[ad_1]

newbie

Navigating the crypto panorama can typically really feel like wading by way of a sea of acronyms and slang. Phrases like HODL, FOMO, and DeFi have change into a part of the lingo, making the world of crypto generally appear as if a secret society with its personal secret language. In such a situation, you may need come throughout the time period ‘crypto whales’ and puzzled, “What are whales in crypto?” On this article, we’ll demystify this time period and make clear its relevance within the digital forex world.

Earlier than we dive in, let me introduce myself. My identify is Zifa. Over two years in the past, I immersed myself within the dynamic and sometimes exhilarating world of cryptocurrencies. I’ve reported on the highs and lows, the pioneering applied sciences, and the influential personalities shaping this business. Immediately, we’re taking a step again to concentrate on the fundamentals. Whether or not you’re new to crypto or just seeking to brush up in your information, this text goals to offer a transparent and complete understanding of the important thing gamers within the crypto world: the whales.

What Are Crypto Whales, Precisely?

A crypto whale refers to a person or entity that holds a major quantity of cryptocurrency, reminiscent of Bitcoin or Ethereum, of their digital wallets. The time period “whale” was derived from conventional monetary markets, the place a whale represents an investor or dealer with substantial holdings, able to influencing market actions as a result of measurement of their transactions.

Within the context of the crypto market, whales play a pivotal function. Their crypto holdings present them with a substantial quantity of energy to impression value actions. When a whale buys or sells a lot of cash, it could actually trigger highly effective fluctuations out there and doubtlessly affect the buying and selling choices of different buyers.

What are the whales shopping for in crypto?

Crypto whales — people or entities with important cryptocurrency holdings — impression the crypto market to an incredible extent. Curiously, what these whales spend money on can provide beneficial insights into their methods. Sometimes, their various portfolios embody established cryptocurrencies like Bitcoin and Ethereum, recognized for his or her relative stability. Additionally they present curiosity in different cash with progress potential, notably these linked to rising blockchain initiatives and applied sciences.

Funding methods amongst whales are usually not uniform: they will range rather a lot, contingent on their threat urge for food and the prevailing market circumstances. Some may lean towards long-term investments, selecting to carry their positions by way of the market’s ups and downs. Others may interact in short-term buying and selling, capitalizing on market volatility and value actions to build up extra belongings.

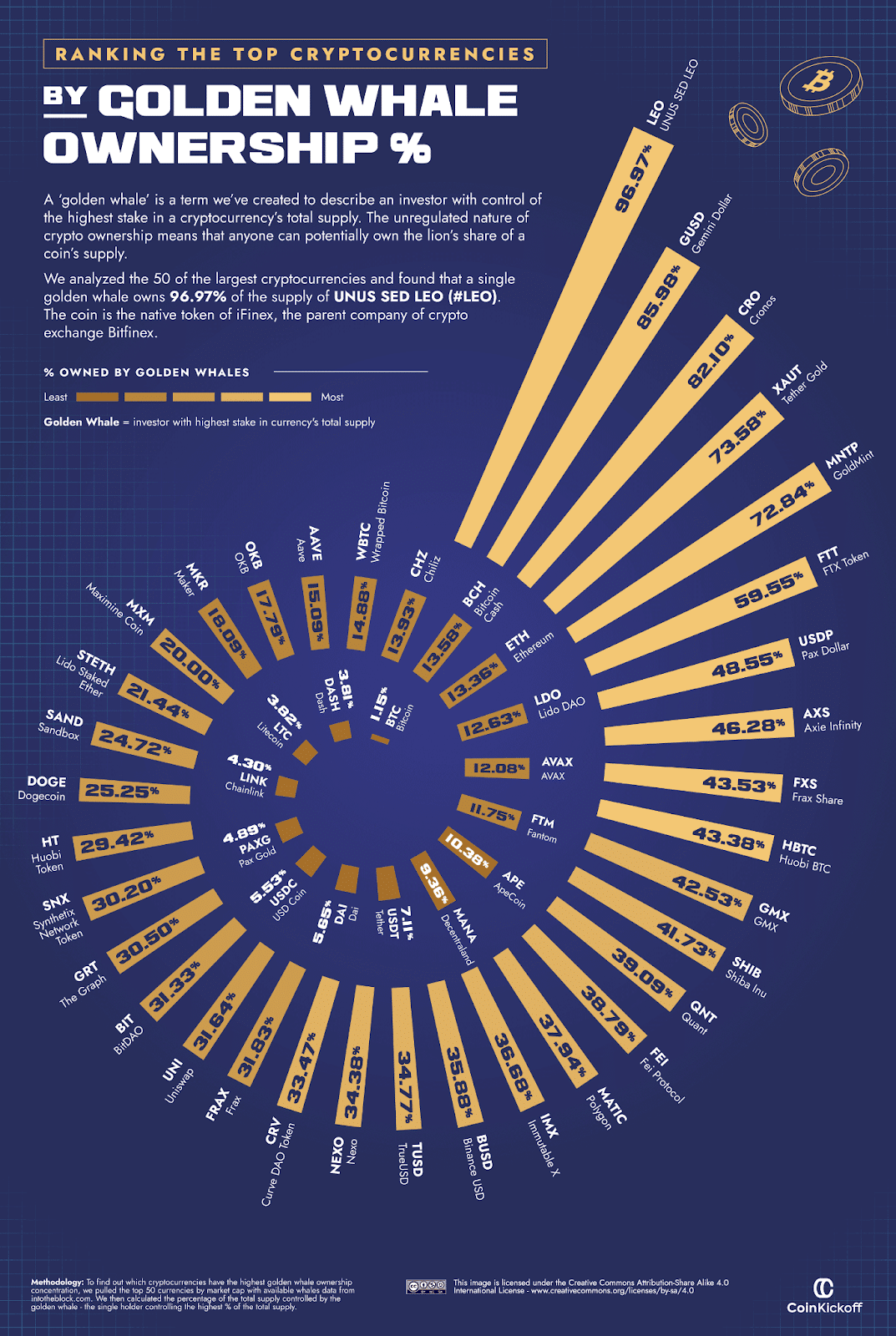

Latest analysis by Coin Kickoff, utilizing knowledge from blockchain analytics platform intotheblock.com, supplies some intriguing insights into whale exercise. It has been revealed that whales management over half of a coin’s inventory in 36 out of the 50 largest cryptocurrencies by market cap. This implies they wield a major affect over the route of those currencies.

One notably putting discovering is {that a} single particular person owns a staggering 96.97% of UNUS SED LEO inventory. This represents the best proportion of a single cryptocurrency owned by one entity. On the reverse finish of the spectrum, Chainlink, recognized by its ticker image LINK, exhibits the best amount of whale possession among the many greater pool of whales. The coin’s whole inventory is unfold throughout 20 buyers, which means these whales management 56% of it.

Are you discovering this text informative and insightful? Don’t miss out on extra similar to it! Subscribe to Changelly’s publication straight away. Click on the subscribe button now and let Changelly information you thru the intriguing maze of digital currencies!

How A lot Crypto Makes You a Whale?

The definition of a “crypto whale” isn’t explicitly tied to a certain quantity of crypto however largely depending on the amount of a specific asset owned by a person or an entity. That being mentioned, whereas there isn’t an actual quantity, a typically accepted threshold within the crypto group to be thought of a whale is possession of round $10 million value of a specific cryptocurrency. Nevertheless, the specifics can range significantly relying on the coin’s value and the general market capitalization.

In essence, being a cryptocurrency whale is extra in regards to the share of the full provide of a given cryptocurrency that one owns, reasonably than the sheer greenback worth. As an illustration, proudly owning a thousand Bitcoins would make one a distinguished Bitcoin whale as a result of restricted provide of 21 million cash. But, possessing a thousand cash of a lesser-known cryptocurrency with a bigger provide could not grant you the standing of the whale.

What Occurs When a Whale Buys Crypto?

Straightforward to guess that whales, with their hefty crypto possession, can form the market, influencing developments and inflicting volatility. Their shopping for exercise typically triggers notable value shifts, fostering synthetic demand for a particular coin and elevating its value. This domino impact entices different merchants, escalating the worth additional. Conversely, a whale’s main sell-off can spark a pointy value drop, inciting panic promoting and market downturns.

The flexibility of whales to control the crypto house can’t be understated. Their strategic buying and selling can mislead smaller merchants and create synthetic market developments. This manipulation can yield market irregularities, distorting value fluctuations and doubtlessly undermining market confidence and stability.

The actions of whales can overshadow smaller merchants and retail buyers. Their large-scale trades could make market development prediction difficult for smaller individuals, probably resulting in substantial losses when buying and selling towards whale-induced value strikes.

Regulatory considerations come up from the whales’ affect available on the market. Their means to control developments and costs raises the danger of market abuse and fraud. Regulators keenly monitor whale exercise to keep up equity and transparency. Placing a stability between market freedom and investor safety is pivotal in nurturing a wholesome, sustainable crypto ecosystem, one the place whales want to have interaction actively.

What’s a cryptocurrency whale pump?

A Whale Pump denotes the strategic value manipulation of a particular cryptocurrency by crypto whales. Utilizing their sizable stakes, they spur a sudden enhance in demand for a particular coin, artificially escalating its value.

Whales manipulate crypto by way of different Whale Pump methods, reminiscent of simultaneous or staggered large-volume purchases, inducing a shopping for frenzy. This exercise creates a value rally, stirring FOMO (concern of lacking out) amongst merchants.

The impact of a Whale Pump available on the market is highly effective, inciting pleasure and optimism amongst retail buyers as they observe the worth surge. Nevertheless, the next sell-off by the whale sometimes triggers a pointy value decline, inflicting large losses for peak consumers and inciting panic promoting.

Notable situations of Whale Pumps embrace the 2017 Bitcoin bull run, propelled by Bitcoin whales, which noticed costs touching practically $20,000. One other instance is the Dogecoin pump instigated by the Reddit group WallStreetBets in 2021. Such occasions underscore why crypto whales matter — their actions have tangible impacts on market developments and values.

How Do You Determine Crypto Whales?

Recognizing a Crypto Whale may be extraordinarily necessary for merchants navigating the risky crypto markets. Whales have the capability to induce important value shifts, influencing market developments. By recognizing indicators of whale exercise, merchants can acquire insights into potential market manipulations, serving to them make knowledgeable choices.

What’s crypto whale monitoring?

Crypto whale monitoring is the method of monitoring massive transactions within the crypto world. Monitoring instruments assist establish whale wallets and observe their blockchain actions. Customers can make the most of blockchain explorers and on-chain evaluation companies for this goal, gaining insights into whale actions, transactions, and holdings.

Blockchain explorers present a clear view into the blockchain community, aiding within the identification of whale wallets by way of the evaluation of enormous transactions. On-chain evaluation companies, utilizing subtle algorithms and knowledge evaluation strategies, provide a deeper understanding of whale actions by monitoring transaction historical past, tackle balances, and extra.

Crypto whale monitoring gives beneficial insights for buyers, serving to them perceive market developments and predict value actions, particularly when whales promote. Monitoring these gross sales can reveal whales’ sentiment and habits, which is important in navigating the unpredictable crypto market. Therefore, monitoring crypto whales by way of these companies is important for buyers to reinforce their market understanding and decision-making course of.

Who Is the Largest Whale in Crypto?

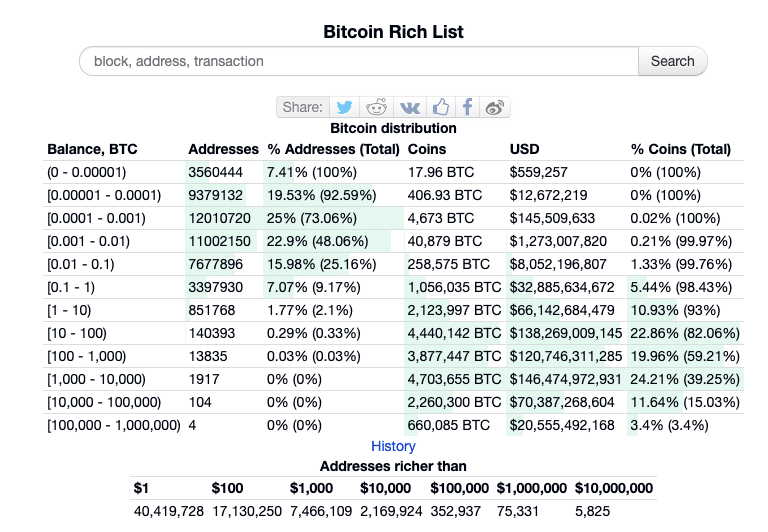

Figuring out the most important whale within the crypto world may be difficult as a result of pseudonymous nature of blockchain transactions. Nevertheless, as per out there knowledge, the most important Bitcoin whale is usually thought of to be the Bitcoin tackle that holds the best quantity of the cryptocurrency. That is believed to be a pockets tackle related to Satoshi Nakamoto, the pseudonymous creator(s) of Bitcoin. The pockets is claimed to carry roughly a million Bitcoins, which might be value billions of {dollars} at present costs. Nevertheless, it’s value noting that these Bitcoins haven’t been moved for a few years, suggesting that they could by no means be used.

One other notable Bitcoin whale is the pockets tackle for the chilly storage of Bitfinex, a distinguished cryptocurrency trade. This pockets persistently holds an enormous quantity of Bitcoin, given the dimensions and quantity of transactions on the Bitfinex platform. Nevertheless, it’s necessary to keep in mind that these holdings characterize the belongings of many people buying and selling on the trade, reasonably than a single entity. As such, whereas this pockets is a ‘whale’ by way of holdings, it doesn’t characterize a single influential actor within the crypto world.

What are the opposite recognized crypto whales?

Crypto whales, these with a big portion of digital belongings, are recognized for shaping market developments. Notable Bitcoin whales embrace:

Michael J. Saylor: The MicroStrategy CEO is acknowledged for his bullish Bitcoin stance and his agency’s sizable investments on this cryptocurrency.Barry Silbert: Digital Foreign money Group (DCG) has invested in a number of crypto initiatives, establishing its founder CEO as an enormous fish within the crypto ocean.The Winklevoss twins: Co-founders of Gemini, these twins are applauded for his or her early Bitcoin funding and pushing for cryptocurrency adoption.Michael Edward Novogratz: The Galaxy Digital CEO and former hedge fund supervisor is optimistic about cryptocurrencies and blockchain know-how.Tim Draper: A enterprise capitalist recognized for profitable investments in blockchain startups, Draper maintains a constructive view on Bitcoin and digital currencies.

These are among the greatest crypto whales whose trades and techniques affect the crypto market significantly. Their impression on value fluctuations and total market sentiment is appreciable. Additional details about Bitcoin whales may be discovered on this article of mine.

The Impression of Whales: Do Whales Management the Crypto Market?

Crypto whales can considerably impression the digital forex market. Their appreciable buying and selling volumes andl capital can affect liquidity, volatility, and investor sentiment.

Whales can sway the market by way of their buying and selling choices. As an illustration, large sell-offs can create a ripple impact on liquidity. If a whale executes a big promote order, it could actually cut back market liquidity, making it tough for smaller buyers to execute trades at most well-liked costs. This lack of liquidity can enhance market volatility, leading to swift value adjustments.

Moreover, whales can manipulate costs. They could spark market-wide sell-offs by executing large-scale trades strategically, inducing panic amongst retail buyers and driving costs down. Alternatively, they will additionally trigger brief squeezes the place their shopping for strain forces short-sellers to cowl their positions, resulting in a speedy value surge.

There are notable examples of such whale exercise. The infamous Silk Highway whale — an enormous Bitcoin holder — triggered main value swings when their pockets transactions have been linked to the darkish internet market’s confiscation. The 2017 flash crash is one other case the place a whale’s massive promote order on the GDAX trade led to a swift value drop.

I can’t stress sufficient the significance of whale watching. Instruments like blockchain explorers and whale monitoring platforms like Whale Alert enable buyers to trace massive transactions. By greedy the actions and intentions of those main market gamers, buyers can higher predict value actions and alter their methods accordingly.

Are crypto whales good or dangerous?

Crypto whales, or people and entities with substantial crypto holdings, play a fancy function within the digital forex market. On the draw back, these whales can manipulate crypto costs by strategically shopping for or promoting massive volumes, inflicting synthetic market developments. Such maneuvers can result in market irregularities and volatility, making it difficult for the broader crypto group — notably for smaller merchants — to foretell and navigate the market.

On the flip aspect, crypto whales may also contribute positively to the market dynamics. By holding a good portion of particular cryptocurrencies out of circulation, they create shortage, doubtlessly driving up demand and the coin’s worth. Furthermore, by capitalizing on market volatility, they will stimulate exercise and progress inside the market. Thus, whereas crypto whales can certainly be a supply of manipulation and unpredictability, additionally they can function key market movers, providing each challenges and alternatives to the crypto group.

What’s wash buying and selling?

Wash buying and selling is a misleading crypto market apply the place people or entities artificially create buying and selling exercise by repeatedly shopping for and promoting the identical asset. This technique, used to control costs, creates a misunderstanding of market curiosity.

Whales can simply interact in wash buying and selling to affect costs. By executing a sequence of trades between themselves, they create the phantasm of large buying and selling exercise, attracting different buyers to affix in. This could result in a rise in demand and in the end drive up the worth of the asset.

The aim of wash buying and selling is to deceive different market individuals into pondering there’s real curiosity and demand for a specific cryptocurrency. This misunderstanding can entice retail buyers and merchants to enter the market or make buying and selling choices based mostly on deceptive info. This manipulation can result in artificially inflated costs or perhaps a market bubble.

Regulators and exchanges are taking measures to detect and forestall wash buying and selling, because it undermines the integrity of the market. Improved surveillance methods and stricter rules intention to establish and penalize people or entities concerned in these misleading practices.

Buyers must be cautious of wash buying and selling and use dependable sources of data to make knowledgeable buying and selling choices. Understanding the potential manipulation by whales and staying up to date on market developments might help mitigate the dangers related to wash buying and selling.

Crypto Whales: Closing Ideas

Counting on my experience, it’s clear that whale exercise within the cryptocurrency market can each stabilize and disrupt it. Whale watching is important, however it’s not the only real think about decision-making.

I advocate that profound analysis on tokens and crypto belongings is essential to mitigating the danger of whale manipulations. Understanding a cryptocurrency’s basic worth safeguards towards synthetic value swings instigated by whales. A concentrate on the underlying know-how and long-term prospects paves the way in which for sustainable investments.

Although instruments like Whale Alert present perception into whale exercise, keep in mind that these could not totally seize the market image as a consequence of techniques like wash buying and selling.

In conclusion, contemplate whale exercise as a part of your crypto investing technique, but in addition concentrate on crypto fundamentals and complete analysis. This stability permits for efficient market navigation and reduces the dangers related to whale manipulation.

Disclaimer: Please notice that the contents of this text are usually not monetary or investing recommendation. The data offered on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native rules earlier than committing to an funding.

[ad_2]

Source link