[ad_1]

Be a part of Our Telegram channel to remain updated on breaking information protection

2023 has been tumultuous for the crypto trade, as 13% of all crypto funds have collapsed, signaling a disaster of confidence and operational challenges. Information insights from 21e6 Capital AG, a Swiss funding advisor, reveal that these funds have confronted a vicious circle of obstacles, together with regulatory uncertainties and difficulties in attracting buyers and banking companions to an unregulated market.

Crypto Funds Wrestle to Survive

Elevated chaos within the crypto trade has led to heightened consciousness and application in prospects and buyers. The necessity for safer crypto exchanges and custodians amid regulatory uncertainties has made it tough for crypto funds to lure buyers contemplating the unregulated standing of the market.

Regardless of the regular rise of Bitcoin skilled because the begin of the 12 months, the report states that 97 out of over 700 crypto funds have closed store, with a lot of the remaining ones struggling to make returns.

Actually, statistics by Bloomberg present that, on common, crypto funds generated a 15.2% return within the first half of 2023. This was a big underperformance in comparison with Bitcoin, which gained 83.3% over the identical interval.

Crypto Panic: Startling Information Reveals 97 Crypto Funds Have Collapsed This Yr https://t.co/6cQ9u6PAyg

— Crypto Dealer Professional 🇺🇸 (@CryptoTraderPro) August 7, 2023

That is primarily as a result of the FTX collapse late final 12 months induced many hedge funds to carry their funds in additional in depth money reserves than common. Whereas this transfer was meant to guard them from the excessive volatility that the market has been struggling, it additionally induced them to overlook out on the Bitcoin surge that has been ongoing because the 12 months started.

As of the tip of July 2023, statistics by 21e6 Capital present that solely 31% of crypto funds had important publicity to Bitcoin.

Apart from the psychological trauma, the demise of FTX additionally immediately impacted crypto funds. As an example, Galois Capital imploded in February with $40 million value of property trapped within the defunct trade.

In its aftermath, prime crypto-friendly banks, comparable to Silvergate and Silicon Valley Financial institution, collapsed, leaving the crypto trade with out banking providers. This created skepticism in the remainder of the standard banking trade, with no financial institution rising to assist the crypto trade. Because of this, “even exceptionally well-performing funds shut down because of lack of a brand new banking associate,” says the report.

Directional Funds Fail to Catch Up with Bitcoin

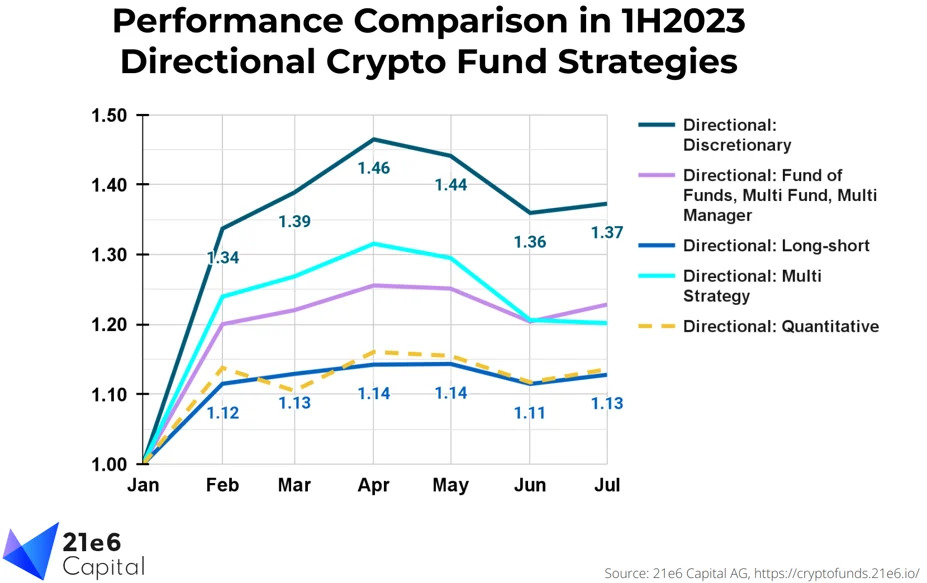

In keeping with the report, directional funds outperformed their non-directional friends. The info confirmed that the latter had a mean return of simply 6.8% from January to June. Alternatively, funds that place directional bets sometimes had a return of 21.9%.

Directional funds implement techniques in response to anticipated market modifications. They rely extra on futures markets and steadily place wagers on short-term value fluctuations than their non-directional counterparts.

Nonetheless, their efficiency was nonetheless considerably decrease than that of Bitcoin. This underperformance has impacted investor confidence, particularly these with important publicity to altcoins, inflicting money inflows and the launch of latest crypto funds to dwindle.

Extra exactly, the “quantitative directional” method, one of many investing methods employed by hedge funds, is the least profitable in 2023 to date.

This methodology sometimes employs buying and selling algorithms and focuses on statistical decision-making. Such data-based techniques introduced directional funds points in a 12 months marked by bumpy markets, as famous within the 21e6 Capital research. In different phrases, though cryptocurrency costs have elevated, they haven’t executed so in a constant method.

As such, the market has been sending erratic indicators to systematic crypto-quant funds. This has aggravated the scenario by deceiving buying and selling algorithms into following sub-optimal methods.

Associated Articles:

Wall Road Memes – Subsequent Large Crypto

Early Entry Presale Stay Now

Established Group of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Greatest Crypto to Purchase Now In Meme Coin Sector

Group Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be a part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link