[ad_1]

Be a part of Our Telegram channel to remain updated on breaking information protection

Enterprise capital investments in cryptocurrency startups have witnessed a big decline of greater than 70% prior to now yr. The business is grappling with a altering panorama as institutional merchants shift their focus from blockchain to synthetic intelligence.

Cryptocurrency Startups Face Steep Decline in Enterprise Capital Investments

Enterprise capital investments in cryptocurrency firms have witnessed a dramatic drop of over 70% prior to now yr, in response to knowledge revealed by RootData, a crypto knowledge supplier.

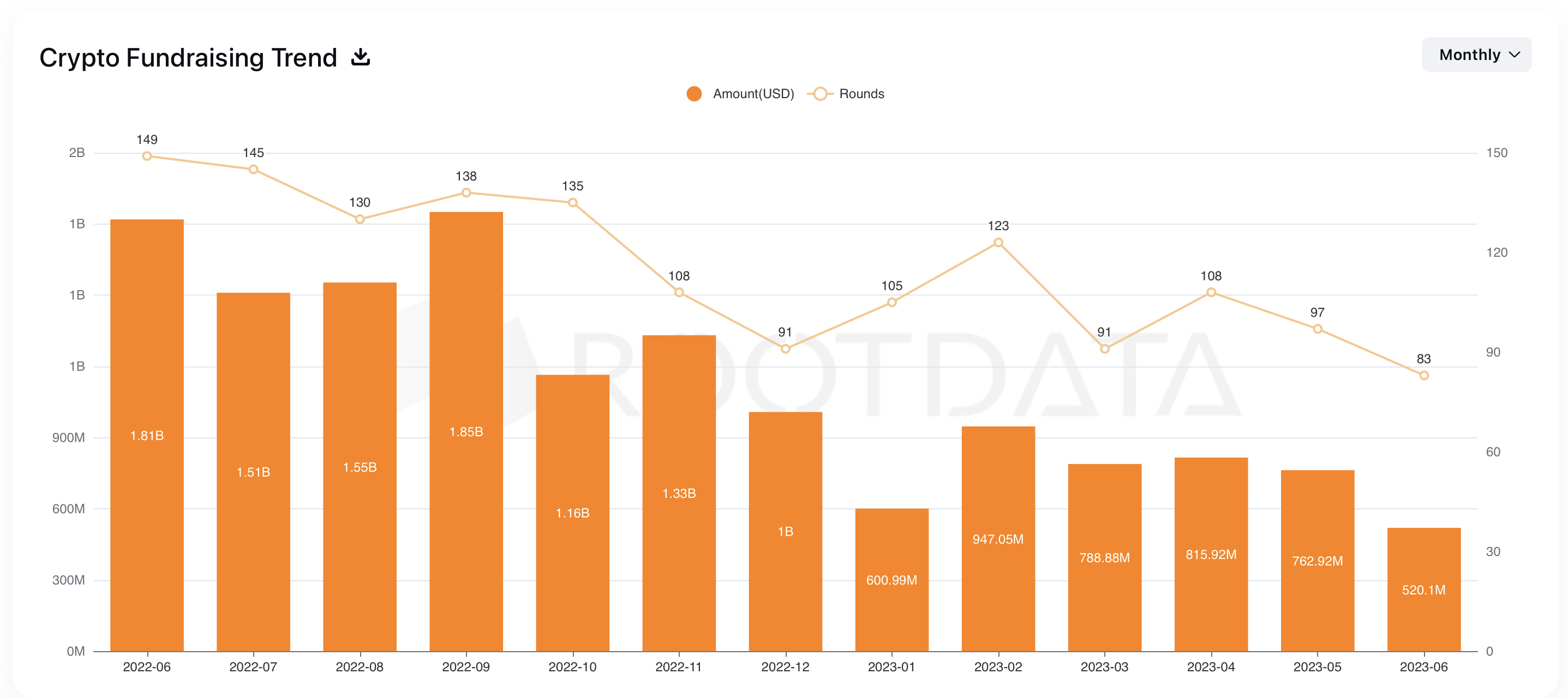

The figures reveal a big shift in investor sentiment, with solely $520 million raised throughout 83 initiatives in June this yr, marking the lowest-funded month up to now.

The downward pattern in enterprise capital curiosity throughout the digital asset area turns into evident when analyzing the info offered by RootData. Though there have been sporadic will increase in funding throughout sure months, the general trajectory has been on a downward slope.

As an example, September 2022 noticed record-breaking funding of $1.85 billion invested in 138 rounds, whereas June of the identical yr witnessed the very best variety of recipients with 149 rounds.

Analyzing the latest knowledge, it turns into obvious that the infrastructure class stays the frontrunner, receiving $213 million in funding final month throughout 26 initiatives.

Nonetheless, even this class skilled an almost 50% lower from the earlier month, when 28 initiatives secured $410 million in funding.

Happy to have @a16zcrypto lead our $43M Sequence A and be part of us on the @gensynai journey!

Thanks additionally to @coinfund_io, @edenblockvc, @ZeePrimeCap, @Maven11Capital, @JSquare_co, @id4vc, Peer, @ai, @protocollabs, @M31Capital, and a few unbelievable angelshttps://t.co/F3QBWbX1v7

— Ben Fielding (@fenbielding) June 11, 2023

Specifically, UK-based startup Gensyn AI emerged because the winner within the infrastructure class, securing a formidable $43 million in a Sequence A funding spherical led by a16z crypto, additional emphasizing the rising significance of synthetic intelligence within the business.

Shifting Panorama: Institutional Merchants Flip In direction of Synthetic Intelligence

In line with a latest report by JP Morgan, institutional merchants have additionally shifted their consideration away from blockchain know-how in direction of synthetic intelligence (AI).

Over half of the institutional merchants surveyed, totalling 835 people throughout 60 international markets, consider that AI and machine studying would be the most influential applied sciences shaping the way forward for buying and selling within the subsequent three years.

These applied sciences had been cited 4 instances extra typically than blockchain and distributed ledger know-how.

The report sheds mild on the evolving patterns in funding preferences throughout the crypto business. Centralized finance (CeFi), embodied by corporations like OPNX and Chiliz, emerged because the second most funded class, attracting a considerable $101 million, which accounted for practically 20% of the entire financing.

The gaming sector carefully trailed behind, securing $62 million in funding, with Legendary Video games claiming the bulk portion by elevating a formidable $37 million throughout its Sequence C1 spherical. DeFi and NFTs full the listing of classes, occupying the following positions within the rating.

Ethereum has emerged because the cryptocurrency with probably the most funded initiatives over the previous yr, with 1,826 rounds of funding, adopted by Polygon (MATIC) at a distant second with 1,076 funding rounds.

Geographically, the USA claimed the biggest portion of funding, receiving 34% of the entire investments. Nonetheless, this dominance could also be topic to alter as market dynamics evolve.

Coinbase Ventures secured the place of probably the most lively enterprise capital agency, collaborating in 71 funding rounds over the previous yr. Hashkey Capital and Shima Capital adopted carefully behind, funding 54 and 49 initiatives, respectively.

The declining curiosity from enterprise capitalists within the crypto asset area might be attributed to varied components. The actions of firms like FTX and Terra, together with the latest banking turmoil that impacted all 4 “crypto-friendly banks,” have doubtless contributed to the decreased investor enthusiasm.

Moreover, the regulatory clampdown in the USA, regardless of being a pacesetter in crypto investments, has created an unsure setting for buyers.

Whereas enterprise capital investments in cryptocurrency firms have skilled a pointy decline, different sectors comparable to synthetic intelligence have garnered vital consideration from buyers.

AI’s potential to cater to a broader viewers has been a driving issue on this shift, as acknowledged by Evan Cheng, co-founder, and CEO of Mysten Labs. Cheng sees AI as complementary to Web3, and this sentiment is mirrored in Justin Solar’s latest launch of a $100 million AI improvement fund.

Because the crypto business faces these challenges, it stays to be seen the way it will adapt and whether or not new tendencies and applied sciences will reshape the panorama within the coming months.

Whereas the tendencies say that VCs are veering away from crypto, there are presale investments nonetheless value noticing.

Wall Avenue Memes is a type of presales that’s trailblazing ahead because of neighborhood assist. Impressed by wall road bets, this token could lie as a testomony to crypto’s energy tied to the neighborhood, not enterprise capitalists.

Associated Information

Wall Avenue Memes – Subsequent Large Crypto

Early Entry Presale Reside Now

Established Neighborhood of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Greatest Crypto to Purchase Now In Meme Coin Sector

Staff Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be a part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link