[ad_1]

On-chain knowledge reveals the Dai sharks and whales have been rising their holdings lately, which may gas Bitcoin’s rally.

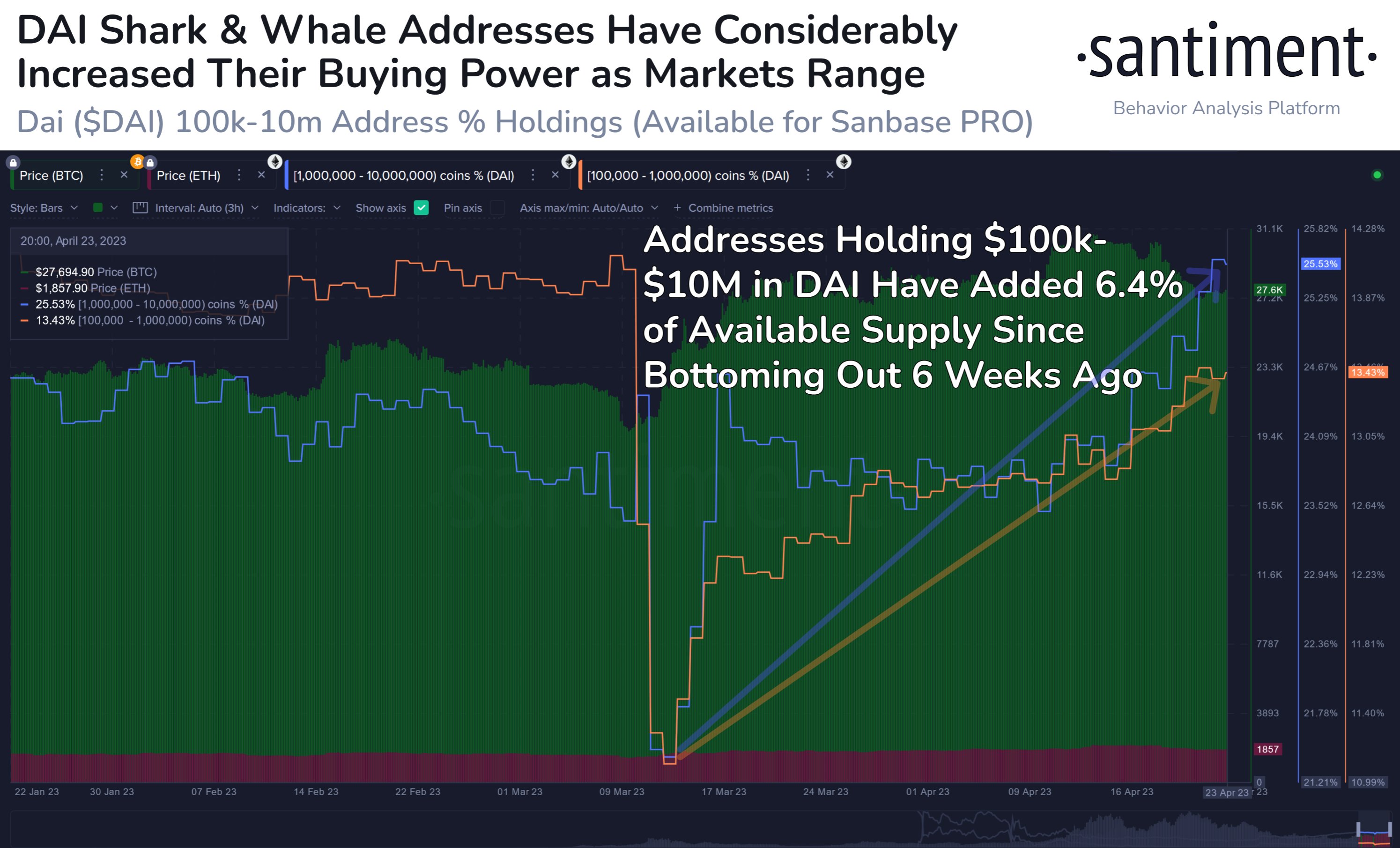

Dai Sharks & Whales Have Purchased 6.4% Of The Provide In Final Six Weeks

In line with knowledge from the on-chain analytics agency Santiment, the holdings of Dai whales and sharks had plunged to a backside final month. The related indicator right here is the “DAI Provide Distribution,” which tells us in regards to the proportion of the entire circulating provide of the stablecoin that every market pockets group is holding.

Addresses are divided into these pockets teams based mostly on the variety of cash they’ve of their balances. For instance, the 100 to 1,000 cash cohort consists of all addresses holding at the very least 100 and 1,000 tokens of the stablecoin.

If the Provide Distribution metric is utilized to this group, then it might measure what proportion of the availability the mixed balances of wallets satisfying this situation add as much as.

Within the context of the present matter, the bands of curiosity are 100,000 to 1 million cash and 1 million to 10 million cash. Here’s a chart that reveals the pattern within the Provide Distribution for these two teams over the previous couple of months:

The values of the 2 metrics appear to have been quickly going up in latest days | Supply: Santiment on Twitter

The primary of those ranges ($100,000 to $1 million) corresponds to a Dai cohort known as the “sharks,” whereas the latter one ($1 million to $10 million) represents the wallets of the “whales.”

These buyers’ wallets have such giant quantities that they will play an essential function available in the market. Naturally, the whales’ holdings are greater than the sharks’, so they’re the extra highly effective group.

Buyers normally use stablecoins like DAI to flee the volatility related to the opposite belongings available in the market. Such buyers usually maintain onto their stables till they really feel the timing is true to re-enter unstable cash like Bitcoin and Ethereum. At this level, they convert their stables into them, thus offering a bullish increase to their costs.

The chart reveals that the proportion of the entire circulating Dai provide held by the sharks and whales plummeted in March when BTC fell beneath the $20,000 stage. Quickly after these buyers shed their holdings, BTC’s value began climbing once more.

This is able to recommend that the sharks and whales of this stablecoin shifted their cash into BTC whereas the cryptocurrency was buying and selling round comparatively low ranges, thus serving to it recuperate.

Within the six weeks since then, these humongous buyers have once more amassed the stablecoin and added round 6.4% of the circulating provide into their wallets. Whereas the sharks’ holdings are presently lower than what they had been earlier than the underside, the whales’ treasuries have gone on to recuperate and surpass the holdings from earlier utterly.

Not too long ago, Bitcoin’s value has plummeted to the low $27,000 stage. Whether or not the Dai sharks and whales convert their saved-up stacks right here to make the most of the dip and assist the cryptocurrency recuperate, identical to a month, stays to be seen.

BTC Value

On the time of writing, Bitcoin is buying and selling round $27,300, down 7% within the final week.

BTC has sharply gone down | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link