[ad_1]

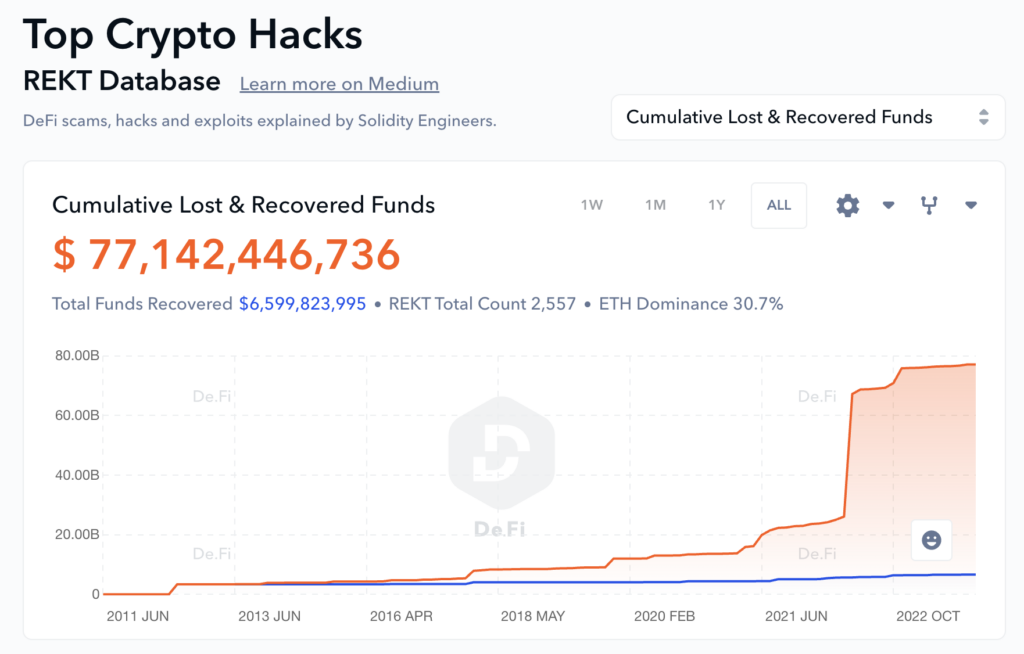

De.Fi’s Rekt Database reviews that July noticed $389.82 million in DeFi losses associated to hacks and exploits, pushing the cumulative whole worth of all of to cross the edge of $77 billion.

Ethereum emerged as essentially the most focused, dropping $350 million throughout 36 incidents. Multichain, nevertheless, suffered essentially the most extreme single-case lack of $231 million as a consequence of an entry management exploit, in accordance with the De.Fi evaluation.

Criminals’ various arsenal of exploits throughout DeFi.

Entry management points led to 3 vital circumstances leading to a staggering lack of $287 million. Rugpulls, regardless that the most typical with 38 reported circumstances, resulted in considerably decrease losses totaling $36 million. Reentrancy assaults, though much less frequent with six circumstances, nonetheless led to substantial losses of $58 million.

Among the many totally different classes of targets, tokens had been essentially the most continuously attacked, with 39 circumstances reported resulting in losses totaling $35.9 million. Borrowing and lending protocols had been focused as soon as, with a lack of $3.4 million. The Bridge class was hit hardest, reporting a lack of $241 million from two incidents.

The Multichain exploit was on the prime of the exploit checklist, with $231.1 million misplaced as a consequence of entry management points. The Vyper Compiler noticed losses of $50.5 million as a consequence of a reentrancy assault, whereas the BALD Token misplaced $23.1 million as a consequence of a token rugpull. De.Fi offered CryptoSlate with an inventory of the highest exploits in July, proven under.

RankPlatform/TokenAmount LostType of Exploit1Multichain$231.1mAccess Control2Vyper Compiler$50.5mReentrancy3BALD Token$23.1mToken Rugpull4AlphaPo$22.8mCeFi, Entry Control5Poly Community$10.2mAccess Management

In line with the Rekt Database, the restoration of exploited funds in July was notably low. A mere $7 million was recouped from the huge loss, persevering with the unlucky pattern of low restoration charges in latest months.

July marks the peak of DeFi’s losses for 2023, with near $1 billion now misplaced in whole for the yr. There was $73 million extra misplaced in July than the subsequent highest month, which occurred in March.

These figures function a sobering reminder of the inherent dangers and vulnerabilities of the present DeFi panorama. Whereas the promise of decentralized finance is compelling, the truth, as evidenced by the $77 billion cumulative whole misplaced, isn’t with out its challenges.

De.Fi’s Rekt Database permits additional evaluation throughout many chains. It consists of the $40 billion loss from the Terra collapse in 2022, together with different notable incidents involving Silk Highway, Africrypt, PlusToken, and lots of extra. Every incident is defined by solidity engineers giving a layer of further transparency to the common investor.

In line with the database, the Terra collapse nonetheless stands tall on the prime of the black hat pile, with ten occasions extra misplaced than the Africrypt rugpull in second place, which noticed $3.8 billion misplaced in 2021.

[ad_2]

Source link