilling and interactive solution to commerce on Kine’s decentralized change (DEX).

Loyalty Factors (LP):

Engagement Indicator: Kine’s Loyalty Factors (LPs) are a precious indicator of a person’s engagement inside the Kine ecosystem. Customers can accumulate LPs by taking part in Kine’s Sport Middle and Loyalty Level platform, in addition to by partaking in future group actions and airdrops.

LP Redemption:

Unique Advantages: Collected LP factors could be exchanged for numerous objects inside the Kine ecosystem, together with $KINE, the platform’s native token. It’s vital to notice that LP tokens can’t be purchased or offered exterior the Kine ecosystem; they’re completely redeemable inside the platform.

Advantages of Kine Protocol

Kine customers have entry to a spread of advantages, a few of which embody:

Staking and Minting

Customers can stake their digital property inside the Kine Finance dApp. This entails setting a “debt restrict” and growing “staking worth” to mint kUSD, representing the precise system debt. For each greenback of debt restrict, 0.8 kUSD could be minted.

This function permits customers to place their property to work and earn curiosity by staking them. Kine’s distinctive debt-limit-based minting system affords a versatile solution to leverage property, setting it other than different protocols.

Buying and selling

Minted kUSD can be utilized as a buying and selling margin on Kine Change. It’s a extremely sought-after coin traded on numerous exchanges, together with Gate.io and OKEx. All buying and selling income and losses are denominated in kUSD.

This buying and selling function streamlines entry to the market, and all income and losses are settled in kUSD, making certain customers have a steady reference level for his or her buying and selling actions.

Token Burning and Unstaking

Customers can withdraw staked property by burning an equal quantity of kUSD to settle their excellent obligations. This course of ensures a safe and clear solution to withdraw staked property. It simplifies the unstaking course of and ensures that customers obtain precisely what they’re owed, distinguishing Kine Protocol from platforms with extra complicated unstaking mechanisms.

Person Incentives

Kine rewards customers with excellent money owed by means of periodic distributions.

This rewards system incentivizes customers to take part actively within the protocol, offering further worth past conventional staking or lending platforms.

Affiliate Revenue

Customers can earn 28% of the gasoline charges paid by people they check with the Kine Protocol. The associates program affords customers a possibility to earn passive revenue by merely referring others, making the protocol extra engaging and community-driven.

How you can Use the Kine Protocol

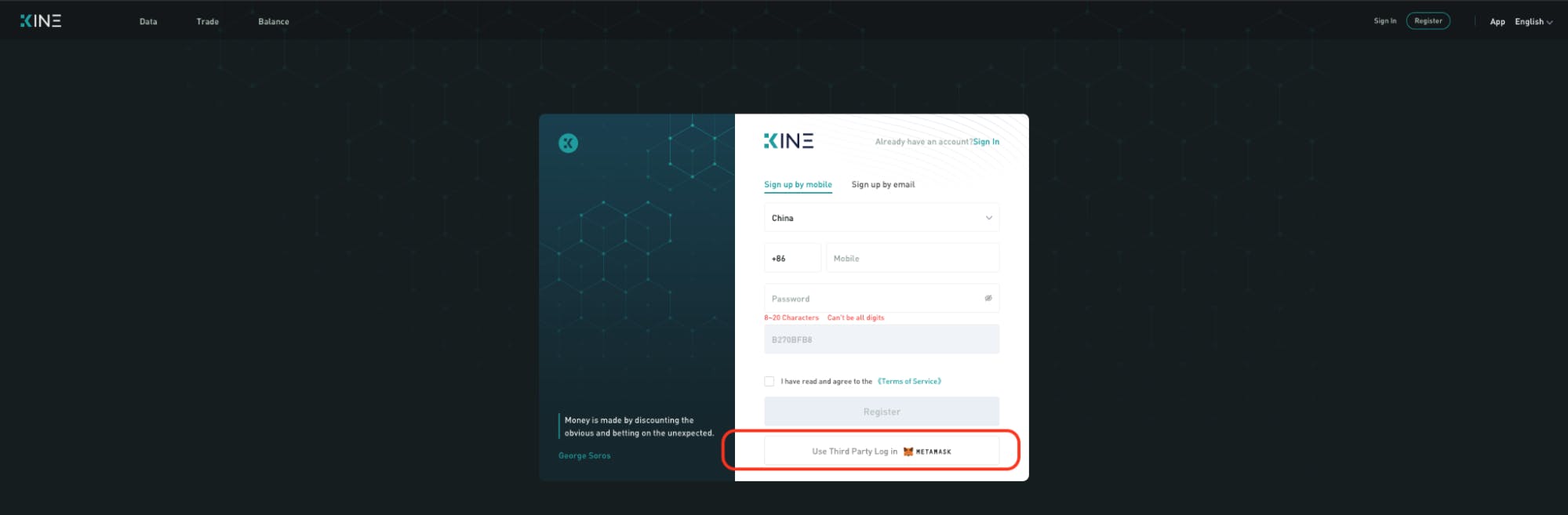

Step 1: Signal Up on the Kine Change and Deposit

MetaMask customers can join on to Kine Change with out registering. After clicking “Join with MetaMask,” you’ll be prompted to signal a message (with out incurring any gasoline charges). After a couple of seconds, you’ll be efficiently logged into Kine Change.

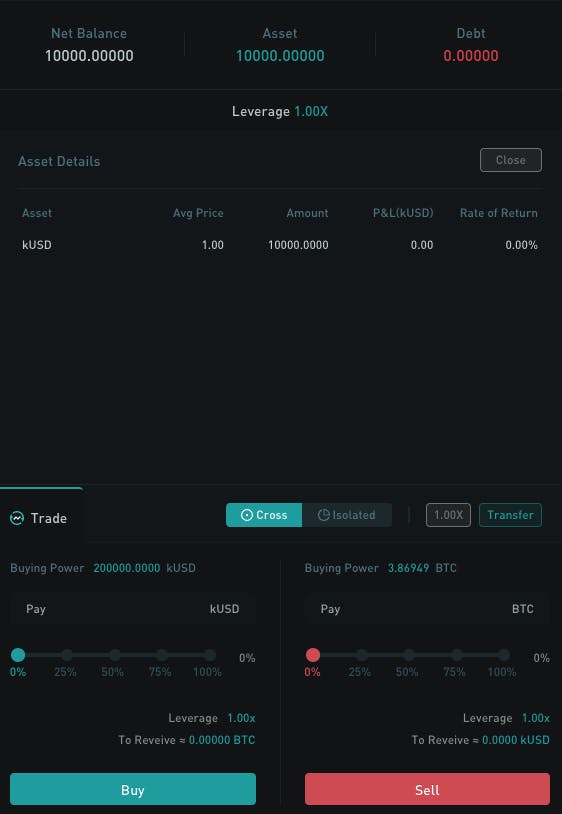

Your property can be displayed in your account’s “Steadiness” tab. To get your deposit handle, click on on “Deposit.” You’ll be able to then ship your kUSD to the offered handle, identical to on most cryptocurrency exchanges. Your token stability can be up to date after 12 blocks have been confirmed.

Step 2: Fund the Cross-Margin Account with kUSD to Begin Buying and selling

You’ll be able to select an asset from the top-left column to watch its value motion and funding charges. Earlier than putting an order, it’s best to evaluate your account’s fairness, debt, property, and the liquidation value for leverage.

Disclaimer: This text is meant solely for informational functions solely and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein needs to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of economic loss. All the time conduct due diligence.

If you need to learn extra articles like this, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, and Instagram, and CoinMarketCap Group.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”

[ad_2]

Source link