[ad_1]

Fast Take

Credit standing company Moody’s has downgraded the crypto change Coinbase from “steady” to “destructive.”

This resolution comes after the June 6 lawsuit from the SEC.

Nevertheless, regardless of the ranking downgrade, Moody’s ranking rationale on their web site does acknowledge their “wholesome liquidity place.”

“The affirmation of Coinbase’s rankings displays its wholesome liquidity place, its latest money movement technology enhancements stemming from prudent expense administration, and since the SEC’s prices pertain solely to a few of Coinbase’s merchandise, and exclude its main traded merchandise.”

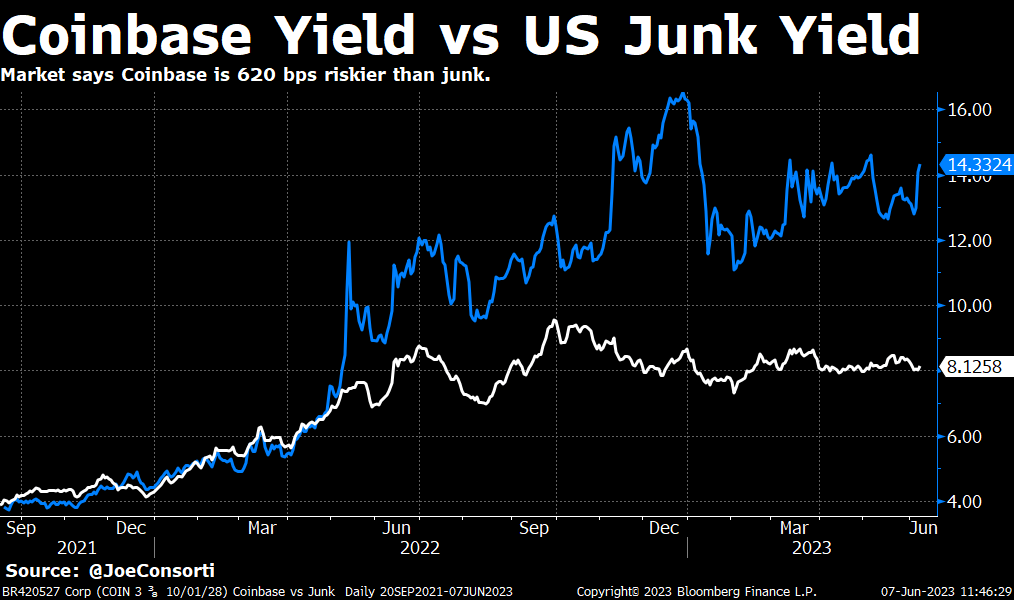

As well as, macro analyst, Joe Consorti from the Bitcoin Layer, identified that Coinbase debt is promoting off quickly. Joe goes on to say

“It yields 14.3% and climbing, which is 1.75x increased than the 8.1% most of America’s junk firms must borrow at. The market is saying that Coinbase is 620 bps riskier than junk.”

Coinbase share worth is at the moment buying and selling at $54.90 however -16% down prior to now 5 days.

The put up Coinbase outlook downgraded from steady to destructive – Moody’s appeared first on CryptoSlate.

[ad_2]

Source link