[ad_1]

newbie

Cryptocurrency storage is a big consideration for each seasoned crypto buyers and newcomers. The 2 predominant choices for storing crypto property are wallets and exchanges. Whereas crypto exchanges facilitate shopping for, promoting, and buying and selling digital foreign money like Bitcoin, wallets function a private financial institution to retailer your crypto holdings securely.

On the subject of utilizing conventional crypto wallets vs. trade wallets, the selection largely depends upon your preferences and traits as an investor. If it is advisable retailer crypto in massive quantities, there’s no better option than a {hardware} pockets. Nonetheless, I personally discover {hardware} and paper wallets a bit awkward to make use of when making frequent transactions.

On this article, I’ll check out how a cryptocurrency trade pockets is completely different from an everyday crypto pockets and look at whether or not you need to retailer crypto in a crypto pockets or an trade.

What Is a Crypto Pockets?

A crypto pockets is actually a digital pockets that permits customers to retailer, handle, and transact digital currencies. Similar to you utilize a bodily pockets to maintain your money or bank cards, a crypto pockets retains monitor of your digital property. The primary distinction, nonetheless, is that as a substitute of storing bodily cash, crypto wallets retailer digital codes or two kinds of keys — the general public keys, that are your public deal with, and the personal keys, which offer you entry to your digital property.

These wallets can be utilized with all kinds of cryptocurrencies, together with Bitcoin, Ethereum, Litecoin, and lots of others. Importantly, whereas they’re referred to as “wallets,” they don’t truly retailer cryptocurrencies. As a substitute, they safe the keys related to these currencies, providing you with the power to entry your property on the blockchain.

How Does a Crypto Pockets Work?

A crypto pockets operates utilizing a expertise often known as public key cryptography. Every pockets has a pair of cryptographic keys: a public key and a non-public key.

The general public key, often known as your pockets deal with, is shared publicly and is what others use to ship funds to your pockets. Consider it as your checking account quantity.

The personal key, alternatively, acts as your digital signature: it’s used to signal transactions, proving that they originated from the pockets proprietor. It’s corresponding to your ATM PIN code and, subsequently, ought to be stored secret and protected as a result of whoever is aware of your personal key has entry to your funds.

When somebody sends you cryptocurrencies, they’re signing off possession of the cash to your pockets deal with. To spend these cash and unlock the funds, your personal key should match the general public deal with to which the foreign money is assigned. If each keys match, the steadiness of your digital pockets will improve, whereas the sender’s steadiness will lower correspondingly.

Forms of Wallets

Crypto wallets come in several kinds, every providing varied options, ranges of safety, and accessibility. Listed below are the most typical sorts:

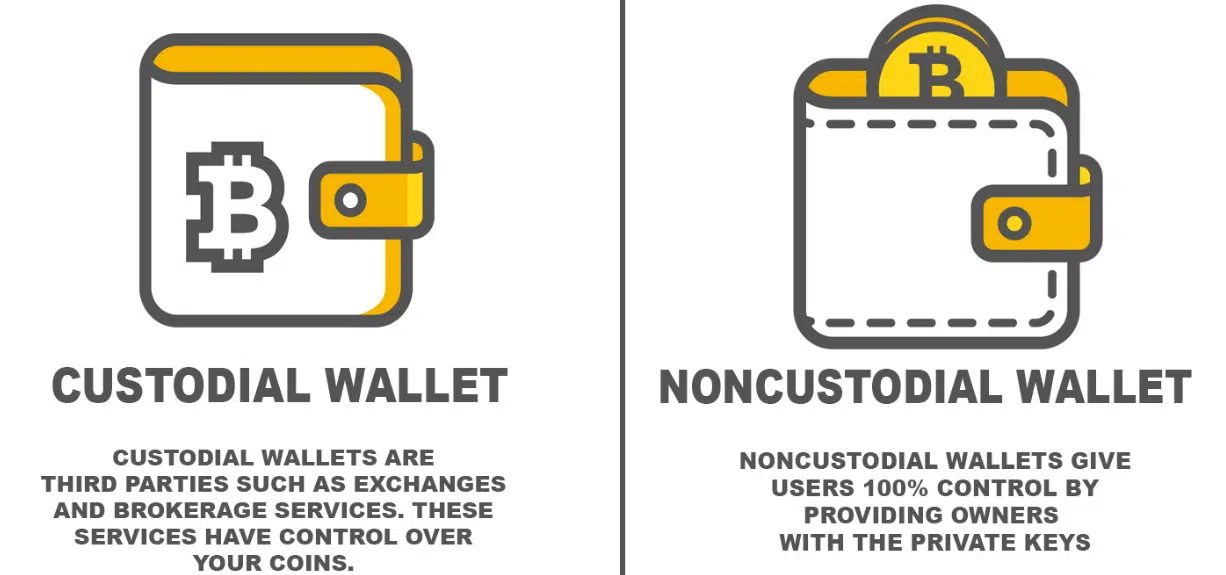

Non-Custodial Wallets: Non-custodial wallets are a sort of cryptocurrency pockets the place solely the person has management over the personal keys and thus has full sovereignty over their funds. This contrasts with custodial wallets, the place a third-party service retains management of the keys.Sizzling Wallets: These wallets are related to the Web.Sometimes simple to arrange and use, they embrace internet, desktop, and cell wallets. They’ve a superb steadiness between comfort and safety, though they’re extra susceptible to on-line threats than chilly wallets.Chilly Wallets: Also referred to as {hardware} or paper wallets, these wallets should not related to the Web, providing higher safety towards on-line threats. They’re primarily used for the long-term storage of cryptocurrencies. {Hardware} wallets are bodily units that securely retailer your personal keys offline. Paper wallets, in the meantime, contain printing out your private and non-private keys and storing them in a protected location.Paper Wallets: Other than being simple to make use of, these wallets present a really excessive stage of safety. The time period “paper pockets” usually refers to a bodily copy or a printout of your private and non-private keys. It could possibly additionally seek advice from a chunk of software program used to securely generate a pair of keys that are then printed.Custodial Wallets: In these wallets, the personal keys are managed by a 3rd get together, reminiscent of a cryptocurrency trade. This makes them a handy possibility for customers preferring to not handle their keys, nevertheless it additionally means the customers need to belief the third get together’s safety measures.

What Is a Cryptocurrency Change Pockets?

A crypto trade pockets is a sort of digital pockets supplied by cryptocurrency exchanges. These wallets enable customers to retailer, obtain, and ship crypto property immediately throughout the trade’s ecosystem. They’re part of the service portfolio designed for customers who commerce on the trade platform.

The first kind of crypto trade pockets is related to centralized exchanges (CEXs). Centralized exchanges like Coinbase, Binance, or Kraken handle these wallets on behalf of the person. Whereas decentralized exchanges (DEXs) are additionally a big a part of the cryptocurrency buying and selling panorama, they usually don’t supply in-built wallets. As a substitute, they permit customers to attach their current wallets (like MetaMask or Belief Pockets) to work together with the trade.

How Does a Crypto Change Pockets Work?

Within the context of a centralized trade, when a person creates an account, the trade generates a pockets related to that account. This pockets operates beneath the management of the trade that holds personal keys, which means the trade is chargeable for managing and safeguarding the property held inside.

When a person decides to commerce, they switch their crypto property into their trade pockets. These property are managed by the trade, which acts as a custodian, sustaining balances, facilitating transactions, and permitting customers to purchase, promote, or commerce crypto property. The trade additionally handles all transaction verifications and safety.

Nonetheless, it’s vital to notice that this stage of comfort comes with a level of threat. By holding person funds and personal keys, centralized exchanges turn out to be enticing targets for potential hackers. If the trade’s safety is breached, customers could lose their property.

Storing Crypto on Exchanges vs. Wallets

Exchanges are platforms the place you possibly can convert fiat foreign money (like {dollars}, euros, and many others.) into cryptocurrency and vice versa. Additionally they allow crypto-to-crypto buying and selling. These exchanges supply web-based wallets the place you possibly can retailer your digital property. That mentioned, exchanges management the personal keys to those wallets, which suggests you’re not the one one with entry to your cryptocurrency holdings.

Then again, crypto wallets might be software- or hardware-based. They permit customers to retailer their personal and public keys, thereby giving them full management over their funds. They provide the comfort of creating transactions immediately from the pockets and infrequently embrace options for managing a number of cryptocurrencies.

Advantages of Non-Custodial Crypto Wallets

Non-custodial wallets, often known as self-custody wallets, boast a number of advantages over their exchange-based counterparts.

Full Management. Non-custodial wallets give customers unique entry to their crypto cash. This implies you’ve gotten full management over your digital property, and no third get together can freeze or lose your funds.Enhanced Safety. These wallets usually supply enhanced safety measures, together with two-factor authentication (2FA), pin codes, and biometric scanning on cell units.Privateness. Since you’ve gotten full management of your pockets, there’s no must share your private info with a 3rd get together, which helps protect your privateness.

The Greatest Non-Custodial Crypto Wallets

Selecting a non-custodial pockets relies upon largely in your particular wants and the extent of comfort and safety you want. Listed below are 5 notable non-custodial wallets you might contemplate:

MetaMask. MetaMask is a software program pockets that operates as a browser extension, permitting customers to work together with decentralized functions (dApps) on the Ethereum blockchain immediately from the browser. Due to its user-friendly strategy, it’s a fashionable selection for these new to the crypto world.Exodus. This can be a software program pockets that gives a sturdy platform for managing a number of cryptocurrencies. Exodus gives a user-friendly interface, reside charts, and portfolio administration instruments. Moreover, it integrates with Trezor {hardware} wallets for added safety.Belief Pockets. Belief Pockets is a cell pockets for storing a variety of cryptocurrencies. It additionally gives a Web3 browser for interacting with dApps, making it a flexible selection for these invested within the wider blockchain ecosystem.Electrum. Electrum is without doubt one of the oldest software program wallets within the crypto house. Whereas its asset vary just isn’t that extensive (it really works just for Bitcoin), its safety is definitely high-level as a result of encryption and two-factor authentication. Its interface is much less user-friendly than some others, so it’s higher fitted to extra tech-savvy customers.Ledger. Ledger produces {hardware} wallets Ledger Nano S and Ledger Nano X. They retailer your personal keys offline on the system, making them resistant to on-line threats. Ledger wallets help an enormous array of cryptocurrencies and combine with varied software program wallets for simple administration.

Every of those wallets has a singular set of options and safety measures, catering to a variety of person wants and ranges of technical proficiency.

Is It Secure to Use an Change Pockets?

Whereas trade wallets lure customers with numerous conveniences, they arrive with safety dangers. Exchanges are enticing targets for hackers. If a hack happens, your crypto holdings may very well be in danger. Moreover, the trade has management of your property, which means they may freeze your account for varied causes.

Nonetheless, many exchanges implement safety measures like two-factor authentication, withdrawal whitelists, and insurance coverage towards theft. That mentioned, the outdated adage of “not your keys, not your cash” holds true. To maintain your funds protected, it’s greatest to maneuver your cryptocurrencies off the trade and right into a safe pockets until you might be actively buying and selling.

How one can Transfer Crypto off an Change

Transferring your crypto cash from an trade to a pockets is a simple course of.

You first must have a pockets. Relying in your preferences, this may very well be a software program, a {hardware}, or a paper pockets.When you’ve arrange your pockets, you’ll have an deal with that may obtain funds. Copy this deal with.Subsequent, navigate to the withdrawal part of the trade. Choose the cryptocurrency you wish to switch and paste the copied deal with into the designated subject.Affirm the transaction. You might have to pay transaction charges, which fluctuate from trade to trade and likewise rely upon community congestion.The trade will course of the withdrawal, and your property will seem in your pockets.

Bear in mind to double-check the pockets deal with earlier than confirming the transaction as crypto transactions are irreversible.

Last Ideas

In the end, whether or not you select to retailer your crypto property in a pockets or an trade ought to rely in your particular person wants and the extent of threat you’re comfy with. If safety and management over your funds are paramount, a non-custodial pockets may very well be the only option. Conversely, in case you are an energetic dealer who wants fast entry to property, preserving some funds in an trade could also be extra handy.

Disclaimer: Please observe that the contents of this text should not monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.

[ad_2]

Source link