[ad_1]

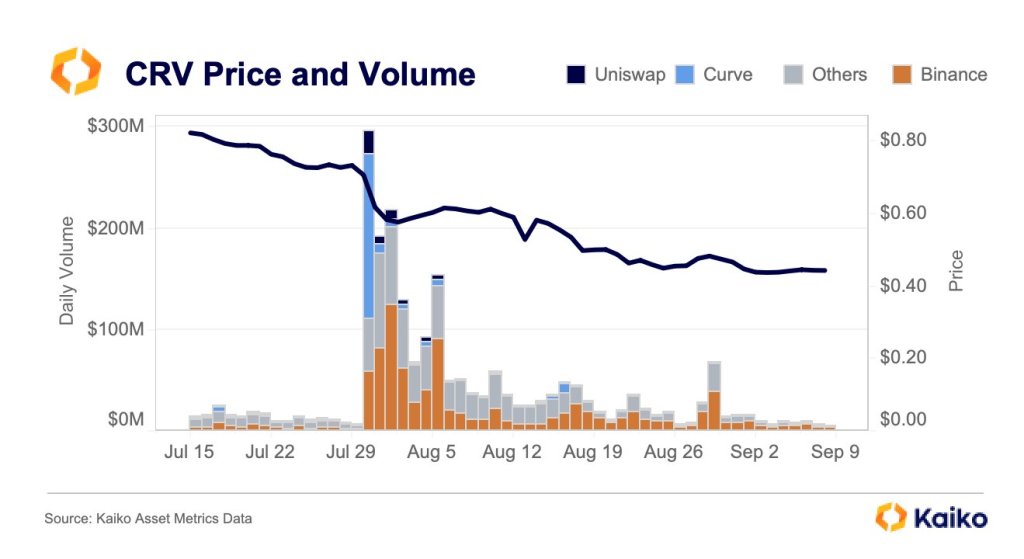

Buying and selling volumes related to CRV, the governance token of Curve, a stablecoin decentralized trade (DEX), is down 97% barely two months after it was hacked in late July 2023. In line with Kaiko, CRV’s buying and selling quantity in centralized exchanges, particularly Binance, the place the token is actively traded, fell from almost $300 million in late July to $7 million as of September 12.

Trackers present that CRV is out there for buying and selling in a number of centralized and decentralized exchanges, together with Binance, Uniswap, and Curve. Nevertheless, contemplating the recognition and liquidity standing of Binance, most CRV buying and selling was focused on the world’s well-liked crypto trade.

For instance, Binance’s share of CRV buying and selling is about 20% when writing, whereas Bitbox is subsequent with a dominance of round 7%.

Curve’s TVL, Worth, And Buying and selling Volumes Collapse

In crypto, a drop in buying and selling quantity typically signifies waning curiosity in a digital asset or normal warning practiced by traders. With falling quantity, the asset’s liquidity takes successful as merchants or traders choose out, even liquidating the coin as they select stability and refuge. Typically, they’ll undertake a wait-and-see strategy, evaluating how the token will react in gentle of fixing market circumstances.

In line with DeFiLlama, Curve has a complete worth locked (TVL) of roughly $2.17 billion, down from $3.25 billion when the protocol was hacked. The decline in TVL and buying and selling volumes comes amid the overall lull within the decentralized finance (DeFi) scene.

The drop in CRV valuation and buying and selling volumes was worsened by the July exploit, which noticed the protocol lose over $50 million value of belongings. Though Curve recovered most of these funds, the impact of the exploit known as into query the overall state of safety.

The Hack And Erogov’s CRV Disposal

Within the July hack, malicious actors exploited varied Curve stablecoin swimming pools utilizing older variations of Vyper, a programming language used to create sensible contracts on Ethereum. All Curve’s swimming pools are automated, and this function allowed hackers to empty a number of swimming pools by a re-entrancy assault.

CRV reacted to this hack by dropping, falling sharply on July 30 from round $0.74 to $0.48. It has since exceeded halved, crashing to $0.40, a brand new 2023 low.

Throughout this time, Curve’s CEO, Michael Egorov, needed to promote CRV holdings he had used to again his loans by way of over-the-counter (OTC) to entities and people equivalent to Justin Solar when costs began falling. Egorov had taken out loans on Aave and Frax Finance secured by CRV.

Characteristic picture from Canva, chart from TradingView

[ad_2]

Source link