[ad_1]

On-chain information exhibits the change inflows throughout the crypto market have remained low just lately. Right here’s what this pattern would possibly imply.

Trade Inflows Of Main Crypto Property Have Been Subdued Just lately

In response to the on-chain analytics agency Glassnode, change inflows throughout the most important property are at present close to cyclical lows. The “change influx” is an indicator that measures the entire quantity of a given crypto that’s being transferred to the wallets of all centralized exchanges.

When the worth of this metric is excessive, it signifies that the buyers are depositing some tokens of the asset to those platforms proper now. As one of many foremost explanation why holders would ship their cash to exchanges is for selling-related functions, this sort of pattern can have bearish implications for the crypto’s value.

However, low values of the indicator indicate that the exchanges aren’t receiving that many cash in the intervening time. Relying on different elements, such a pattern might be both impartial or bullish for the worth of the asset.

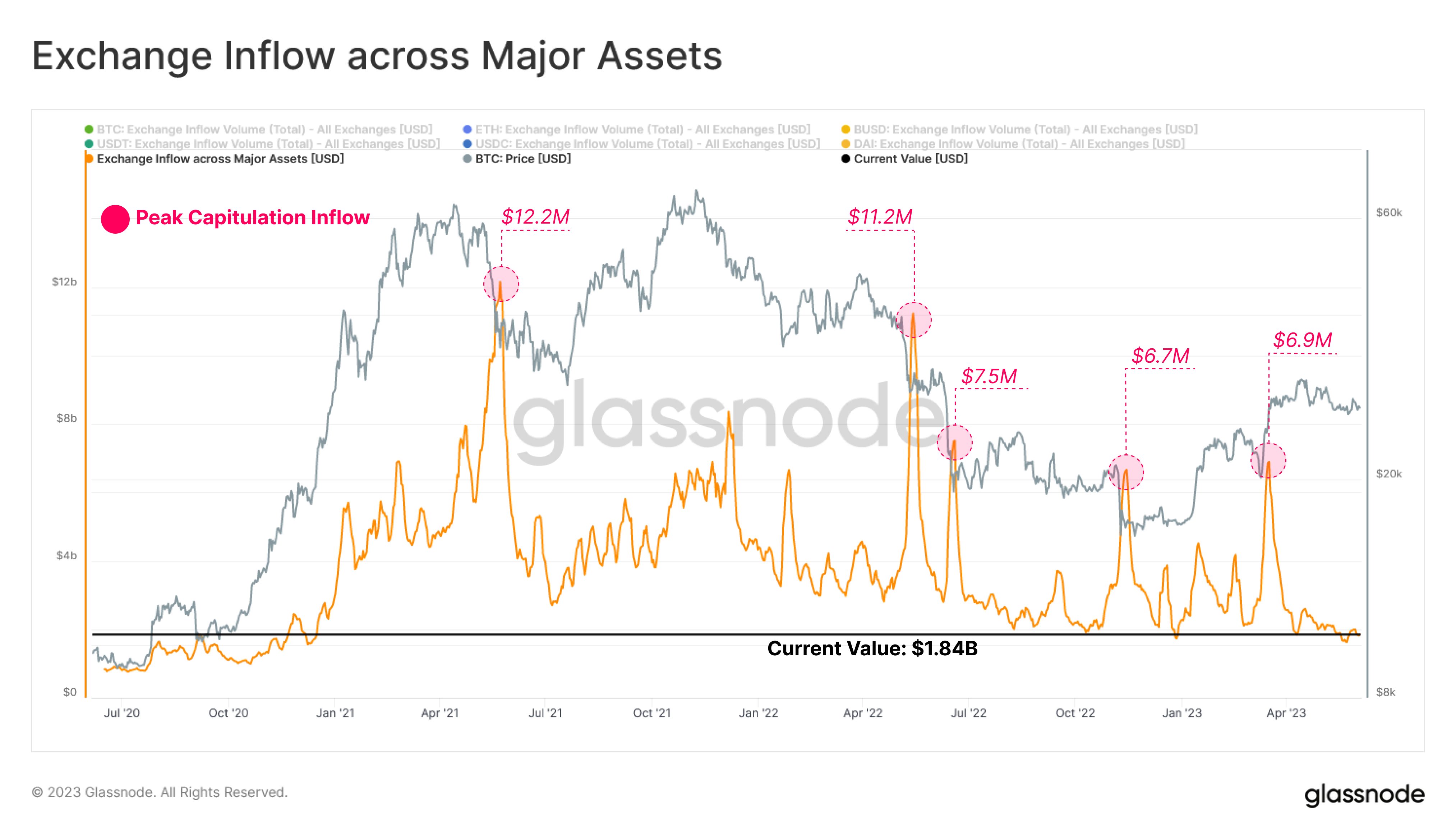

Now, here’s a chart that exhibits the pattern within the mixed change influx for the most important property available in the market (like Bitcoin and Ethereum) over the previous couple of years:

Seems like the worth of the metric has declined in current weeks | Supply: Glassnode on Twitter

From the graph, it’s seen that the change influx for the most important crypto property has gone down just lately and has hit some fairly low values. This could indicate that not many buyers are at present depositing their tokens to those platforms.

Naturally, this indicator has had excessive values in periods of heavy promoting stress available in the market. As highlighted by Glassnode within the chart, Might 2021 noticed the metric register its largest worth of $12.2 billion for this era.

Again then, the primary half 2021 bull run was winding off and these massive inflows occurred because the selloff occurred. Very massive spikes within the indicator have been additionally seen in different main selloffs, just like the LUNA crash in Might 2022, the 3AC chapter in June 2022, and the FTX collapse in November 2022.

Enormous inflows throughout the market have been additionally seen across the time of the selloff again in March of this 12 months when the value of Bitcoin had crashed under the $20,000 degree.

Presently, the most important crypto property are solely observing whole change inflows of $1.84 billion, which could be very low when in comparison with any of the aforementioned spikes.

The low inflows proper now can recommend that there isn’t a lot urge for food for promoting throughout the crypto market, which is of course one thing that would permit the tokens to construct up some upwards momentum.

Nevertheless, the truth that the present ranges are so low that they’re close to cyclical lows would recommend there may be an total lack of participation within the sector from buyers. Low participation is often related to sideways-moving markets, which is what Bitcoin and others are experiencing in the intervening time.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,700, down 4% within the final week.

BTC has gone down just lately | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link