[ad_1]

Coinbase’s market share climbed to its highest level since January 2023 in June regardless of the U.S. Securities and Trade Fee lawsuit towards the agency, in accordance with Kaiko information.

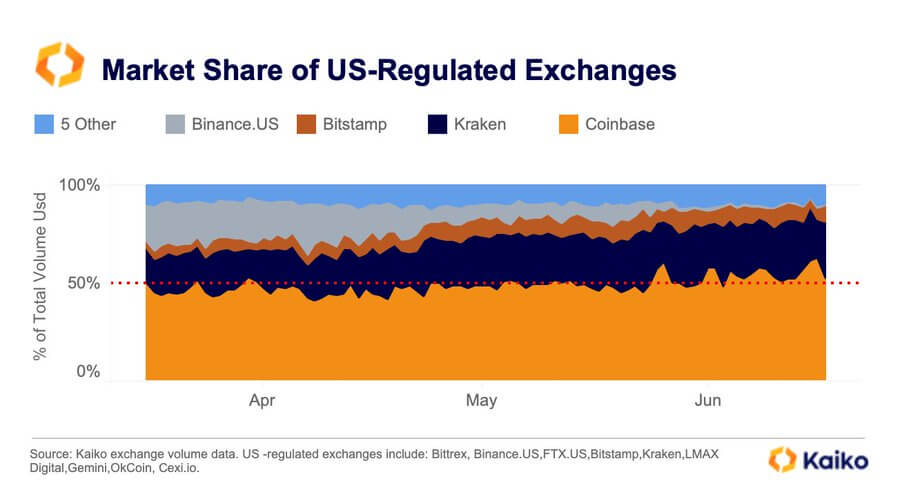

In line with the chart beneath, Coinbase has constantly managed round 50% of buying and selling actions in U.S.-regulated exchanges for the reason that starting of the yr. Nonetheless, its market dominance witnessed a fast uptick in June, peaking at 64%, because the SEC filed expenses towards it and Binance over federal securities regulation violations.

In the meantime, different U.S. platforms like Kraken and Bitstamp additionally elevated their market share throughout this era.

Conventional monetary establishments nonetheless in enterprise with Coinbase

Regardless of the SEC’s lawsuit, a number of conventional monetary establishments, together with BlackRock, Constancy, and ARK Investments, signed a surveillance-sharing settlement with Coinbase for his or her spot-Bitcoin exchange-traded fund (ETF) submitting.

BlackRock, the world’s largest asset supervisor, selected Coinbase Custody because the custodian for its belief’s BTC holdings.

Messari founder Ryan Selkis recommended that these partnerships underscore Coinbase’s legitimacy as a U.S. monetary establishment, signaling a rising acceptance of cryptocurrency enterprises within the conventional monetary sector

Professional-XRP lawyer John Deaton corroborated Selkis’s view, including that over 2,000 Coinbase customers have “joined to doubtlessly be heard as amici curiae” within the SEC’s lawsuit towards the crypto agency.

An amicus temporary, generally often known as a “buddy of the courtroom” temporary, is a written submission made by a person or group that isn’t straight concerned because the plaintiff or defendant in a authorized case however holds a considerable curiosity within the matter. The aim of an amicus temporary is to supply the courtroom with extra views and opinions that may doubtlessly impression the ultimate authorized resolution.

Binance US market share evaporates

The SEC lawsuit seems to have impacted Binance US severely as its market share plunged to lower than 1% from a peak of 20% recorded in April.

Binance US, transitioning to a crypto-only platform, has confronted important liquidity points after its banking companions halted their USD cost channels, posing challenges to its operations and affecting its market place.

On June 21, BTC flash-pumped to $138,000 on account of its low market depth. Earlier than then, the flagship digital asset traded at a 3% low cost on the platform in comparison with different rival exchanges.

The submit Coinbase’s market share is on the rise despite SEC actions appeared first on CryptoSlate.

[ad_2]

Source link