[ad_1]

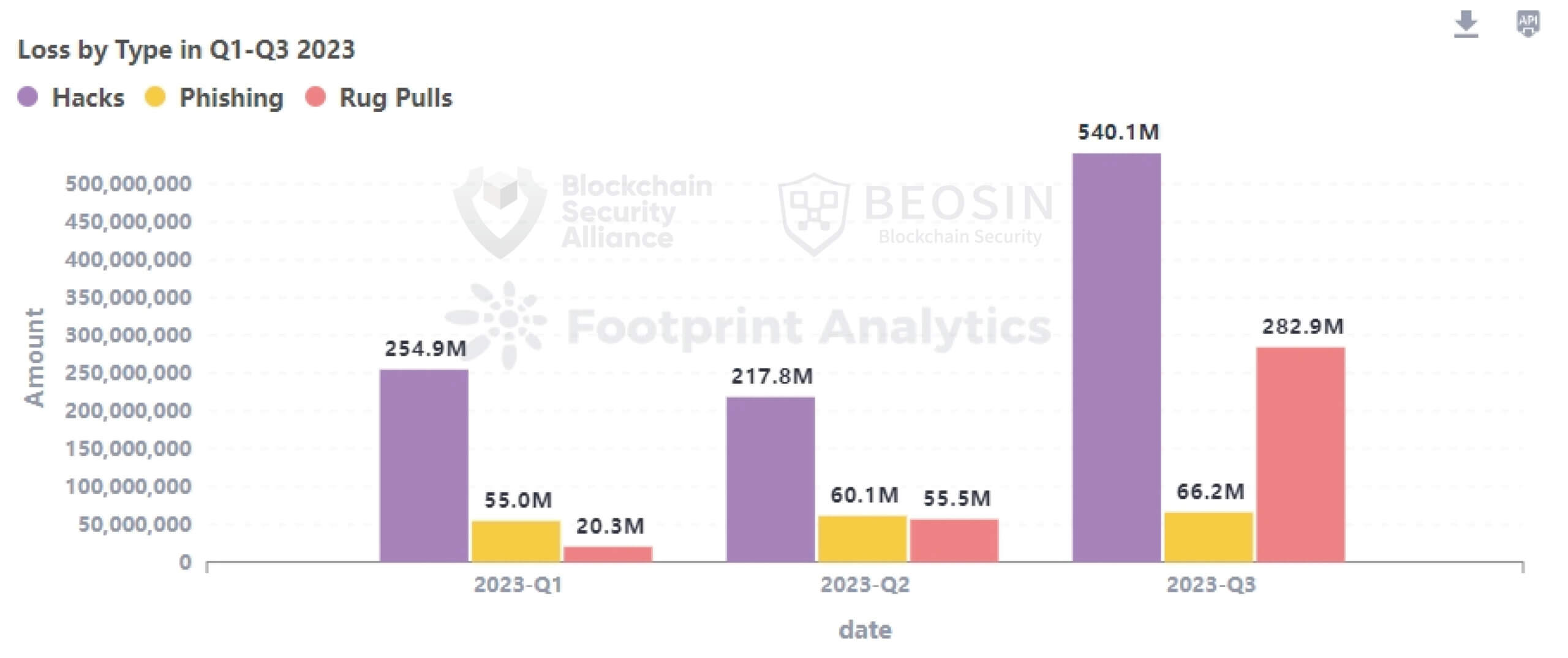

Crypto initiatives misplaced almost $889 million to hacks, phishing scams, and rug pulls throughout the third quarter, blockchain safety agency Beosin revealed in its World Web3 Safety Report.

Based on the report, crypto traders misplaced $282.96 million to rug pulls throughout 81 incidents, whereas phishing schemes generated $66.15 million in ill-gotten good points throughout the identical quarter.

The most important hit got here from hacks the place 43 crypto initiatives suffered safety breaches that led to the lack of $540.16 million. Through the interval, CryptoSlate reported notable hacks of various crypto initiatives, together with the $200 million hack of Mixin Community, the $73 million exploit of Curve Finance, and the $8 million HTX misplaced to a scorching pockets compromise.

This marks a major upsurge in comparison with the cumulative losses of the primary half of the yr, totaling $330 million throughout the first quarter and a slight enhance to $333 million by the yr’s second quarter.

The report was revealed in collaboration with different members of the blockchain alliance, together with Footprint Analytics and SUSS NiFT.

Malicious gamers preserve focusing on DeFi initiatives.

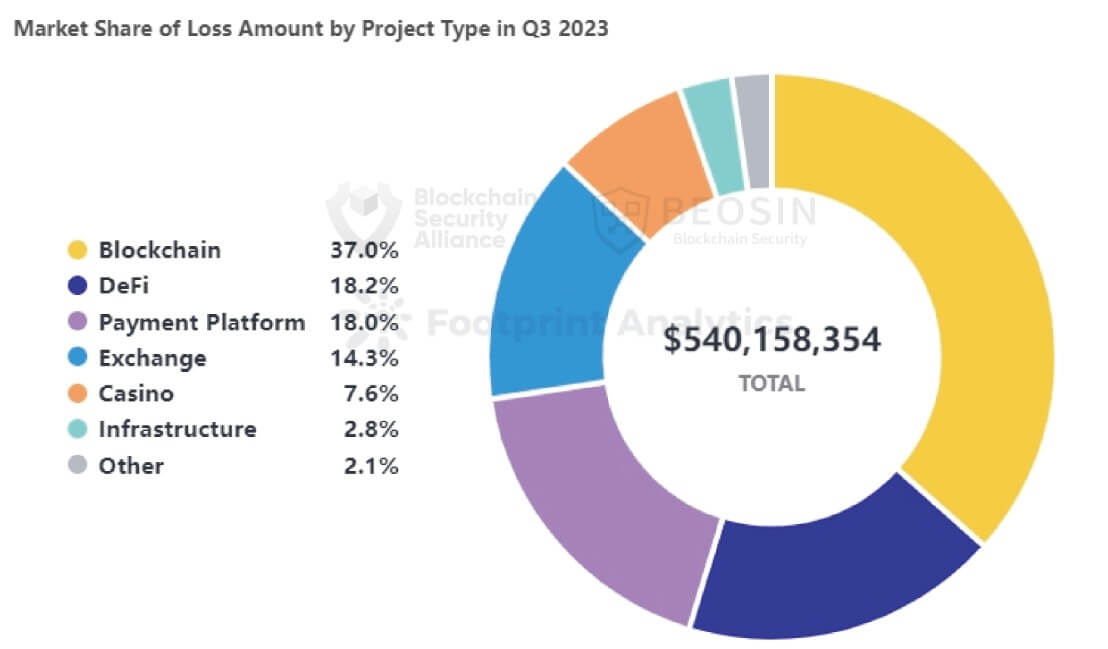

Beosin revealed that decentralized finance (DeFi) initiatives suffered probably the most hacks throughout the interval, with round 67% of the breaches focusing on platforms within the sector. Nonetheless, it’s important to notice that different sectors, resembling blockchains, fee platforms, exchanges, casinos, and infrastructure, additionally suffered hacking incidents throughout the interval.

Regardless of malicious gamers’ penchant for focusing on DeFi initiatives, public blockchains recorded the best financial loss due to the $200 million breach of Mixin Community. This single breach accounts for 37% of the whole losses for the quarter and is probably the most important crypto lack of this yr.

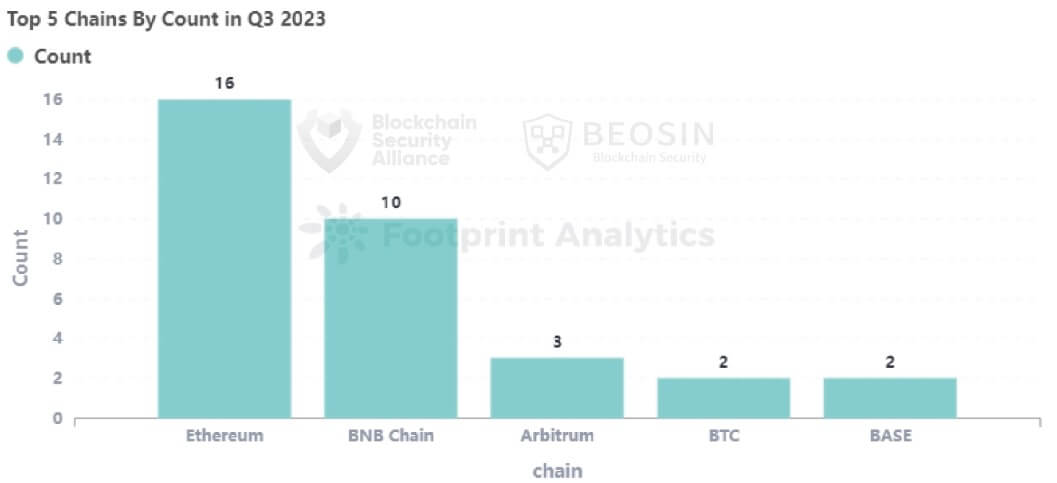

In the meantime, Beosin wrote that the Ethereum blockchain suffered probably the most losses and incidents throughout the interval. It mentioned:

“Ranked by variety of assaults, the highest 5 chains with probably the most safety incidents have been: Ethereum (16 occasions), BNB Chain (10 occasions), Arbitrum (3 occasions), BTC (2 occasions), and Base (2 occasions).”

Most exploits have been preventable

Curiously, almost half of the attacked initiatives (46.5%) had not undergone any safety audits. Beosin added that 14 (63.6%) of the 22 initiatives attacked attributable to contract vulnerabilities had by no means been audited.

This highlights that many of those exploits may have been prevented had initiatives taken the required precautions to conduct audits and tackle vulnerabilities.

Regrettably, solely 10% of the stolen funds have been efficiently recovered, leaving a considerable sum of roughly $800 million unaccounted for, underscoring the challenges of retrieving stolen crypto property.

[ad_2]

Source link