[ad_1]

Fast Take

As Q1 has ended with a outstanding Bitcoin efficiency of over 70%, it’s value analyzing the spot vs. derivatives pattern over Q1.

The community is way more healthy on the finish of the quarter than once we began again in January.

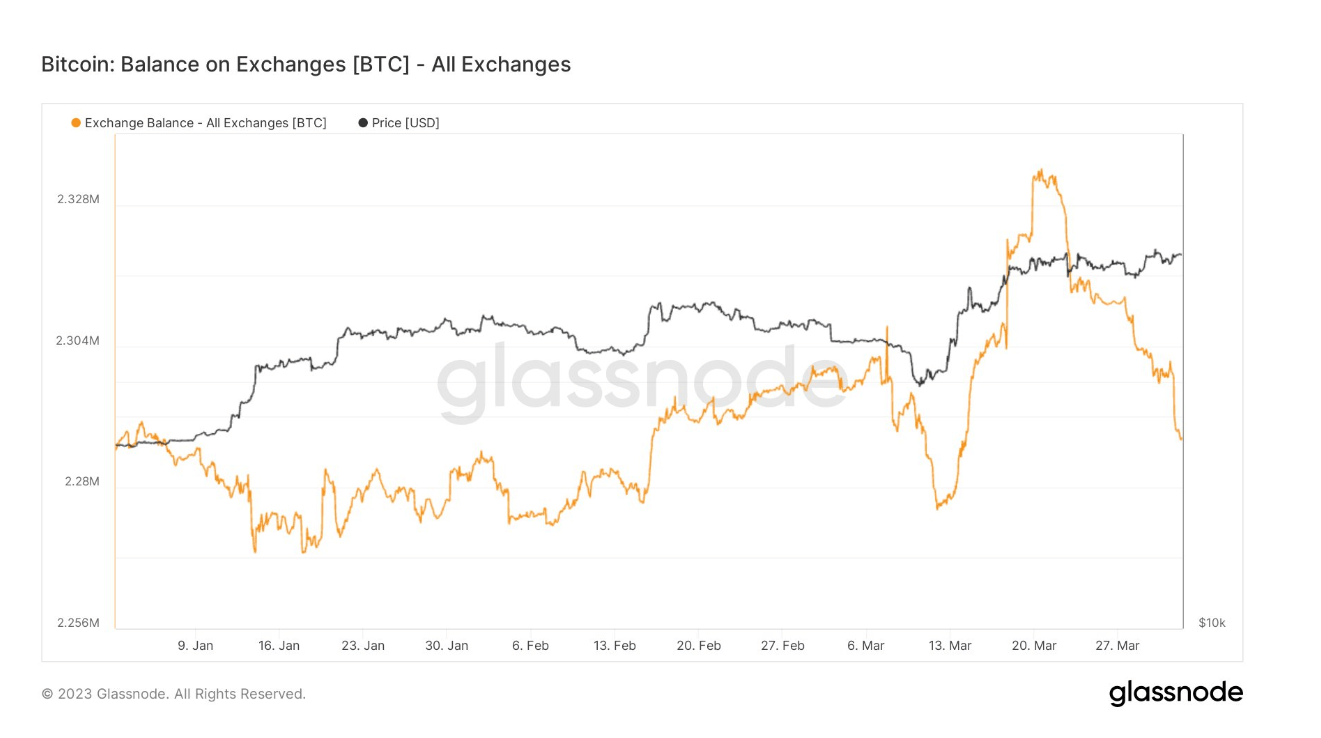

The alternate stability is now flat year-to-date, with roughly 2.28 million Bitcoin on exchanges, and demand began to return after the SVB collapse.

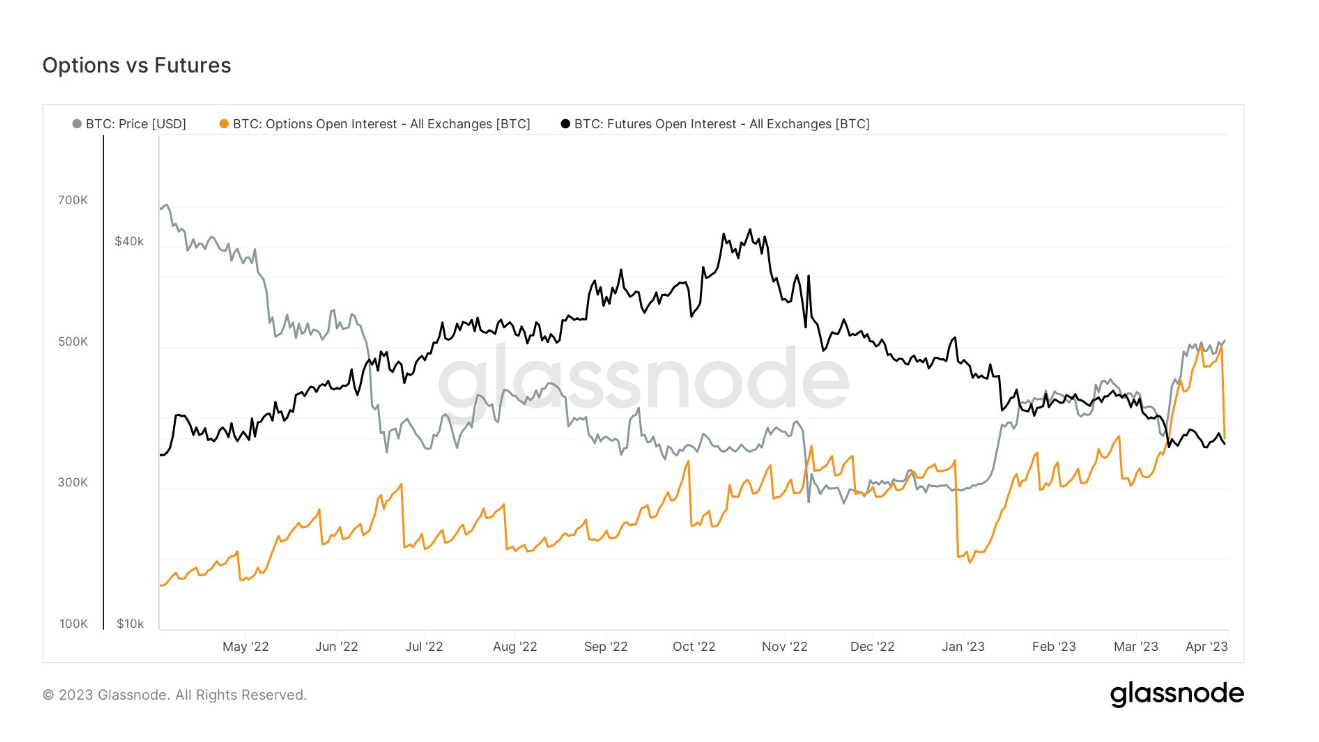

Futures’ open curiosity is now at a one-year low, with roughly 300,000 Bitcoin liquidated from the 2022 peak in October.

Final, choices open curiosity noticed a record-breaking quantity of $4 billion value of choices expiring on March 31. Roughly 130,000 Bitcoin have been unwound in contracts from the alternate Deribit.

The rally in Bitcoin worth has been pushed by spot demand in current weeks.

The put up Evaluating Bitcoin’s spot and derivatives markets in Q1 2023 appeared first on CryptoSlate.

[ad_2]

Source link